Crude has continued its downward slide, edging lower for the sixth consecutive week amid solidifying concerns about a potentially oversupplied market. On Tuesday prices plunged by 5 dollars, the worst day for crude trading in the past three years. Prices have, however, partially rebounded since, ending the 12 day falling streak.

(Click to enlarge)

OPEC played a significant role in reversing the price dynamics, stating that it might return to production cuts if need be. Moreover, ongoing reports of Russia and Saudi Arabia cooperating on oil pricing issues supported crude prices. On Friday, Brent traded in the $67-68 per barrel interval, whilst WTI moved towards $58 per barrel.

1. US Crude Stocks Continue to Rise Amid Falling Product Stocks

(Click to enlarge)

- US Commercial crude stocks increased for the eighth week in a row, adding in a hefty 10.3 MMBbl w-o-w hike, reaching 442.1 MMBbl.

- Even though crude imports rose by 270 kbpd w-o-w, the extent of the crude buildup most likely disguises a discrepancy between real and reported crude export volumes.

- Regardless of this discrepancny, the US oil sector will have to fight its way through the current period of crude oversupply.

- US refinery runs have remained largely stagnant at 16.4 MMbpd, ahead of this week’s restart of the 410kbpd Whiting refinery in Indiana.

- Gasoline inventories dropped by 1.4 MMbbl w-o-w, largely due to imports decreasing by more than…

Crude has continued its downward slide, edging lower for the sixth consecutive week amid solidifying concerns about a potentially oversupplied market. On Tuesday prices plunged by 5 dollars, the worst day for crude trading in the past three years. Prices have, however, partially rebounded since, ending the 12 day falling streak.

(Click to enlarge)

OPEC played a significant role in reversing the price dynamics, stating that it might return to production cuts if need be. Moreover, ongoing reports of Russia and Saudi Arabia cooperating on oil pricing issues supported crude prices. On Friday, Brent traded in the $67-68 per barrel interval, whilst WTI moved towards $58 per barrel.

1. US Crude Stocks Continue to Rise Amid Falling Product Stocks

(Click to enlarge)

- US Commercial crude stocks increased for the eighth week in a row, adding in a hefty 10.3 MMBbl w-o-w hike, reaching 442.1 MMBbl.

- Even though crude imports rose by 270 kbpd w-o-w, the extent of the crude buildup most likely disguises a discrepancy between real and reported crude export volumes.

- Regardless of this discrepancny, the US oil sector will have to fight its way through the current period of crude oversupply.

- US refinery runs have remained largely stagnant at 16.4 MMbpd, ahead of this week’s restart of the 410kbpd Whiting refinery in Indiana.

- Gasoline inventories dropped by 1.4 MMbbl w-o-w, largely due to imports decreasing by more than 300kbpd on the week, to a total level of 226.6 MMbbl.

- Distillate stocks have fallen for eight consecutive weeks by a cumulative 21 MMbbl, reaching 119 MMbbl - the lower limit of the five-year average range.

2. Iraq Going Against the Tide with December OSPs

(Click to enlarge)

- SOMO has lifted prices for European and US cargoes, running counter to Saudi Arabia’s easing of prices for December 2018 loadings.

- Saudi Aramco has cut its Arab Medium price (Ras Tanura basis) delivered to the Mediterranean by 30 US cents, whilst SOMO has the similar quality Basrah Light by 20 US cents.

- Basrah Light prices for Asia were kept at the same level, whilst Basrah Heavy cargo premiums to Asian customers will be increased by 50 US cents.

- This means SOMO has gone back to the traditional Middle Eastern setup – Basrah Light is at a 10 US cent discount to Arab Medium.

- Interestingly, SOMO has cut the December price of Kirkuk crude heading to Europe by 1.25 USD per barrel to this year’s record level of -4 USD per barrel.

- It has to be noted, however, that SOMO does not market Kirkuk crude currently – all the volumes are exported by the Kurdistan Regional Government instead. There are talks that SOMO might restart some Kirkuk exports in the upcoming weeks.

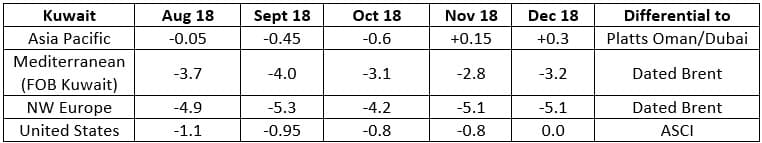

3. Kuwait Keeps Its Crude Competitive vis-à-vis Saudi Arabia

(Click to enlarge)

- The Kuwait Petroleum Corporation (KPC) raised its Asia-bound official selling price for Kuwait Export Crude (KEC) by 15 US cents per barrel, keeping it competitive against Arab Medium which was previously raised by 20 US cents.

- Thus, the Asian KEC-Arab Medium discount has gone back to 40 US cents per barrel after the last month’s five-year high of 35 US cents per barrel.

- KPC followed the footsteps of Saudi Aramco regarding European supplies, too – Saudi Aramco cut the Arab Medium FOB Sidi Kerir price by 40 US cents and the FOB Ras Tanura by 30 US cents per barrel, KPC went for 50 and 40 US cents per barrel, correspondingly.

- Moreover, KPC rolled over the Northwest Europe prices from November, whilst Saudi Aramco has raised Arab Medium by 60 US cents per barrel.

4. Asian Refiners Lose Out on Switch From South Pars Condensate

Source: OilPrice data.

- South Korean and Japanese refiners that previously went heavy on refining the Iranian South Pars Condensate (SPC) are set to lose out from switching to other supply streams.

- Most of the potential SPC substitutes are significantly heavier than the 62° API Iranian supply, substantially changing the yield structure for the worse.

- The Australian 50° API Ichthys condensate yields up to 15 percent of fuel oil, whilst SPC yields little to none of it.

- Another potential substitute, the American Eagle Ford Condensate’s metals content is a worry, too - it contains 15 times as much nitrogen, 30 times as much mercury and double the amount of arsenic, compared to SPC.

- Moreover, due to the heterogeneity of Eagle Ford (its API might be anywhere between 50-60° API), its quality might vary from cargo to cargo, making it all the more difficult for Asia-Pacific refineries to adapt to it.

- For those not having splitters that can cope with Eagle Ford or Ichthys, Australia’s 63° API North West Shelf Condensate will be the most optimal way out.

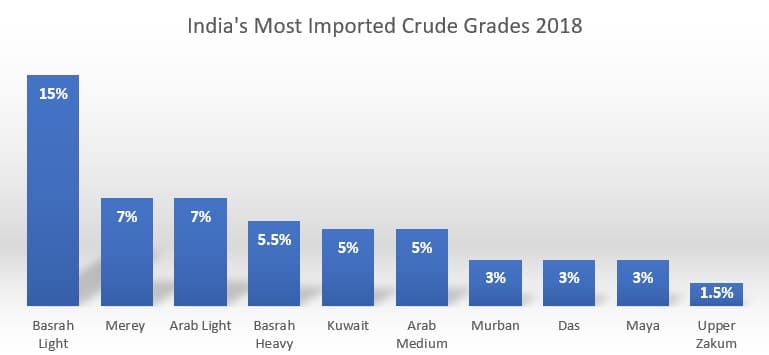

5. ADNOC Moves Further Into Indian Strategic Storage

(Click to enlarge)

Source: OilPrice data.

- ADNOC signed a memorandum of understanding with the Indian Strategic Petroleum Reserve to store crude at the 2.5 Mmt Padur storage facility in the southern state of Karnataka.

- This marks the second step in Phase I of the Indian Strategic Reserve’s program, which stipulates the creation of three storage sites in Padur, Mangalore and Vishakhapatnam.

- ADNOC already uses up to half of Mangalore’s 1.5Mmt storage capacity, having supplied the first shipment this May.

- India does not have to pay for the crude in return for allowing ADNOC to use its underground storage and has the first right to the oil in case of an oil shortage.

- Otherwise, ADNOC, which accounts for 7 percent of Indian crude imports, is free to sell it to Indian refiners.

- It is expected that the second half of Padur capacity will be allocated to Saudi Aramco.

- India already has 5.33Mmt worth of strategic storage capacity, and to two new sites in Odisha and Karnataka that are set to be built in the next few years will increase its capacity by a further 6.5 million tons.

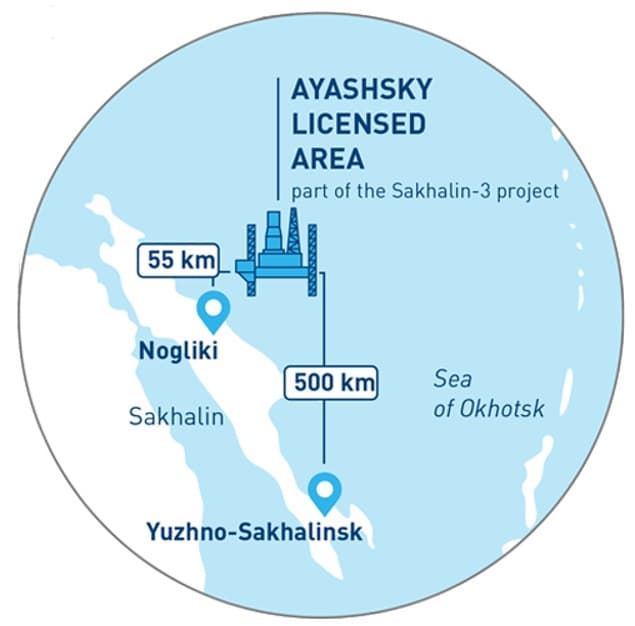

6. Gazprom Neft Strikes Oil Again in the Okhotsk Sea

(Click to enlarge)

Source: Gazprom Neft.

- Gazprom Neft’s latest discovery, Triton, was drilled in the Ayashskiy license blocks in water depth of 80 meters, unearthing at least 1 billion barrels of oil reserves.

- It was estimated that the Bayutinskiy prospect contains around 700 million barrels, so the results of the drilling surpassed initial expectations.

- Triton is found close to the Neptune, a 2017 discovery which turned out to be the one of the largest in Russia’s Sakhalin offshore – Neptune’s in-place reserves are estimated at 3 BBbl and recoverable ones at 0.91 BBbl.

- Before Neptune and Triton (the field naming follows a pattern, since Triton was the son of Neptune in Roman mythology) it was estimated that the Ayashskiy area contained up to 5TCf of gas, however, the discoveries testify to a more oil-bearing zone.

- Gazprom Neft does not rule out the participation of foreign partners, Mitsubishi was rumoured to be interested in closer cooperation regarding offshore Sakhalin.

7. China Stores Iranian Condensate in Southeast Asian Waters

- According to Platts, an Iranian VLCC (Dover) has transferred this week part of its 2 billion barrel cargo of South Pars Condensate to the Vanguard floating storage vessel, operated by the Chinese Kunlun Company.

- There seems to be a larger trend behind this as Chinese companies are increasingly seen storing Iranian volumes in Southeast Asian international waters.

- Two other Iranian-owned VLCCs are currently located in the region, most probably waiting for a ship-to-ship transfer to offload their cargoes into floating storages there.

- The number of ships used for floating storage in Indonesia’s Nipah and Malaysia’s Tanjung Telepas areas has been gradually growing in the past weeks.

- At least three Iranian fully laden VLCCs are now currently around China’s port of Dalian as floating storage.