Friday September 28, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

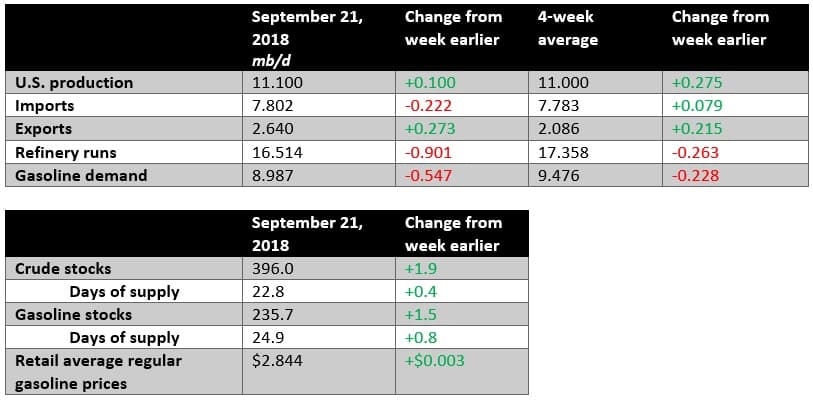

- In a somewhat quiet report this week, the EIA said that crude oil inventories rose by 1.9 million barrels, ending several consecutive weeks of drawdowns. That is not necessarily surprising as refineries pare back runs after the summer season. Indeed, refining runs fell sharply.

- Production rose by another increment of 100,000 bpd, a sign that the shale bonanza continues to grind higher, even if at a slower pace.

1. Legacy production decline growing

(Click to enlarge)

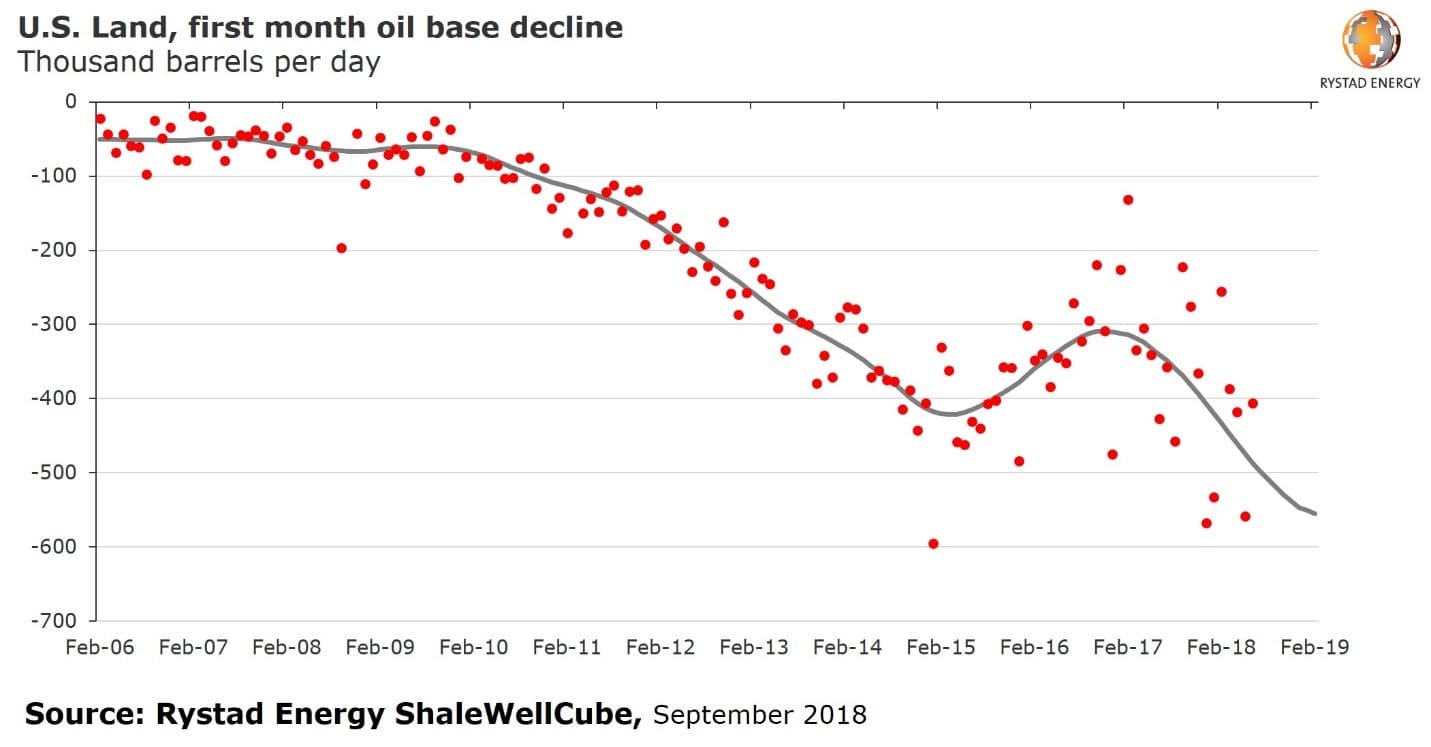

• The higher the level of shale drilling, the larger the base of decline becomes.

• That is just a reflection of a larger production base, as well as the rapid decline that shale wells typically experience.

• In the first half of 2018, the U.S. needed to add around 500,000 bpd of new production every month just to keep production from falling, according to Rystad Energy.

• That is up from a decline base of 50,000 to 60,000 bpd in 2006-2009, prior to the shale revolution.

2. East Coast refiners resort to imports

(Click to enlarge)

• East Coast refiners are somewhat isolated from the production…

Friday September 28, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- In a somewhat quiet report this week, the EIA said that crude oil inventories rose by 1.9 million barrels, ending several consecutive weeks of drawdowns. That is not necessarily surprising as refineries pare back runs after the summer season. Indeed, refining runs fell sharply.

- Production rose by another increment of 100,000 bpd, a sign that the shale bonanza continues to grind higher, even if at a slower pace.

1. Legacy production decline growing

(Click to enlarge)

• The higher the level of shale drilling, the larger the base of decline becomes.

• That is just a reflection of a larger production base, as well as the rapid decline that shale wells typically experience.

• In the first half of 2018, the U.S. needed to add around 500,000 bpd of new production every month just to keep production from falling, according to Rystad Energy.

• That is up from a decline base of 50,000 to 60,000 bpd in 2006-2009, prior to the shale revolution.

2. East Coast refiners resort to imports

(Click to enlarge)

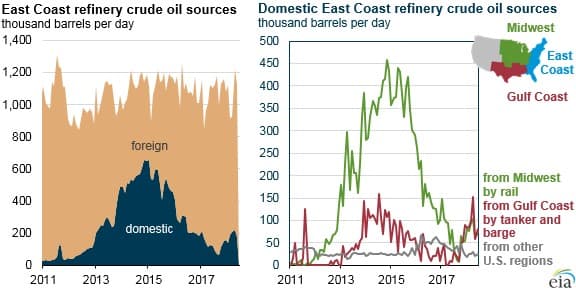

• East Coast refiners are somewhat isolated from the production base in North America, and historically resorted to imports from abroad.

• The steep discount for WTI in the 2013 to 2015 period – which also coincided with a boom in production – made it economical to ship oil via rail from North Dakota to refiners on the East Coast.

• But the oil-by-rail boom was only temporary. The opening of new pipelines to the Gulf Coast rerouted much of that oil to the South. New pipelines and exports also narrowed the WTI discount to Brent, which meant rail shipments to the East Coast no longer made sense.

• As a result, East Coast refiners’ purchases of domestic crude is down 77 percent since its peak in 2014.

3. Oil industry spending too little

(Click to enlarge)

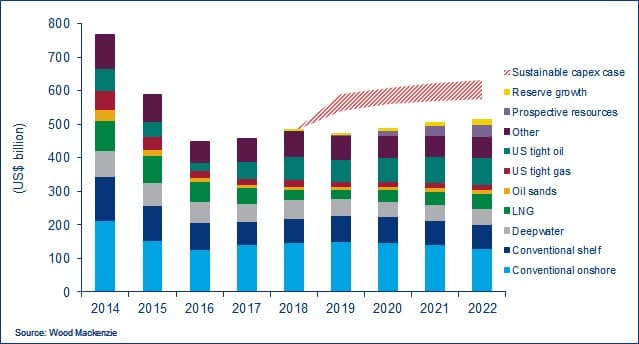

• The oil industry is not spending enough to meet future demand, according to Wood Mackenzie.

• WoodMac calls 2018 a “golden year,” with Brent set to average $75 per barrel and a rough breakeven price at $50 per barrel. That could translate into around $160 billion in free cash flow for the industry.

• WoodMac says that despite the good times, the industry is not spending enough for its long-term health.

• Investment could rise from $460 billion in 2016 – the low point – up to $500 billion in the early 2020s. But that’s still way below the $750 billion peak of 2014.

• The result could be a shortfall of supply, which could reach 3 million barrels per day by 2030.

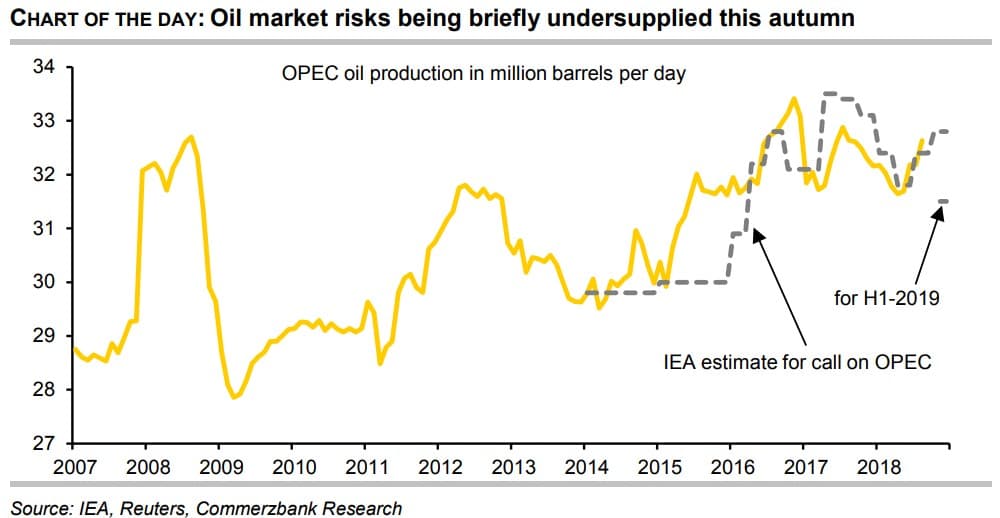

4. Supply crunch before end of the year?

(Click to enlarge)

• The supply losses from Iran, which could balloon to more than 1 mb/d by the end of the year, could significantly tighten the oil market, perhaps tipping the balance into a deficit.

• “The Iran sanctions mean a risk of tightening supply at least until year’s end,” Commerzbank said in a note. “Assuming that the shortfall in supply from Iran drives OPEC production down from 32.6 million barrels per day now to 31.8 million barrels per day, the supply gap based on the IEA estimate would total approx. 1 million barrels per day in the fourth quarter.”

• Commerzbank says that this gap could be met by a sale of 90 million barrels from the U.S. Strategic Petroleum Reserve, and because seasonal demand will decline in the first half of 2019, the SPR release could tide the market over until then.

• “Hence, OPEC production could decrease to this level next year without the need for any compensatory measures,” Commerzbank said.

5. Brent timespreads look bullish

(Click to enlarge)

• Brent timespreads have rallied in September, a reflection of the tightening oil market.

• The prompt spread has strengthened to over $0.60 per barrel.

• The backwardation, a situation in which front the spot barrel trades at a premium to the future price, is an indication that the market thinks inventories will continue to decline and the supply picture will tighten in the months ahead.

• “[W]e believe that being long oil offers a compelling returns opportunity, mostly from the 10% annual carry created by the current level of backwardation,” Goldman Sachs said in a note. “A long oil position would further bene?t from price upside should additional disruptions occur, although this is currently not our base case assumption.”

Heard on the Street

Oil not going to $100:

“Iran exports have declined faster than we (and consensus) had expected, OPEC failed to deliver a commitment to strongly increase production over the weekend, while global growth (especially EM) expectations are stabilizing and China restocking is occurring. While this set up can likely keep prices in the low $80s/bbl initially…we believe another supply catalyst beyond Iran would likely be needed for prices to meaningfully break to the upside. In particular, we continue to expect that production from other OPEC producers and Russia will offset losses out of Iran, as has been the case so far.” – Goldman Sachs

Or will oil prices spike way above $100?

“[W]e note that the likelihood of an oil spike and crash scenario akin to the one observed in 2008 has increased.” – Bank of America Merrill Lynch

Don’t worry about supply:

“Our plan is to respond to demand…If demand [for Saudi crude] is 10.9 million b/d you can certainly take it to the bank that we will meet it. But the demand is 10.5 million b/d or 10.6 million b/d. I think October will be more than this.” – Saudi oil minister Khalid al-Falih

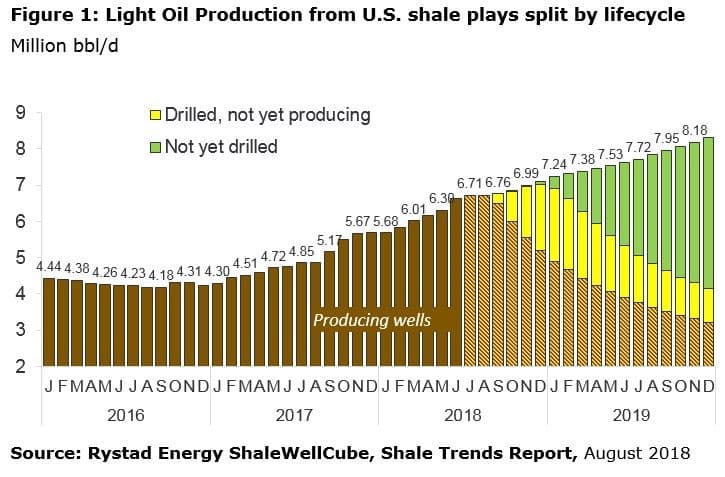

6. Shale growth already in the pipeline

(Click to enlarge)

• As of June 2018, U.S. shale production had increased by 1.85 mb/d, year-on-year.

• Many analysts and forecasters expect a slowdown, but the current level of activity puts the industry on track to grow production by another 0.5 mb/d over the second half of 2018, according to Rystad Energy.

• On top of that, the backlog of drilled but uncompleted wells (DUCs) ensures output growth will continue through the end of this year and into 2019.

• By December 2019, U.S. shale is expected to account for 8.3 mb/d of production.

7. SPR sales are baked in

(Click to enlarge)

• The decision by OPEC+ not to formally increase production raised speculation about a U.S. SPR release.

• U.S. Secretary of Energy dismissed those questions this week, saying that any sale would only offer minor and temporary relief.

• Meanwhile, the U.S. is selling off its strategic stockpile anyway. Several pieces of legislation signed into law authorize the sale of oil from the SPR. 11 million barrels will be sold off in the next two months.

• More than 100 million barrels will be sold between 2022 and 2027.

• As a result, the SPR could fall by about 40 percent over the coming decade, declining from 695 million barrels to just 410 million barrels by 2028.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.