Friday December 22, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. 2017: Record low oil discoveries

(Click to enlarge)

- In 2017, the oil industry discovered the least amount of oil since at least the 1940s.

- The industry discovered just 7 billion barrels of oil equivalent, down from even the seven-decade low of 8 billion boe posted in 2016, according to Rystad Energy.

- Several years of savage cuts to exploration budgets have led to the dwindling number of new discoveries.

- Moreover, the average discovery is also getting smaller – 100 million boe in 2017, compared to an average size of 150 million boe in 2012.

- The declining rate of new discoveries could create supply shortages at some point in the 2020s.

2. 2018 forecasts differ widely

(Click to enlarge)

- The oil market seems to be improving, and the OPEC extension puts the market on a path towards rebalancing next year. But analysts have very different expectations for what might go down in 2018 with inventories, the all-important metric upon which OPEC is basing its action.

- Inventories typically climb in the beginning of the calendar year on softer demand. Both the IEA and OPEC predict an uptick in inventories in the first…

Friday December 22, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. 2017: Record low oil discoveries

(Click to enlarge)

- In 2017, the oil industry discovered the least amount of oil since at least the 1940s.

- The industry discovered just 7 billion barrels of oil equivalent, down from even the seven-decade low of 8 billion boe posted in 2016, according to Rystad Energy.

- Several years of savage cuts to exploration budgets have led to the dwindling number of new discoveries.

- Moreover, the average discovery is also getting smaller – 100 million boe in 2017, compared to an average size of 150 million boe in 2012.

- The declining rate of new discoveries could create supply shortages at some point in the 2020s.

2. 2018 forecasts differ widely

(Click to enlarge)

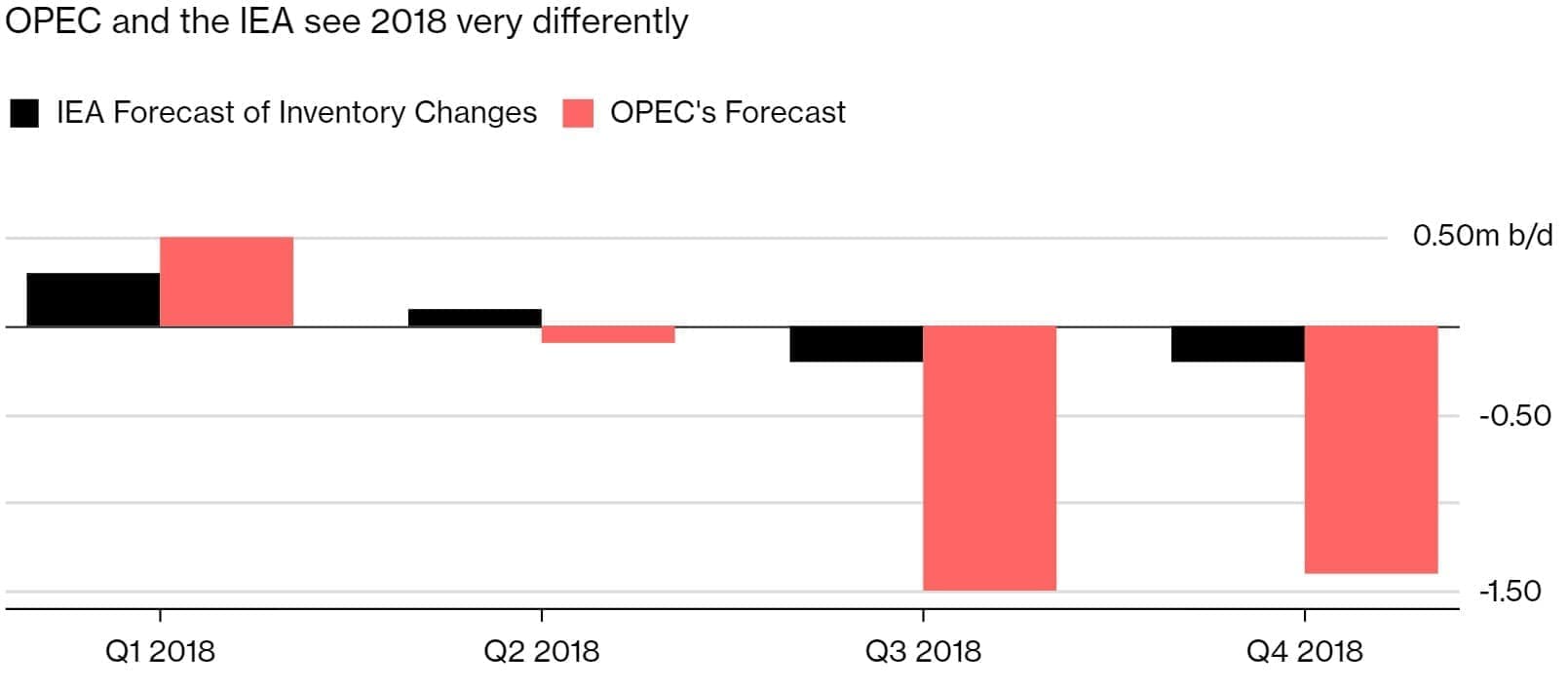

- The oil market seems to be improving, and the OPEC extension puts the market on a path towards rebalancing next year. But analysts have very different expectations for what might go down in 2018 with inventories, the all-important metric upon which OPEC is basing its action.

- Inventories typically climb in the beginning of the calendar year on softer demand. Both the IEA and OPEC predict an uptick in inventories in the first quarter, before narrowing pretty closely to a balance in 2018.

- But they diverge quite a bit in the second half of the year. IEA sees only marginal inventory declines, which, if true, would mean the surplus sticks around for the duration of 2018.

- OPEC, on the other hand, predicts massive inventory drawdowns, with stocks drawing at a staggering 1.5 million-barrel-per-day rate in the third quarter.

- Other analysts fall in between. The gap between these forecasts is large, and the fate of oil prices rest with whoever is more correct in these estimates.

3. Hedge funds bullish on oil

(Click to enlarge)

- Hedge funds amassed a staggering level of bullish bets on crude futures ahead of the OPEC deal, and despite some predictions, they held onto those bets into December.

- Brent net-length is at a record high, according to Bloomberg, a sign that major investors remain bullish on the trajectory of oil prices next year.

- “Post-OPEC, you can’t be short,” Chris Kettenmann, chief energy strategist at Macro Risk Advisors LLC, told Bloomberg. “OPEC restored a tremendous amount of credibility.”

- However, the lopsided positioning exposes the market to a greater degree of downside risk. At several moments in the last few years when investors staked out high ratio of bullish positions, a selloff ensued.

- If sentiment starts to turn bearish, there is a real risk of a sharp price correction as hedge funds and other money managers back out of their bullish bets.

4. Canadian rail shipments rise

(Click to enlarge)

- The Canadian oil industry has found itself in a bind. Rising production is running headlong into a shortage of pipeline capacity, forcing steep discounts for Western Canada Select.

- The outage at the Keystone pipeline in November also led to swelling inventories in Canada.

- Producers are trying to get their product on to trains, which are vastly more expensive than pipeline.

- By 2016, trains had fallen out of favor, and shipments of oil-by-rail from Canada dipped to a low point of nearly 40,000 bpd.

- But rail shipments are back on the rise amid pipeline shortages. The problem for Canada’s oil producers is that rail cannot solve the ballooning problem.

- Canadian oil supply is set to rise by 315,000 bpd in 2018, and then by another 180,000 bpd in 2019. There aren’t any major pipelines set to come online in that timeframe.

- WCS is trading at a $28-per-barrel discount to WTI, a painful blow to Canada’s oil producers.

5. Lower refining maintenance could push up oil prices

(Click to enlarge)

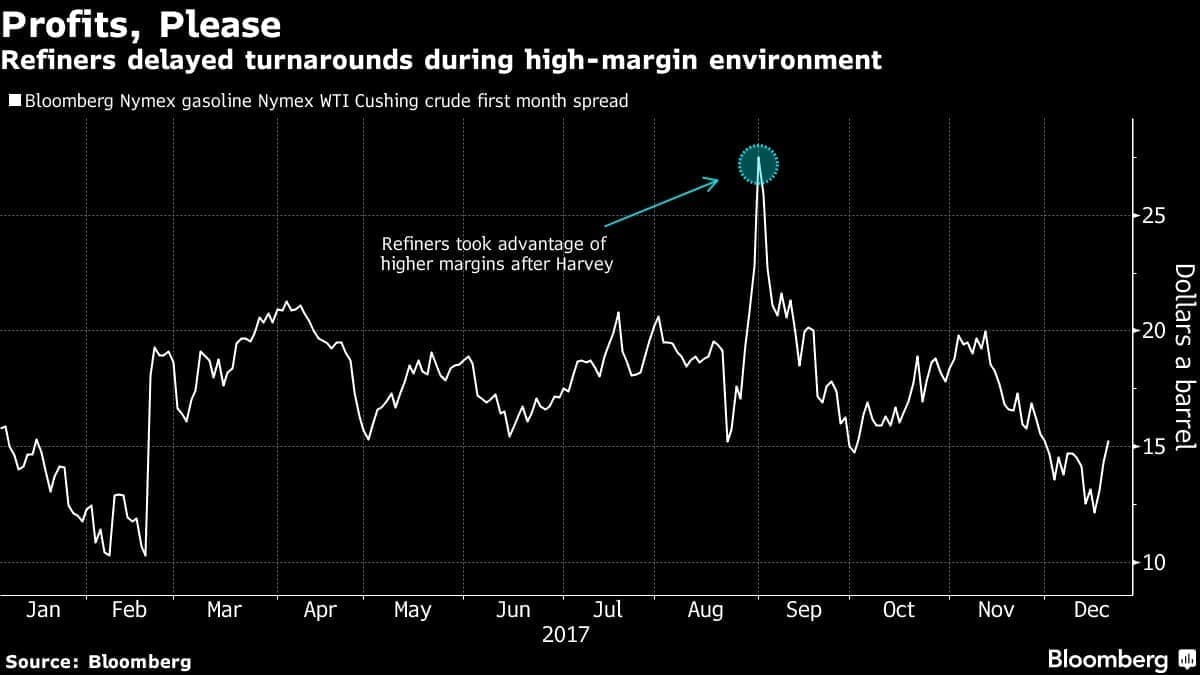

- U.S. refineries are scheduled to take a lighter round of maintenance this winter, which could mean a stronger pull on crude stocks.

- According to Bloomberg and Energy Aspects, the number of refinery shutdowns will be 35 percent smaller in January and February of 2018, year-on-year. By March, refinery maintenance should be 55 percent lower than it was in the same month of 2017.

- “If you have less turnarounds, refiners are going to be demanding more crude, so a lighter turnaround season is supportive for crude prices,” Andy Lipow, president of Lipow Oil Associates, told Bloomberg.

- Refiners operating at higher levels will support larger drawdowns in crude inventories, which ultimately could speed up the rebalancing process.

- The flipside, however, is that they will be churning out more gasoline and diesel. That could lead to a surge in product socks and depress refining margins, hurting earnings and perhaps leading to lower run rates later in the year.

6. Permian growth continues

(Click to enlarge)

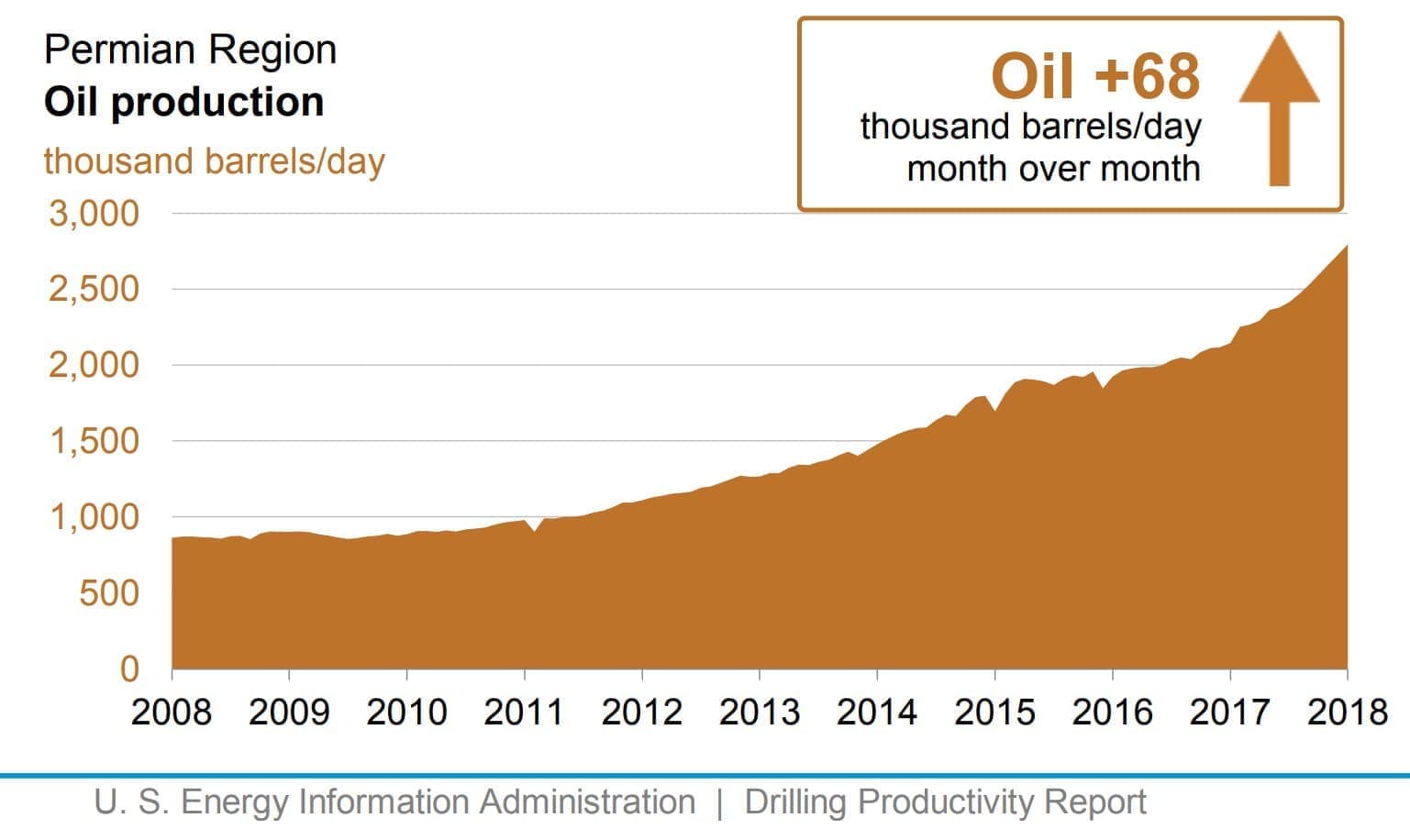

- U.S. shale is expected to continue to grow production well into 2018 at least.

- Most of U.S. growth is concentrated in the Permian Basin. The EIA predicts that the Permian will add 68,000 bpd of new supply in January, an impressive figure that will put the basin just shy of 2.8 mb/d.

- Meanwhile, the Bakken will come in a distant second, adding 9,000 bpd of new supply in January.

- At the same time, the legacy decline rate for the Permian continues to deepen, a reflection of the large production baseline from the region. The Permian loses more than 160,000 bpd each month to depletion, up from 100,000 bpd last year. That means that the industry needs to drill more to keep production flat.

- But, fortunately for the Permian, drillers continue to keep the pace of drilling high. Gains are expected for the foreseeable future.

7. ANWR finally opens

(Click to enlarge)

- The GOP tax bill opened up the Arctic National Wildlife Refuge (ANWR) for oil and gas exploration.

- ANWR could hold between 5.7 and 16 billion barrels of oil. But that assessment is nearly two decades old.

- The potential is enormous, but the reality is very little is known about ANWR’s resources. There was one well drilled in ANWR, but that took place in the 1980s.

- ANWR could rival some of the major shale basins in the U.S. in terms of size, according to Barclays, but the operative word is “could.”

- The industry won’t be able to learn more until it can enter ANWR and begin surveying and exploration. But that could take years.

- The political uncertainty is not over, even with the greenlight from Washington. A lease sale could take years, and could stretch into the next administration, at which point, a less friendly government could reverse course.

- It remains to be seen if a barrel of oil will ever be produced from ANWR.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.