Volatility has been low this week with market liquidity drying up ahead of the Christmas and New Year breaks, but the U.S. West Texas Intermediate and international-benchmark Brent crude oil trended high enough to put them in positions to challenge their highest levels since 2015.

U.S. WTI and Brent crude oil were primarily supported by a bullish weekly government inventories report and the continued shutdown of the North Sea Forties pipeline system.

According to the U.S. Energy Information Administration (EIA), U.S. crude oil stocks fell by 6.5 million barrels, more than expected, in the week to December 15, while gasoline stocks rose 1.2 million barrels, less than anticipated, even though refining activity rose.

Crude stocks, excluding the U.S. Strategic Petroleum Reserve, currently stand at 436.5 million barrels, the lowest since 2015.

The EIA also said that for the most recent week, refiner capacity utilization rose to 94.1 percent, the highest since the summer, and above average for December.

In other news, Kuwait’s oil minister Bakhit al-Rashidi said compliance among both OPEC and non-OPEC members currently stands at 122 percent, highest since the OPEC-led deal to cut production was implemented in January.

Forecast

The same factors that influenced the price action this week should continue to support crude oil prices next week. Brent crude oil prices are expected to be supported by the continuing outage of the U.K.’s Forties…

Volatility has been low this week with market liquidity drying up ahead of the Christmas and New Year breaks, but the U.S. West Texas Intermediate and international-benchmark Brent crude oil trended high enough to put them in positions to challenge their highest levels since 2015.

U.S. WTI and Brent crude oil were primarily supported by a bullish weekly government inventories report and the continued shutdown of the North Sea Forties pipeline system.

According to the U.S. Energy Information Administration (EIA), U.S. crude oil stocks fell by 6.5 million barrels, more than expected, in the week to December 15, while gasoline stocks rose 1.2 million barrels, less than anticipated, even though refining activity rose.

Crude stocks, excluding the U.S. Strategic Petroleum Reserve, currently stand at 436.5 million barrels, the lowest since 2015.

The EIA also said that for the most recent week, refiner capacity utilization rose to 94.1 percent, the highest since the summer, and above average for December.

In other news, Kuwait’s oil minister Bakhit al-Rashidi said compliance among both OPEC and non-OPEC members currently stands at 122 percent, highest since the OPEC-led deal to cut production was implemented in January.

Forecast

The same factors that influenced the price action this week should continue to support crude oil prices next week. Brent crude oil prices are expected to be supported by the continuing outage of the U.K.’s Forties pipeline in the North Sea, which delivers crude. The latest estimates from operator Ineos call for repairs to last two to four weeks.

Although U.S. crude oil output is expected to break the all-time production record of more than 10 million bpd soon, inventories have been steadily declining in the United States due to strong export demand and efforts by major oil producers to restrict supply.

Unless traders decide to book profits ahead of the end of the year, WTI and Brent prices are expected to remain in positions to challenge their multi-year highs.

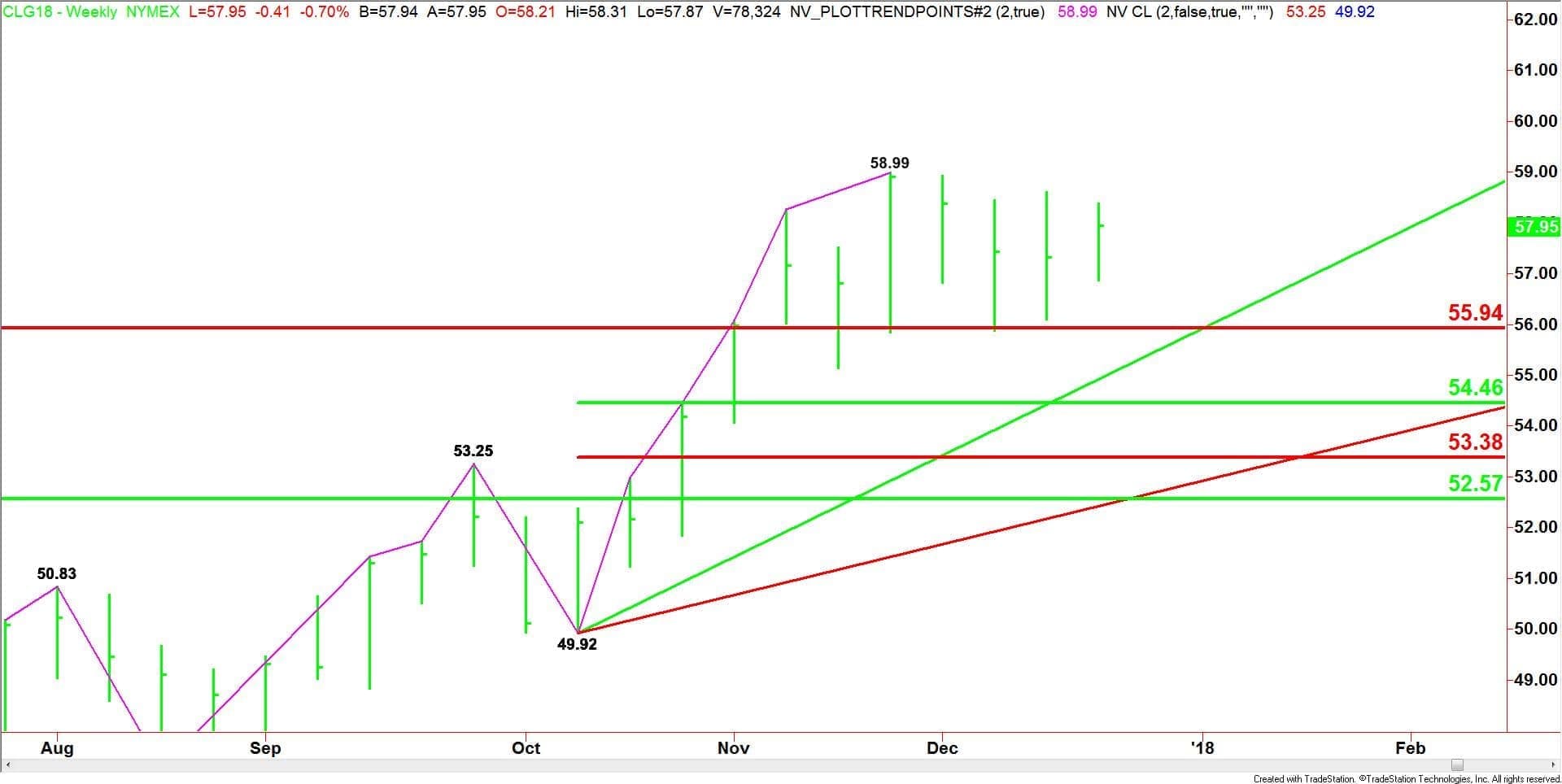

Weekly February West Texas Intermediate Crude Oil Technical Analysis

(Click to enlarge)

The main trend is up according to the weekly swing chart. However, the February WTI crude oil futures contract has been drifting sideways since late November when the OPEC-led group decided to extend its program to cut output, trim the excess global supply and stabilize prices until the end of 2018.

A trade through $58.99 will signal a resumption of the uptrend. In order to sustain the move, real buying has to come in to support the rally. The current price action suggests that the hedge funds are willing to support the market on dips, but they seem to have little interest in buying strength.

The nearest support is a major 61.8% level at $55.94. This level has been providing support for seven weeks. I don’t think we’re going to see a meaningful sell-off until this level is taken out with conviction.

The current short-term range is $49.92 to $58.99. If there is a correction then its 50% to 61.8% level at $54.46 to $53.38 will become the primary downside target.

Weekly March Brent Crude Oil Technical Analysis

(Click to enlarge)

The main trend is up according to the weekly swing chart. However, the closing price reversal top from the week-ending December 15 has stopped the upside momentum.

The potentially bearish chart pattern will be confirmed if sellers can take out $61.47. This could trigger the start of a 2 to 3 week correction. A move through $64.92 will negate the closing price reversal top and signal a resumption of the uptrend.

A break though $61.47 will indicate the presence of sellers. This could lead to a quick break into the minor bottom at $60.92 and the uptrending angle at $59.77. Since the main trend is up, we could see a technical bounce on the first test of this level. However, if it fails to provide support, look out to the downside.

The main range is $50.27 to $64.92. If sellers take out the uptrending angle then look for an eventual move into its retracement zone at $57.60 to $55.87.

Conclusion

Since the OPEC-led decision to extend the output cuts, the crude oil market has been moving mostly sideways. The market has been primarily supported by the Forties pipeline outage. Due to this event, the hedge funds have been coming in to support the market on weakness.

Although U.S. inventories have been declining, the fact that production has been increasing is the major concern. If it weren’t for the Forties shutdown, I think that prices would be a lot lower due to the increasing U.S. production.

I mention this because the pipeline is going to be fixed within a couple of weeks and without this event to prop prices higher, I’m anticipating the start of a meaningful sell-off. It’s just a matter of time, in my opinion, before prices retreat to more realistic levels.