I have never subscribed to the Bitcoin craze.

In my opinion, it is a massive pyramid scheme that is rapidly creating a dangerous bubble.

The kind of dangerous bubble we haven’t seen since the subprime mortgage implosion almost a decade ago.

However, I am not here to talk about the sustainability of Bitcoin.

I’m here to talk about the massive impact it has on energy.

Regardless of my personal feelings, Bitcoin is influencing the price of energy.

In fact, the connection between Bitcoin and energy costs is one of the main reasons China has become the world’s leading location for “mining” the currency.

At issue is how much each Bitcoin costs in energy terms.

This is something that cryptocurrency enthusiasts have only begun to consider.

Fact is, Bitcoin might be all the rage…

But most investors are still in the dark about how they are manufactured.

And the opportunities that’s creating for energy investors…

How the Bitcoin Boom Really Works

An English study published earlier this year estimated that there are as many as 5.8 million individual users using a cryptocurrency “wallet” for transactions.

Most of them are using Bitcoin, although there have been other cryptocurrencies established.

Bitcoins comprise a decentralized digital currency having no central bank releasing them or administrator overseeing their exchange.

Transactions occur between users directly through the use of cryptography, without an intermediary.

These transactions are verified by network nodes and recorded in an immutable public distributed ledger called a “blockchain.”

Individual cryptocurrency units, such as Bitcoins, are created as a reward for a process known as mining.

It is the mining, or creation, of a Bitcoin that provides the huge profits we’ve witnessed lately.

Bitcoin transactions are secured by computer miners, who are competing for rewards in the form of coins from the network.

New sets of transactions (blocks) are added to the blockchain roughly every 10 minutes by the “miners.”

While working on the blockchain, these miners aren’t required to trust each other.

The only thing miners have to trust is the code that runs the process.

The code includes several rules to validate new transactions. For example, a transaction can only be valid if the sender actually owns the sent amount. Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners.

The trick is to get all miners to agree on the same history of transactions.

Every miner in the network is constantly tasked with preparing the next batch of transactions for the blockchain.

Only one of these blocks will be randomly selected to become the latest block on the chain.

Random selection in a distributed network isn’t easy, so this is where proof-of-work comes in.

Trial and Error

In proof-of-work, the next block comes from the first miner that produces a valid one.

This is easier said than done.

The difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid block every 10 minutes on average.

Once one of the miners finally manages to produce a valid block, it will inform the rest of the network.

Other miners will accept this block once they confirm it adheres to all rules, and then discard whatever block they had been working on themselves.

The lucky miner gets rewarded with a fixed amount of coins, along with the transaction fees belonging to the processed transactions in the new block.

The cycle then starts again.

Related: How Many Barrels Of Oil Are Needed To Mine One Bitcoin?

The process of producing a valid block is largely based on trial and error, where miners are making numerous attempts every second trying to find the right value for a block component called the “nonce”, and hoping the resulting completed block will match the requirements (as there is no way to predict the outcome).

For this reason, mining is sometimes compared to a lottery where you can pick your own numbers.

The number of attempts (hashes) per second is given by your mining equipment’s hashrate.

This will typically be expressed in Gigahash per second (1 billion hashes per second).

It is at this point that the huge (and expanding) energy footprint of Bitcoin mining becomes an issue.

Bitcoin’s Alarming Energy Consumption Rate

The continuous block mining cycle entices Bitcoin mining globally.

As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it.

Over the years, this has caused the total energy consumption of the Bitcoin network to grow massively, as the price of the currency reached new highs.

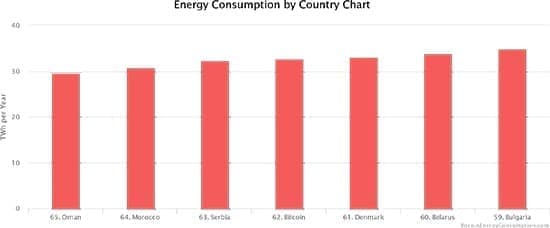

The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency.

If Bitcoin were a country, it would rank between Serbia and Denmark:

(Click to enlarge)

In October, James Stafford of Oilprice.com estimated that Bitcoin mining consumes 22.5 terawatt hours (TWh) of energy annually, which amounts to 13,239,916 barrels of oil equivalent.

With 12.5 Bitcoins mined every 10 minutes, that means the average energy cost of one Bitcoin would equate to 20 barrels of oil equivalent.

As Stafford adds, “mining Bitcoin has the potential to be a wildly lucrative business, with a single Bitcoin now valued at more than 100 barrels of oil. That kind of price makes it one of the most valuable commodities on the planet and, just like oil, this commodity is increasingly valuable to mine if the energy costs can be kept down.”

The mega computing required is a very energy-intensive process, and cheap electricity is exactly what resulted in China being the location for as much as 85 percent of all Bitcoin mining worldwide.

The cost of energy (i.e., the cost of computing) determines the profitability of the operation.

Successful Bitcoin mining requires cheap energy; best around 2 cents a kilowatt-hour (KWh).

As noted in this graph, the low cost of (state-subsidized) power generation in China has been why so many Bitcoin miners has flocked there.

(Click to enlarge)

Yet for environmentalists, Bitcoin’s biggest problem is not even its massive energy consumption.

A majority of the mining network is fueled by Chinese coal-fired power plants.

But, even with a conservative emission factor, this results in an extreme carbon footprint for each unique Bitcoin transaction. Related: Santa Is Putting Christmas On The Blockchain And Saving Billions

Well, those same cost factors have prompted a new rush to somewhere else in the world entirely – Iceland.

A New Bitcoin Haven

The reasons are simple.

First, it’s freezing there, so the relative energy cost of mining is lower.

That’s because mining hardware requires enormous power and creates tons of heat, and natural temperature is key: Iceland saves on cooling costs, making it one of the most profitable locations to mine Bitcoins.

See, the days are fast closing when Bitcoins can be effectively mined on individual computers.

We are in the age of industrial-scale Bitcoin mining.

And the goal is to keep energy costs down.

That’s why HIVE Blockchain Technologies Ltd. (PRELF) – once a gold-mining company, now a Bitcoin miner – recently moved some of its operations to Iceland.

And why several other (still private) companies are following suit.

HIVE has in its corner legendary mining mavericks Frank Giustra and Frank Holmes. Giustra built up Goldcorp Inc. (GG) in 2000. Today, it is one the largest gold mining operations in the world, and trades at a market cap approaching $11 billion.

He also pioneered what is now Wheaton Precious Metals Corp. (WPM), the biggest silver and gold-streaming company in the world. Oh yes, Giustra also heads up the entertainment (and Oscar-winning) giant Lions Gate Entertainment Corp. (LGF-A/LGF-B).

But he’s not the only one with an impressive resume.

Holmes is CEO of U.S. Global Investors Inc. (GROW), which has $2.6 billion in assets under management and is one of the top metals funds.

Both are backing HIVE, with Holmes as its chairman. Point is, these are executives that have their thumb on the pulse of the industry.

And that pulse leads directly to Iceland.

Now, Bitcoin may still be a pyramid waiting to collapse, but if companies like HIVE can continue to cut the cost of mining cryptocurrencies, it will open up a flurry of intriguing energy plays for us to target.

By Dr. Kent Moors

More Top Reads From Oilprice.com:

- U.S. Oil Rig Count Dips, Ending 5 Week Streak

- IEA Dashes Bullish Sentiment In Oil

- Russia, China Grow Closer As The New Silk Road Unfolds

You need to read and educate yourself before you make uninformed comments about things you have no clue about.

You sound very ignorant.

Good luck