Iraq produced more than 650,000 barrels per day (bpd) above its target output level in May and is now being asked to make up for its non-compliance in future months. Rystad Energy estimates Iraq’s actual ability to cut more barrels is limited to between 300,000 and 500,000 bpd. Achieving any output target below 4 million bpd is overambitious given Iraq’s dire economic need for oil revenues right now.

Out of the 650,000 bpd, Iraq has asked international companies such as BP, ExxonMobil, and Lukoil to help out with 350,000 bpd of cuts in the Basrah region, and the state operator – Basra Oil Company (BOC) – to cut the remainder 300,000 bpd.

Iraq committed to OPEC to produce 57,000 bpd below its target production level of 3.75 million bpd in July and then go deeper and come in 258,000 bpd below in August and September against the slightly higher target production level of 3.96 million bpd. There is even talk of trying to get Kurdistan to contribute with 100,000 bpd of production cuts – an effort we believe to be futile.

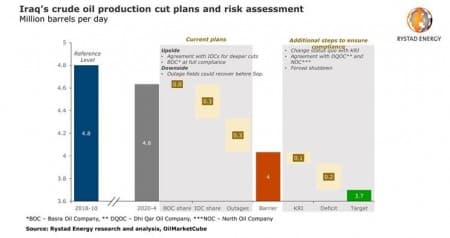

Rystad Energy estimates Iraqi oil production reached 4.8 million bpd in October 2018, the month used as a reference in estimating the production cuts for the OPEC+ member nations. Iraqi oil production reached 4.6 million bpd in April 2020 and the compliance level was set at 3.7 million bpd.

Now, Iraq plans to cut 650,000 bpd from southern Federal Iraq (FI) and has directed the Kurdistan Region of Iraq (KRI) to cut about 100,000 bpd. If Kurdistan doesn't "hand over the barrels", Iraq will be forced to hatch a new plan and look at other fields that can fill the gap. Related: Suppliers Fight For Dominance In This Crucial Gas Market

“Even before Covid-19 hit, Iraq and the rest of OPEC+ were cutting production to manage the market. Then, after the group failed to renew the agreement in March it was an all-out production war. But Iraq failed to ramp up production, so when the deeper cuts started in May, most BOC fields were already at near-compliance levels, leaving little to cut,” says Rystad Energy’s senior analyst Aditya Saraswat.

There are many points of contention on oil resource management between Federal Iraq (FI) and the Kurdistan region of Iraq (KRI). Economic strategies are not aligned and revenues flow into separate budgets, which makes it unlikely that KRI will acquiesce to the request of FI to cut 100,000 bpd. The KRI controls about 450,000 bpd of oil production and over 90% of volumes are exported through a pipeline to the Ceyhan terminal in Turkey.

FI demands a bigger share from the pipeline exports. On the other hand, KRI operates as an independent government entity with an independent fiscal regime and growth ambitions that do not fall in line with OPEC. Like most of the oil-dependent economies, KRI’s financials are struggling which has led to deferrals in oil payments to IOCs and salaries for public employees. Thus, the tightening gridlock with vulnerable oil prices poses a risk to that KRI will be able to contribute with cuts.

Lower oil demand amid Covid-19 has forced about 300,000 bpd in production cuts in Iraq, as buyers in lockdown in Asia either canceled orders or storage became limited. PetroChina had to halve production at Halfaya field down to 200,000 bpd. Petronas had to shut down 100,000 bpd of production capacity at Garraf due to quarantine measures taken to protect workers. In short, Covid lockdowns are a natural force in keeping oil in the ground and bringing Iraq closer to compliance. A swifter return to the ‘normal’ would adversely affect the country’s compliance.

A reason for Iraq’s under compliance is its very urgent need to use oil export revenues to help build up its gas production potential to meet surging demand. The need to become self-sufficient in natural gas stems from the fact that Iraq’s main gas supplier – Iran – is under all sorts of sanctions and the US is encouraging Iraq to halt Iranian imports or potentially face sanctions.

Iraq gas reserves are primarily associated gas – extracted alongside with oil. But due to limited infrastructure, Iraq flares most gas it produces. The country was relying on the giant Akkas and Mansuriya gas field developments to feed demand, but international operators have had to declare force majeure due to worsening security conditions north of Baghdad.

Citing the above, Iraq has opposed the process to decide its quota with OPEC as it points out that it doesn’t take its fiscal situation and regional issue with KRI into consideration. To address this, Saudi Arabia and Russia have signed a memorandum of understanding to develop the Akkas and Mansuriya fields, respectively, to help ease Iraqi investment obligations.

As both time and cuts are of the essence, a mere initial gas agreement won’t help Iraq address peak gas demand for the upcoming summer season, again putting another kink in Iraq’s motivations to comply or fill up its budget.

“It will be a very tall order for Iraq to lower oil production below 4 million bpd, given the reference level of 3.7 million bpd combined with the fact that cut contributions from BOC and KRI will only be marginal. The country would have to think of a ‘Plan B’ if they want to go for complete compliance,” adds Saraswat.

Additional measures could include forced shutdowns as well as including other state operators like North Oil Company (NOC) and Dhi Qar Oil Company (DQOC) in the cut agreements. These two operators can at least provide 100,000 bpd of additional cuts but this might not be a sustainable option as most of this production feeds regional refineries.

But the question that remains at large is – for how long? Former oil minister Thamir Ghadhban recently said in an interview, "With a lower price and reduced production, the petroleum cost repayments… could exceed 40% of Iraq's total oil revenue which has to be paid to international oil companies, and which Iraq cannot afford."

By Rystad Energy

More Top Reads From Oilprice.com:

- Oil Market Optimism Is Entirely Misplaced

- Inside Singapore's $3 Billion Oil Trading Scandal

- How Viable Are Net Zero Strategies For Energy Companies?