Friday August 24, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

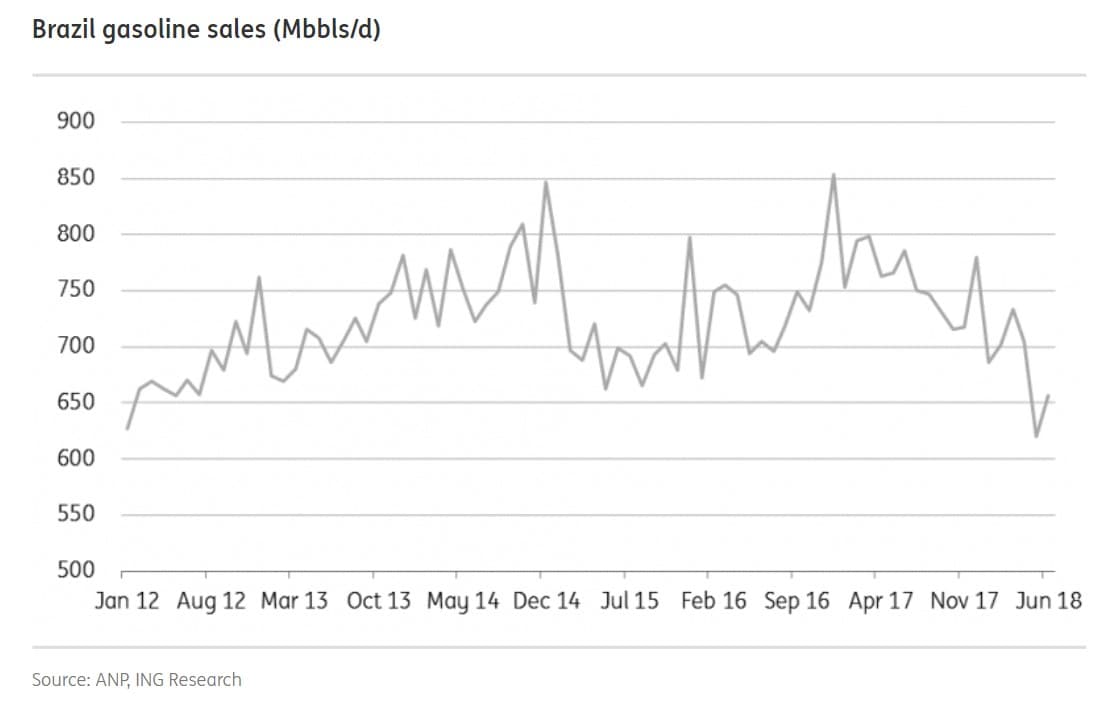

1. Brazil gasoline demand plunges

(Click to enlarge)

- Gasoline sales in Brazil have plunged this year, the result of higher oil prices combined with the relative weakness of the country’s currency, the real.

- Also, Brazil has one unique aspect to its fuel market that other countries don’t have: Roughly 50 percent of Brazil’s passenger vehicle fleet is flex-fuel, capable of filling up with gasoline or 100 percent ethanol. If gasoline gets too expensive, motorists switch to sugar-based ethanol.

- Gasoline demand in Brazil is down nearly 100,000 bpd year-to-date compared to the same period in 2017, according to ING.

- While Brazil is unique with its flex fuel vehicle fleet, the demand story is instructive because currency pressures in emerging markets around the world will likely begin cutting into demand.

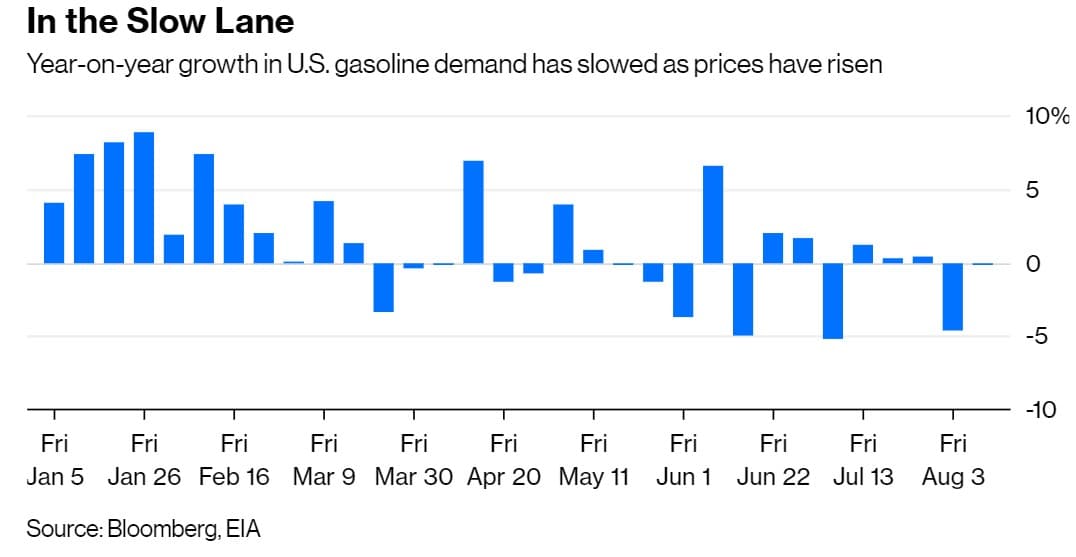

2. U.S. gasoline demand down too

(Click to enlarge)

- It isn’t just emerging markets that are seeing a slowdown in gasoline demand. The U.S. has also seen demand flat line or even dip compared to last year’s levels.

- Earlier this year, it was not uncommon to see weekly demand figures from the EIA that showed gasoline demand…

Friday August 24, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Brazil gasoline demand plunges

(Click to enlarge)

- Gasoline sales in Brazil have plunged this year, the result of higher oil prices combined with the relative weakness of the country’s currency, the real.

- Also, Brazil has one unique aspect to its fuel market that other countries don’t have: Roughly 50 percent of Brazil’s passenger vehicle fleet is flex-fuel, capable of filling up with gasoline or 100 percent ethanol. If gasoline gets too expensive, motorists switch to sugar-based ethanol.

- Gasoline demand in Brazil is down nearly 100,000 bpd year-to-date compared to the same period in 2017, according to ING.

- While Brazil is unique with its flex fuel vehicle fleet, the demand story is instructive because currency pressures in emerging markets around the world will likely begin cutting into demand.

2. U.S. gasoline demand down too

(Click to enlarge)

- It isn’t just emerging markets that are seeing a slowdown in gasoline demand. The U.S. has also seen demand flat line or even dip compared to last year’s levels.

- Earlier this year, it was not uncommon to see weekly demand figures from the EIA that showed gasoline demand up 7 or 8 percent year-on-year. In the past three months, however, with retail gasoline prices just below $3 per gallon, gasoline demand has been either flat or down.

- For instance, in the first week of August, gasoline demand was down 4.6 percent year-on-year.

- The U.S. economy is still growing at a robust rate, unlike emerging markets, so the slowdown has much more to do with fuel prices than it does with a slowing economy.

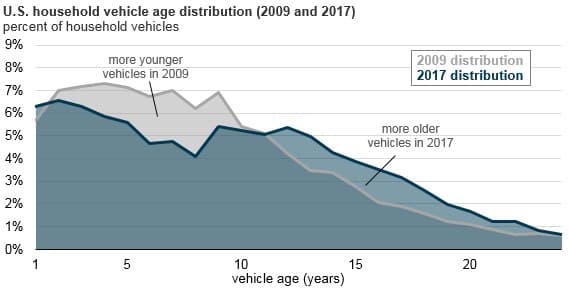

3. U.S. households holding onto older vehicles

(Click to enlarge)

- The vehicle turnover in the U.S. slowed significantly over the past decade.

- U.S. households are holding onto their cars, trucks and vans much longer than they used to. The average vehicle age in the U.S. in 2017 was 10.5 years, compared to just 9.3 years in 2009.

- American drivers are holding onto vehicles longer, and deferring purchases of new vehicles.

- A slower vehicle turnover will slow expected increases in fuel efficiency, and could keep oil demand higher than it otherwise would be, because older vehicles are much less efficient.

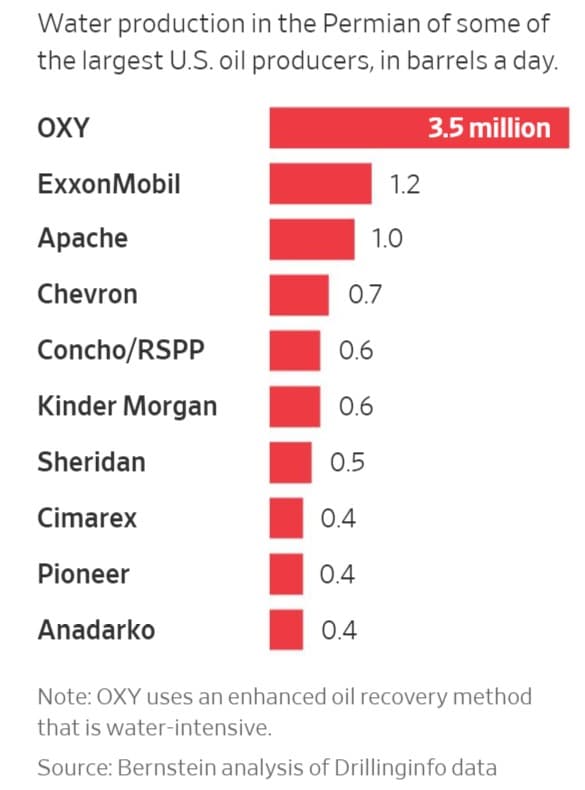

4. Oil companies are “producing” water

(Click to enlarge)

- Permian drillers produce over 3 million barrels of oil per day, but they are also “producing” a lot of water.

- There has been a lot of attention about wastewater that is injected into the ground during a fracking job, which must be disposed of, but much less attention paid to “produced” water – briny, salty water is extracted from the ground during the drilling process, which must be handled by the driller. According to the Wall Street Journal, about 25 percent of a well’s lease operating expense is in the handling of this produced water.

- Water management has become a big-time business in the Permian. “If the Permian goes up by one million barrels per day in oil production, it’s going up six million barrels in water. That’s an opportunity,” Christopher Manning, a managing partner of Trilantic Capital Management LP, which invested $100 million in Solaris Water Midstream, a wastewater disposal company, told the Wall Street Journal.

- Some wells produced 10x as much wastewater as they do oil, according to Wood Mackenzie.

- Companies have traditionally shipped this water on trucks, but a bottleneck for this service (just like the bottleneck for pipelines, labor, completion services, etc.) have driven up costs. Companies are now building pipelines to transport water for disposal.

- WoodMac says higher wastewater disposal costs are adding $6 per barrel to production costs for oil companies, which could translate into lower production in the Permian by about 400,000-bpd by 2025.

5. Shale companies step up spending

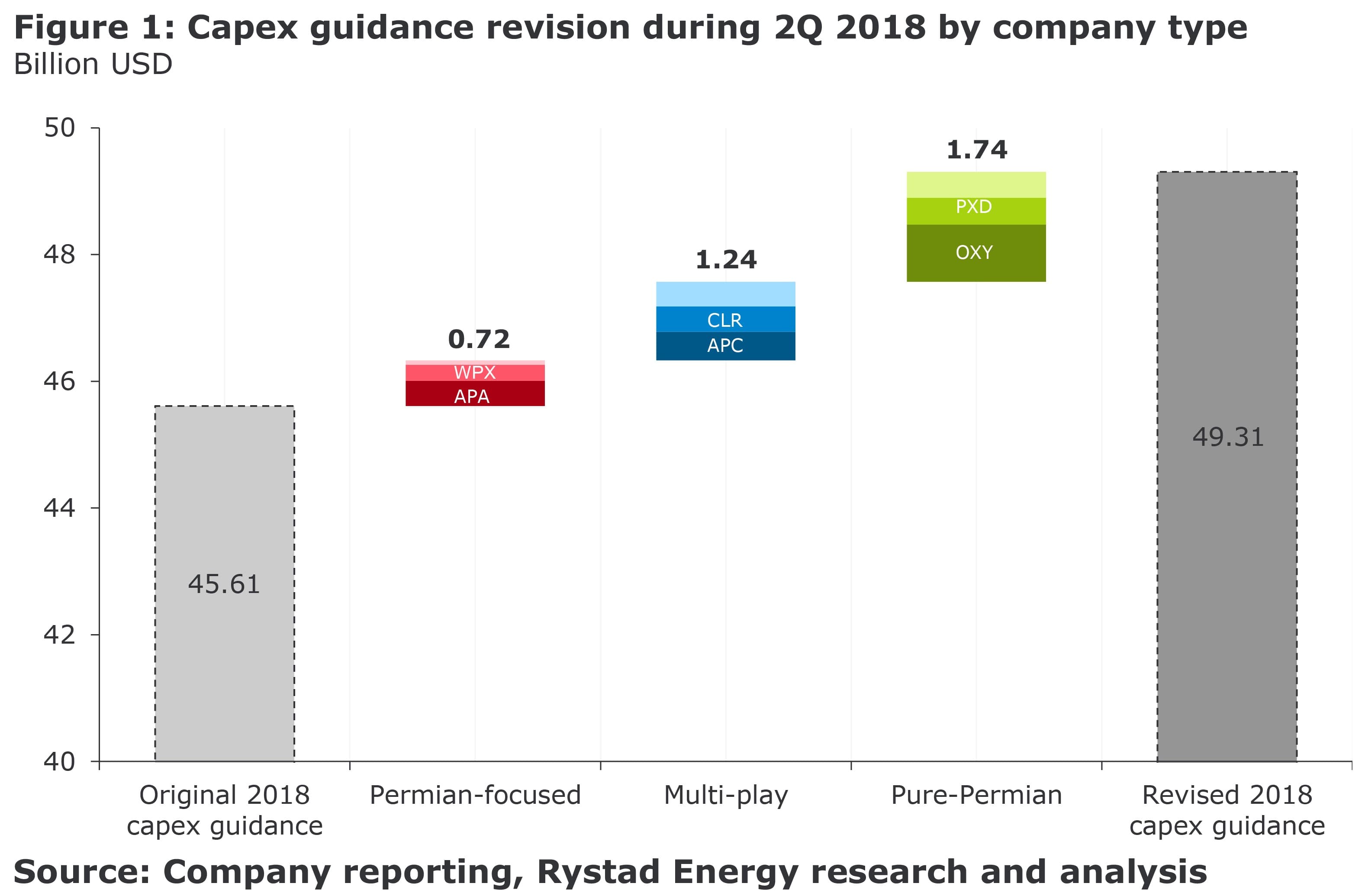

- Capital discipline has been the mantra in the shale industry for the past year, but that promise is looking shaky. Second quarter earnings reports from shale E&Ps revealed plans to significantly increase spending.

- Rystad Energy surveyed 33 U.S. shale companies, and they announced plans to increase spending by a combined 8 percent, or $3.7 billion, relative to spending guidance issued at the beginning of the year.

- But the 8 percent increase in spending will only result in an estimated 1.4 percent increase in production growth. “This disconnect might suggest that the shale industry requires more capital than before to achieve healthy production growth,” Rystad Energy said.

- Not so fast. While there is cost inflation, which is forcing companies to spend more for the same amount of oil, the spending increases are also expected to result in production increases for next year.

- “While higher cost inflation played a role in the uptick in investment budgets, as evident from 2Q earnings reports, the majority of incremental capital expenditure is still planned to be directed to a larger number of intensive long-lateral completions and facility build-outs,” Rystad Energy concluded.

6. Angola’s production down

(Click to enlarge)

- Much of the media has rightly been focusing on the supply losses in Venezuela, Libya, Nigeria and Iran. But there has been considerably less attention paid to Angola, which has seen production fall sharply in the last few years.

- Angola’s production stood at 1.47 mb/d in July, down 200,000 bpd from a year ago, and down more than 300,000 bpd from two years ago.

- Natural declines at aging fields are the main culprit, combined with “technical issues” at offshore blocks, the IEA says.

- Still, Total SA (NYSE: TOT) is expected to bring online new supplies from the $16 billion Kaombo project, which began operations last month.

- Within six months, the project is expected to add 115,000 bpd, and it will ramp up to full capacity at 240,000 bpd next year.

7. U.S. oil prices show increasing regional differences

(Click to enlarge)

- The pipeline bottleneck in the Permian has begun to create interest in specific regional prices. More specifically, there has been a spike in interest on betting on the differentials between WTI Houston and WTI in Midland.

- The higher interest reflects bets and hedges on the price differential. “When traded against Houston, WTI Midland enables traders to bet on transport costs between Permian oil fields and the coast,” the IEA said in a recent report.

- Open interest in the Argus Midland vs. NYMEX WTI differential hit 182,000 lots in July, the IEA said, close to a record high and up from negligible levels as recently as 18 months ago.

- “It gained sharply in late 2017, presumably as market participants factored in Permian takeaway capacity constraints,” the IEA said.

- The next question is what happens after pipelines come online, which should narrow the regional differences. Some say Houston makes more sense as a hub because of the increase in exports. But the reduction in price differentials could also reduce the specific interest in WTI Houston.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.