With the IEA's most recent report suggesting a global supply glut may be looming, it seems the oil bulls have retreated and prices have stagnated.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

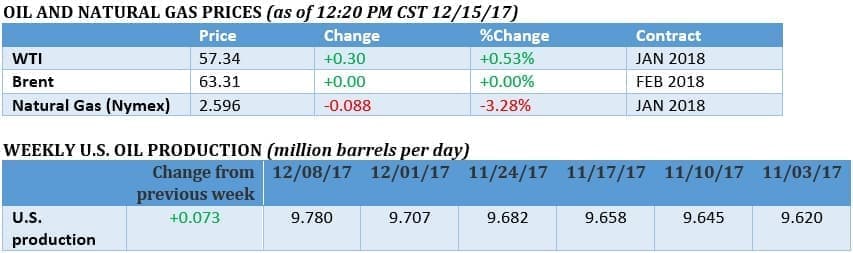

Friday, December 15, 2017

Oil prices fell back from their highs earlier this week after the Forties outage, as the IEA dashed hopes of continued bullish momentum when it reported that the global supply surplus could return in 2018.

Inventory surplus shrinks. OPEC said that the global surplus in oil inventories dropped to 130 million barrels above the five-year average in November, down sharply from 154 million barrels the month before. “We are beginning to see a return to stable markets,” OPEC Secretary-General Mohammad Barkindo said. “Something that has eluded us for several years.” There are growing expectations that OPEC will need to offer details of an exit strategy at its June 2018 meeting.

IEA: Inventory surplus to return. The IEA published a bearish report this week. The headline conclusion was that U.S. shale would grow so sharply that it would help bring back inventory builds in 2018. The Paris-based energy agency predicted that non-OPEC supply would grow by 1.6 mb/d, overwhelming demand growth of just 1.3 mb/d. That would put an end to the strong inventory drawdowns that we have seen this year, and the agency predicted that inventories would rise by a rate of 200,000 bpd in the first half of 2016. The report undercuts the notion that the oil market will reach balance at some point in mid- to late-2018. Meanwhile, OPEC predicts strong inventory declines in the second half of 2018 – a notable difference from the IEA. “Both cannot be right,” Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen, told Bloomberg. “Whichever way the pendulum swings will have a significant impact on the market.”

Global finance curtailing fossil fuel investments. A growing number of large financial institutions have pledged to end their support for fossil fuels. The World Bank said earlier this week that it would no longer finance coal plants beginning in 2019. But other examples continue to pop up. BNP Paribas said in October that it would no longer lend to shale and oil sands projects. Dutch lender ING said it would cut off finance for upstream oil and gas by 2019. French insurer AXA said it would no longer insure oil sands or coal projects.

Related: U.S. Shale Sends OPEC Deal Back To Square One

CNPC to take over Iran gas project. If French oil company Total (NYSE: TOT) exits the giant South Pars natural gas project in Iran due to U.S. sanctions, CNPC is poised to fill the void, according to Reuters. The $1 billion contract that Total signed with Iran included a provision to allow CNPC to take over Total’s stake if the oil company left. CNPC has a 30 percent stake, while Total is the operator with 50.1 percent.

Asian buyers wary of Eagle Ford shale. Bloomberg reports that some Asian refiners that have scooped up crude cargoes from the U.S. are learning that not all barrels from U.S. shale are the same. In fact, at least three Asian refiners that bought oil from the Eagle Ford shale said they wouldn’t follow up with more purchases because of a lack of consistency in quality. Two sources told Bloomberg that the Eagle Ford cargoes had more liquid petroleum gas and naptha than they expected. “Unlike Middle Eastern or West African crudes, which originate from one single large and stable reservoir, shale crudes are often extracted from multiple layers and can originate from different parts of a basin which have varying geological characteristics,” Virendra Chauhan, an analyst at industry consultant Energy Aspects Ltd., told Bloomberg. To be sure, U.S. oil exports are not going to drop anytime soon, but large refiners around the world are learning that U.S. shale doesn’t always meet their specifications.

Big Finance not shying away from shale. Hedge funds and private equity are pouring money into the shale patch despite a growing chorus of investors demanding higher returns from shale companies, according to Reuters. The pressure from investors raised questions about Wall Street’s commitment to the shale industry, but Reuters says that the flow of money has continued to flood in unabated.

Saudi Aramco to regain market share after OPEC deal. Saudi Aramco’s CEO Amin Nasser said that his company would regain lost market share once the OPEC deal expires. “We had to cut our allocations to certain markets based on the (OPEC) agreement ... hopefully we will regain these markets as soon as this deal ends,” he said in a Reuters interview. He also said that Aramco would pursue a large expansion in the downstream sector, with India as one particular place where Aramco wants to expand.

Elliot Management pushes changes at Hess Corp. Elliot Management, which owns a 6.7 percent stake in Hess Corp. (NYSE: HES), is trying to push out Hess’ CEO John B. Hess. Elliot is also pushing for a dividend cut in exchange for higher share buybacks. The push by the activist investor comes as Hess’ stock has underperformed. “As long-term shareholders in Hess, we are frustrated by the company’s continuing underperformance,” Elliott portfolio manager John Pike said in a statement to The Wall Street Journal. “Shareholders are getting impatient because the changes needed to remedy Hess’s severe undervaluation are substantial and need to be announced without delay.”

GOP tax bill to include renewables, EV tax credits. The tax proposals that worked their way through the U.S. Congress in recent weeks eliminated tax credits for wind, solar and electric vehicles, but as both chambers work to reconcile their differences, the compromise legislation will reportedly leave those tax credits unchanged. That includes the $7,500 rebate for EVs, and the 2.3-cent-per-kilowatt-hour tax credit for wind and solar.

BP to invest $200 million in renewables. In the latest example of an oil major stepping up stakes in renewables, BP (NYSE: BP) announced an investment of $200 million into Lightsource, a UK-based solar developer. The move marks a return to the renewables sector for BP after it closed the door on solar investments in 2011. BP says it has learned from its poor investment in low margin solar panel manufacturing from years ago. The investment gives the British oil giant a 43 percent stake in Lightsource. The move is significant because it is the latest example of large oil companies diversifying into the increasingly attractive renewables sector amid questions surrounding the long-term health of the oil business. Related: Adapt Or Die: Oil Majors In The New World

Ineos shuts down Scotland refinery on Forties outage. The shutdown of the Forties pipeline system in the North Sea has left the Grangemouth refinery in Scotland without any crude to process. Ineos, which owns both, said that it would shut down the refinery and possibly move up its maintenance schedule.

Goldman: Big Oil is back. Goldman Sachs predicts that the oil majors are set for huge gains in 2018 after years of underperforming. The investment bank says they will be flush with cash that will be used to send to shareholders in the form of higher dividends and share buybacks. Plus, consolidation in the industry, combined with the oil majors’ unrivaled ability to pursue risky projects, means that they will stand out. “It’s a very exciting time,” Michele Della Vigna, Goldman’s head of energy industry research, said in an interview with Bloomberg TV. “We’re back to a concentrated market like we had in the 90s,” with the oil majors earning higher returns than their smaller peers, he said.

More Top Reads From Oilprice.com:

- U.S. Oil Rig Count Dips, Ending 5 Week Streak

- Goldman: These Are The Hottest Commodities In 2018

- Russia, China Grow Closer As The New Silk Road Unfolds