Electric vehicle sales are finally starting to take off in larger numbers, surpassing 1 million in 2017 after growing 56 percent from a year before. By 2020, sales are expected to rise to about 4 million and before jumping to 21.5 million in EV sales by 2030.

The grow rate of EV sales has been rather high for several years, but always from a low base. Now that base is starting to build, making the additions more meaningful. The global EV stock grew above 3 million last year, but could triple to 13 million over the next two years, according to a new report from the International Energy Agency. Electric buses are also making rapid headway, with the stock rising to 370,000 units, almost exclusively because of China.

The falling cost of batteries is a crucial ingredient in the acceleration of EV sales. The high cost of batteries are the main reason why EVs cost more than a traditional gasoline or diesel-powered vehicle, so ongoing cost declines are a pivotal factor in the success of EVs.

(Click to enlarge)

Norway has “the world’s most advanced market of electric cars” with a 39 percent market share for EVs, while China is far and away the leader in absolute numbers.

As the IEA notes, the countries with the most success in rolling out EVs have led with policy support, including public procurement programs, financial incentives, fuel-economy standards, and restrictions on vehicles based on emissions. Related: OPEC Unlikely To Open The Oil Taps In June

Norway is an interesting case since EVs have grabbed nearly 40 percent market share in terms of sales in just a few years. Norway offers EVs exemptions for a value-added tax (VAT) and registration tax, free access to toll roads and tax rebates. Meanwhile, the Netherlands actually saw a dip in EV sales and market share over the past few years after a tax change, demonstrating the strong link that EV sales have with policy at the moment.

Over the long-term, a growing list of countries are set to ban the internal combustion engine, forcing a phase out of gasoline and diesel vehicles. France and the UK will do it by 2040, Scotland by 2032, while Ireland, the Netherlands and Slovenia will implement bans by 2030. Norway is aiming for 2025. An even longer list of cities – including Los Angeles, Paris, Rome, London, Cape Town, Mexico City and more – will introduce access restrictions on their roads for gasoline and diesel vehicles, many of which will be implemented by 2030.

So, while EVs still depend on policy support, the trend is clear: EV costs are declining, while restrictions on gasoline and diesel will rise.

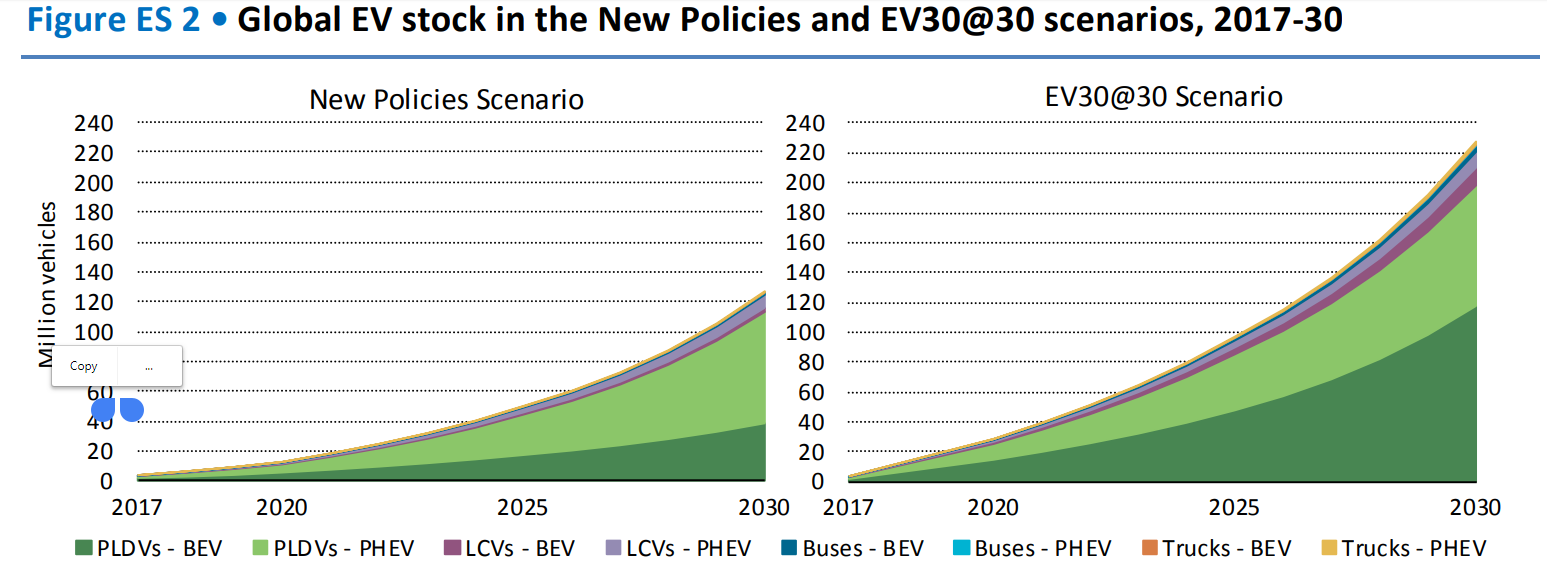

Looking forward, the IEA’s main scenario, which incorporates existing and announced policies, sees the EV stock reaching 125 million by 2030, a figure that would balloon to 220 million if more aggressive climate policies were adopted.

(Click to enlarge)

The 3 million EVs already on the roads last year displaced about 0.38 million barrels per day (mb/d) of oil demand. By 2030, EVs will knock off 2.57 mb/d of oil demand, or 4.74 mb/d in the more aggressive scenario incorporating more climate policy. Related: Emerging Market Meltdown Could Undermine Oil Rally

Even the higher number is a rather small figure in a 100-million-barrel-per-day oil market, but prices are largely decided at the margins. U.S. shale was largely responsible for crashing the entire market in 2014 after adding nearly 4 mb/d over the course of a few years. Oil demand won’t disappear overnight, but as EVs scale up, they could certainly keep a hard cap on oil prices, more or less permanently.

The report comes a week after Bloomberg New Energy Finance came to similar conclusions. BNEF said that EVs will beat the internal combustion engine on cost within a decade, putting EVs on track to capture a majority of auto sales on an annual basis by 2040. That would erase more than 7 mb/d of oil demand by that date.

Obviously, these forecasts should be taken with a grain of salt – forecasting over that length of time inherently involves a lot of guesswork. The precise numbers are a bit beside the point. The main takeaway is that the trend is only going in one direction – EVs growing and cutting into oil demand. We can debate about the pace of transition, but the transition is coming.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Musk: Tough Regulations Prevent Tesla From India Entry

- OPEC Overcompliance Has Created A Problem

- Goldman: The Oil Price Rally Isn’t Over Yet

We also are seeing the proliferation of plugs via PHEVs and that it is becoming price competitive at the dealership BEFORE incentives (e.g. BMW 530e MSRPs for the same price as the 530i and is still eligible for tax credits and rebates). As more people start driving even a portion of their miles electric, they'll both be interested in driving electric more often and considering an actual EV as their next vehicle.

Finally, the Electrify America expenditure will have a hugely positive effect on sales as well as people start to see EVs out in public and talk to the owners about what it's ACTUALLY like to own an EV. Coupled with the proliferation of charging opportunities to vanquish "range anxiety" and the more capable options hitting the market at the same time, most every automaker will be scrambling to increase production of their EVs by the end of the year. This will be even more pronounced if oil prices stay at current levels or trend even higher.