Friday November 10, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. shale growing or slowing down?

(Click to enlarge)

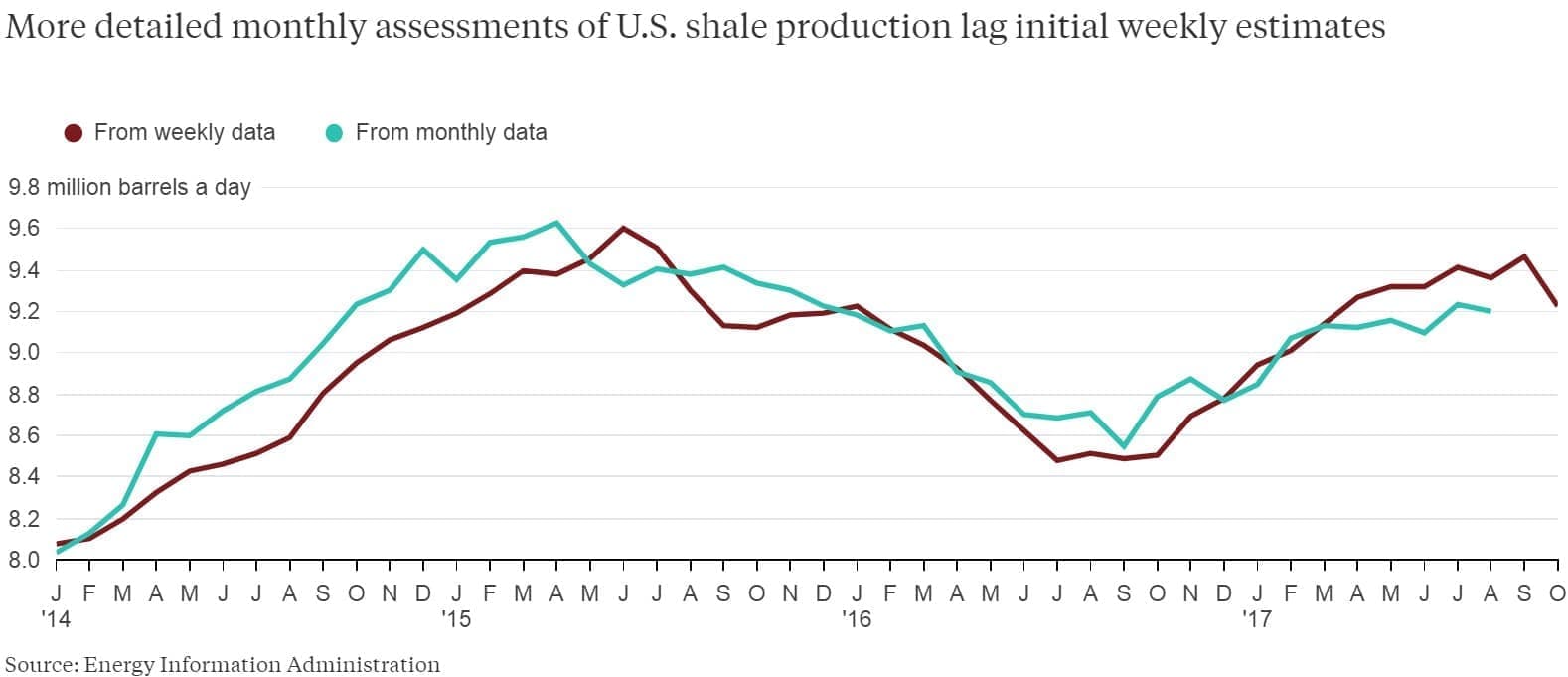

- Oil prices faltered mid-week on news that U.S. oil production jumped up to 9.62 mb/d in the first week of November, a gain of 67,000 bpd week-on-week.

- The uptick in output suggests that shale growth remains robust, putting output more than 1 mb/d higher than the low point last year of 8.5 mb/d.

- But the weekly EIA data has consistently over predicted output this year, at least according to the EIA’s own monthly data, which is widely seen as more accurate but is published on a several-month lag.

- The monthly data only runs up through July, a month in which the U.S. averaged 9.238 mb/d. But at the time, in July, the EIA predicted in its weekly data that the U.S. was producing about 9.4 mb/d.

- The discrepancy might seem minor, but the weekly data has an enormous impact on day-to-day oil price movements, as seen this week when WTI and Brent retreated after the publication.

- The implication is that there is evidence that the U.S. is producing less oil than the market currently believes.

2. Shale deals increasingly include “earnouts”

(Click to enlarge)

- The…

Friday November 10, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. shale growing or slowing down?

(Click to enlarge)

- Oil prices faltered mid-week on news that U.S. oil production jumped up to 9.62 mb/d in the first week of November, a gain of 67,000 bpd week-on-week.

- The uptick in output suggests that shale growth remains robust, putting output more than 1 mb/d higher than the low point last year of 8.5 mb/d.

- But the weekly EIA data has consistently over predicted output this year, at least according to the EIA’s own monthly data, which is widely seen as more accurate but is published on a several-month lag.

- The monthly data only runs up through July, a month in which the U.S. averaged 9.238 mb/d. But at the time, in July, the EIA predicted in its weekly data that the U.S. was producing about 9.4 mb/d.

- The discrepancy might seem minor, but the weekly data has an enormous impact on day-to-day oil price movements, as seen this week when WTI and Brent retreated after the publication.

- The implication is that there is evidence that the U.S. is producing less oil than the market currently believes.

2. Shale deals increasingly include “earnouts”

(Click to enlarge)

- The shale industry has seen a sharp increase in the use of “earnouts,” or payouts to the seller if things go well for the buyer, according to Bloomberg.

- For example, ExxonMobil (NYSE: XOM) bought a huge piece of territory in the Permian basin earlier this year, a deal that included $5.6 billion in Exxon shares for the seller, plus an additional $1 billion sweetener to be paid in 2032…but only if things go well for Exxon.

- This is a way for buyers, like Exxon, to sweeten the pot but also hedge against disappointment, particularly because there are still long-term questions about the health of shale.

- Sometimes these “earnouts” are contingent upon oil prices, or future profits, or production volumes, Bloomberg reports.

- Bloomberg says that there have been at least 24 oil and gas deals in North America that have included earnouts this year, deals worth a combined $25 billion. That compares to just $5 billion worth of deals including earnouts from last year.

3. Oil rally in danger of market correction

(Click to enlarge)

- The sharp rally in oil prices – up about 14% per barrel in the past month – has established a new sense of bullishness in the market. But that doesn’t mean that a return to $50 WTI is out of the question.

- Some of the rally has been driven by bullish positioning from hedge funds and other money managers, who have staked out the most net-long positioning in months.

- After speculators took their bets to a record high in net-length in February, they quickly abandoned those bullish bets when it became clear that it was unsustainable. That coincided with a sharp decrease in prices, taking WTI from the mid-$50s to the mid- to upper-$40s.

- The current net-length is not as high as it was in February, but the more speculators go long on WTI, the greater the risk of a retracement.

- The only way that higher prices are sustainable is if the fundamentals justify them. Some think that might be the case. "We do not see the latest rise in prices as speculative," Paul Horsnell, global head of commodity strategy at Standard Chartered, wrote a recent note. "We think the move reflects the start of a widespread re-evaluation."

4. Shale breakevens sharply down, but largely flat in 2017

(Click to enlarge)

- The rebound in shale growth since 2016 is predicated on the notion that the entire industry has succeeded in cutting costs so dramatically, that they can breakeven at today’s lower prices.

- Breakeven prices have fallen dramatically, with the Permian in particular seeing a 45 percent drop in breakeven costs since the beginning of 2014.

- Just about all of the major shale basins have seen sharp declines in breakeven prices, except for the DJ Basin, which has seen that threshold climb over the past year.

- Still, even in the Permian, breakeven prices have stagnated in 2017, as the cost of oilfield services rebounds. Even if further cost reductions can be made, the "greatest leaps forward in lowering costs are now behind us," said Michael Poulsen, senior oil risk analyst with Global Risk Management, according to Bloomberg.

5. OPEC revises up U.S. shale forecast

(Click to enlarge)

- OPEC revised up its forecast for U.S. shale this week, as part of its 2017 World Oil Outlook.

- OPEC now envisions shale output growing from 5.1 mb/d this year to 7.5 mb/d by 2021. That is quite a turnaround from OPEC’s 2016 prediction, pointed out by Bloomberg Gadfly, in which it forecast shale declining to just 4.8 mb/d in 2021.

- The revision is an acknowledgement that years of flooding the market did not succeed in driving shale drillers out of business. OPEC has decided it will have to live with shale for the long haul.

- That likely means the group will avoid a price war, at least for the time being, hoping to balance stable prices with production restraint while also avoiding boosting prices too much, which would spur more output from shale. It’s a tricky balancing act, but OPEC no longer believes that U.S. shale is going to go away.

6. Energy digitalization will make oil production cheaper

(Click to enlarge)

- The IEA released a new report on the coming wave of digitalization that will sweep over the energy industry. Much about oil and gas production is already digitalized, but dramatic changes are still coming.

- 3D printing, Big Data, automation, robotics, predictive analytics, and a general increase in connectivity will revolutionize the energy business, the IEA says.

- Big Data can optimize drilling decisions, processing complex data sets that could drastically reduce reliance on trial and error.

- The IEA says that overall, digitalization could drive oil production costs down by 10 to 20 percent.

- That will also put more oil in play. Digital innovation will increase the volume of technically recoverable oil and gas reserves by 5 percent globally.

- The flip side is that all of these technologies could eat into oil demand. Electrification and automation in the transportation sector could cut energy use in half in the most optimistic scenario.

7. Oil dividends set to rise again

(Click to enlarge)

- BP (NYSE: BP) announced a share buyback program last week, but that could be the beginning of a new round of higher payments to shareholders in the coming years.

- After three years of austerity for oil shareholders, a renewed growth in profits could bring them a windfall. BP’s and Statoil’s (NYSE: STO) decisions to end their scrip dividend program and return to cash payments also ups the pressure on their peers to boost shareholder payments.

- Reuters says there is now pressure on Royal Dutch Shell (NYSE: RDS.A) to follow through on its promise to remove its scrip program and initiate a $25 billion share buyback program through 2020. Shell declined to address that in its latest earnings report.

- The other oil majors have not made any decisions yet, fearing another oil price downturn. But analysts see dividend hikes coming soon.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.