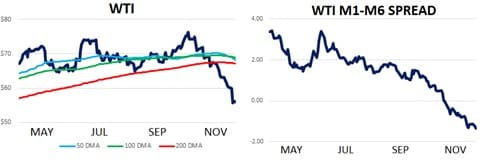

Oil’s bear market shifted into overdrive this week following the largest daily selloff in three years. Brent futures dropped to $65 while WTI hit $55. Both grades have sold off by about $21 since early October. In dissecting the decline, the usual culprits seem to be at work; demand forecasts have dimmed, supplies from Russia, Saudi Arabia and the U.S. have been massive and the waivers granted to Iran’s eight largest customers have mostly negated the effect of sanctions.

The impact of the bearish cocktail pushing markets lower has been an immense buildup of crude oil which few predicted just two months ago. We are, after all, in a seasonal period where refineries should be working full tilt to produce distillate fuels and crude oil inventories should be falling. Instead, recent IEA estimates suggest that global crude stocks are increasing by 700k bpd. Physical markets are showing serious signs of bearish strain with Brent spreads flipping from strong backwardation into a flat term structure while WTI spreads have flipped into a deep contango. Both trends will only incentive traders to put more barrels into storage in order to sell them later (when prices on the curve are higher) as opposed to selling them to refineries now. Cash differentials also point to serious oversupply in pockets of the North America. In Canada the glut is becoming so large that major producers are lobbying the government to arrange a nationwide reduction in production.

The oversupplied state…

Oil’s bear market shifted into overdrive this week following the largest daily selloff in three years. Brent futures dropped to $65 while WTI hit $55. Both grades have sold off by about $21 since early October. In dissecting the decline, the usual culprits seem to be at work; demand forecasts have dimmed, supplies from Russia, Saudi Arabia and the U.S. have been massive and the waivers granted to Iran’s eight largest customers have mostly negated the effect of sanctions.

The impact of the bearish cocktail pushing markets lower has been an immense buildup of crude oil which few predicted just two months ago. We are, after all, in a seasonal period where refineries should be working full tilt to produce distillate fuels and crude oil inventories should be falling. Instead, recent IEA estimates suggest that global crude stocks are increasing by 700k bpd. Physical markets are showing serious signs of bearish strain with Brent spreads flipping from strong backwardation into a flat term structure while WTI spreads have flipped into a deep contango. Both trends will only incentive traders to put more barrels into storage in order to sell them later (when prices on the curve are higher) as opposed to selling them to refineries now. Cash differentials also point to serious oversupply in pockets of the North America. In Canada the glut is becoming so large that major producers are lobbying the government to arrange a nationwide reduction in production.

The oversupplied state of the physical market highlights the extent to which the US has taken advantage of the Saudis in their efforts to thwart Iran while maintaining a well-supplied oil market. The story has gone something like this- the US approached the Saudis in a cooperative effort to place harsh sanctions on Iran. This required the Saudis to pump oil like mad to replace ‘lost’ Iranian barrels in order to keep gasoline prices down for US consumers. Then, rather than implement those sanctions, the US has granted 6-month waivers to Iran’s largest buyers. This gave the Trump White House two wins in the form of lower oil prices and appearing to act tough on Iran which is their major Middle East policy initiative.

Unfortunately for the Trump administration this double win will be virtually impossible to repeat. We certainly don’t expect the Saudis to get fooled again the next time Trump asks them for help with oil prices. We anticipate OPEC+ will fully execute the stated supply cut initiative of 1.4m bpd disclosed this week because they simply don’t have much of a choice in the current pricing environment. Aramco officials will not want to relive the 2016 price collapse now that another IPO-attempt is being considered and their relationship with the Trump administration is likely strong enough- despite Khashoggi- to withstand higher prices. As we mentioned in our last note, Trump has little choice but to lean on the Kingdom for Middle East partnership after spending the last two years alienating Iran. Going forward, look for Saudi Arabia to use up some of their goodwill with the current US administration and put serious teeth into their next effort to tighten the market.

Quick Hits

- WTI dropped nearly 10% from the Sunday night open through the end of trading on Tuesday and is $12 below its 200-day moving average for the first time since 2012. The low print of the week came at $54.75 representing an 8-month low.

- The IEA’s latest monthly report predicted that global crude stocks will increase by 700k bpd in 4Q’18 and by 2m bpd in 1H’19 unless OPEC + Russia reduce exports. The organization still sees global crude demand growth at 1.4m bpd in 2019.

- The IEA’s supply gain forecast is corroborated by the massive bearish shift in crude oil time spreads. To the right, we chart the WTI 1 month – 6 month spread which is currently 25 cents / month contango.

- Most of the sell side research we’re seeing sees crude oil bouncing heading into the end of the year. Goldman Sachs released a note this week which predicted a run towards $75 for brent.

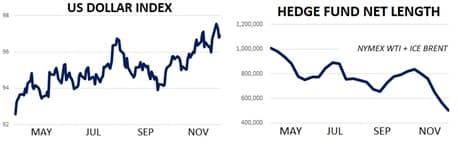

- US Fed chief Jerome Powell gave a broadly upbeat talk on the health of the US economy this week but said that tightening fiscal conditions and a slowing housing market could weigh on growth in 2019. Increased strength in the US Dollar Index- which is up about 8% this year- continues to put pressure on oil.

- Donald Trump was active on Twitter yet again this week imploring OPEC not to cut production. We must admit, Mr. Trump has been effective in pushing the Saudi’s to keep a lid on prices. Unfortunately, Trump has a limited number of buttons to push now that he’s aligned himself so firmly with the Saudis and we don’t expect pressure from Washington to prevent any potential OPEC + Russia supply cut agreements.

- Hedge funds continue to be massive sellers of NYMEX WTI and ICE Brent contract and likely played an outsized role in this week’s bearish carnage. Net length held by hedge funds for the two primary oil contracts is lower by 50% since May and stands at its lowest point in sixteen months. We’re expecting next week’s COT data to reveal another massive round of selling from funds given this week’s sharp price action which could set up a nicely for a short-cover rally heading into 2019.

DOE Roundup

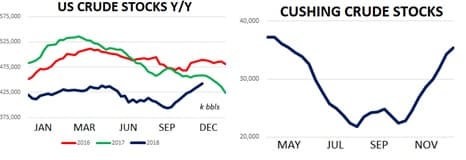

If you’re becoming bored with reading extremely bearish DOE reports then you may want to skip this one. US crude oil inventories increased for an eighth straight week last week. This time the jump was an incredible 10m bbls.

- Overall US crude stocks have jumped by 46m bbls in just the last two months and are now lower y/y by just 3%. The recent deluge of supplies the US, Russia and Saudi Arabia has largely undone most of the supply-tightening work that OPEC did in the last three years and OPEC+ will have its work cut out for them as they try to normalize balances.

- Crude stocks in the Cushing, OK delivery hub are showing the stress of increased supplies. Inventories hit 35m bbls this week for a six-month high and have increased by 13m bbls in the last seven weeks.

- US crude production also continued its monotonous march higher. Output reached 11.7m bpd last week for a 100k bpd w/w improvement and a stunning 2m bpd y/y increase. US crude oil rigs stand at 886 representing a three-year high.

- Refiner demand came in with a thud last week at 16.4m bpd- lower by about 200k bpd y/y. Runs will need to seriously accelerate heading into year end in order to reverse the current trend of inventory builds. Fortunately, we can expect another +1m bpd from the US by the end of December based on seasonal needs for heating oil.

- Speaking of heating oil, distillate supplies appear to be the only bullish part of the crude oil barrel at the moment. US distillate stocks fell 3.5m bbls last week and are lower y/y by about 4%.

- The glut of gasoline in the US is seriously hurting refining margins. US gasoline stocks enjoyed a small w/w decline to 226m bbls but are still higher y/y by about 8%. As a result, the WTI 321 crack – a broad metric for the health of US refining margins – continues to languish near $16/bbl.

- US gasoline demand has also slowed and is currently flat y/y. Distillate demand is better y/y by more than 10% in November.