Europe’s Mediterranean region is emerging as Europe’s main front of commercial rivalry – natural gas producers that rely on pipeline supplies and utilize primarily oil-indexed or hybrid-pricing terms are taking on LNG exporters, tallying unprecedented numbers throughout the first half of 2020 as LNG prices in Europe remain so low that many gas producers are marketing their volumes to their financial detriment. We have looked into the energy choices of Greece, yet the rivalry taking place in Turkey seems even more grand-scale – the Turkish natural gas market is supplied by two Russian conduits, two pipelines from Azerbaijan including the newly-built TANAP, a pipeline from Iran, not to forget the ever-increasing number of LNG cargoes feeding its economy.

Substantial amounts of cheap LNG have blown up the Turkish gas market – in the case of Iran, the sentence might even be read literally to a certain extent. Flows through the Iran-Turkey gas pipeline (throughput capacity of 14 BCm per year) were halted March 31 after a sabotage attack on Turkish territory (a mile from the Iranian border) which Ankara has blamed on PKK insurgents. There was at least a dozen of such instances in past years and usually the repair works rarely go beyond several weeks – this time Turkey’s national gas company BOTAS seems to be stalling maintenance on the back of said LNG abundance. Iran’s national gas company has signaled that gas flows would be restarted by July 21, however this was not corroborated in any way by the Turkish side.

Graph 1. Turkey’s LNG Imports in 2017-2020 (million tons of LNG).

Source: Thomson Reuters.

All the while Turkey’s gas imports from Iran will decrease palpably this year from their 2019 level of 7.5 BCm, gas trade with Azerbaijan seems to be suffering much less than with any other pipeline partner. In fact, in Q1 2020 Azerbaijani pipeline exports to Turkey have gone up 20% year-on-year to 2.73 BCm, indicating yet another year of growth on the back of increasing Shah Deniz volumes. With this, Azerbaijan has consolidated its position as the leading gas supplier to Turkey, accounting for 23% of its gas needs, a status long held by Russia. This is all the more noteworthy as landed LNG prices to Turkey remain firmly below $2 per MMbtu for the third month in a row (having ended 2019 at $5.50 per MMbtu which was back in late last year considered to be really cheap).

In January-May 2020 Turkey has brought in 6.97 million tons LNG (9.5 BCm), an almost 40-percent increase year-on-year. February 2020 hit an all-time monthly intake record with 1.81 million tons LNG delivered, of which almost half was from the United States, supplied across 11 deliveries. Since then US LNG exports to Turkey have dropped back to 1-3 vessels per month but LNG purchases were tangibly beneficial to the mending of US-Turkey political ties (not to speak of halting Iranian imports and minimizing Russian ones). In the end, however, geographic proximity seems to have prevailed as currently Algeria and Qatar stand atop the leading LNG suppliers’ list; the former delivered 5 cargoes both in May and June, out of the 14 and 10, respectively. Related: China’s Oil Imports From Saudi Arabia Jump To Record High

According to a recent report by the Wall Street Journal, Turkey’s reluctance to buy natural gas might stem from the hefty debts garnered by their energy companies in 2019. Under long-term take-or-pay contracts (albeit at a fixed discount of 15%), these private entities still owe Gazprom around $2 billion for past deliveries, their deals’ underperformance notwithstanding. Much of the transaction financing goes through Turkish state banks, potentially leaving Ankara with additional exposure from Gazprom. These banks would ultimately prefer to restructure the liabilities amassed as Turkey’s economy is expected to decline by 4 percent in 2020, aggravated by the value drop of the Turkish lira and the weak tourism season on the back of COVID restrictions.

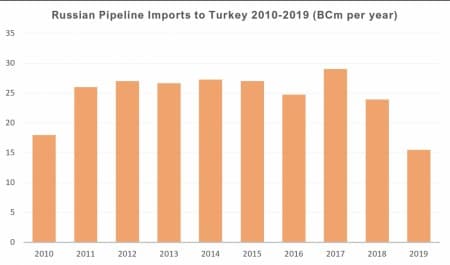

This being said, Turkish authorities have argued that Gazprom would be politic not to pressurize them with immediate reimbursement demands and wait out the trouble, otherwise Turkey would conclusively move towards further diversification. A recurring theme in the Russo-Turkish energy relations, the Erdogan administration has used it vis-à-vis Gazprom since at least 2015 when the downing of a Russian fighter aircraft provoked a spectacular rapture between Presidents Putin and Erdogan. Navigating the difficult geopolitical landscape with some skill, Russian and Turkey witnessed a thaw in their relations which also boosted energy cooperation – in 2017 Turkey imported 29 BCm of natural gas (see Graph 2), an all-time high. Despite winding down Russian pipeline imports this year, Turkey did not derail the construction of TurkStream and kept the construction of the Akkuyu nuclear plant rolling.

Graph 2. Turkey’s Imports of Russian Gas.

Source: Gazprom.

Thus far there seemed to be little intent to extrapolate political matters into the realms of energy cooperation, despite having amassed several flash points. The fate of Idlib, where Turkish and Russian armed forces are positioned side-by-side and clash directly over the future of the entire governorate and the role federal Syrian authorities might play therein, remains a constant thorn in the flesh. Yet developments in Libya have turned out to be potentially even more consequential – Field Marshal Haftar’s advance on Tripoli followed by the eventual fizzling out of LNA steam continues to poison their relationship, to the extent that the planned June 14 Istanbul summit between the nations’ foreign and defense ministries was postponed indefinitely.

With LNG costing half of what Russia’s pipeline-supplied gas does, Turkish gas companies like BOTAS have reoriented themselves towards liquefaction. Given BOTAS’ 8 BCm per year take-or-pay requirement (its supply contract runs out in 2021), it becomes understandable why Turkish authorities press Gazprom to relax pricing conditions and to „exercise flexibility”. Gazprom has to tread lightly as it would want to avoid underutilization of the 7 billion TurkStream and another layer of prolonged arbitrage disputes, all the while NordStream 2 is still not commissioned. Gazprom has previously indicated that it expects its 2020 annual export volumes by 16% to 167 BCm and its average European price to drop a hefty 37% year-on-year to some $133 per MCm.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Market Optimism Is Entirely Misplaced

- Inside Singapore's $3 Billion Oil Trading Scandal

- How Viable Are Net Zero Strategies For Energy Companies?