The World Economic Forum’s annual Davos gathering is occurring this week and once again your beloved author’s invitation seems to have been lost in the mail. Hurt feelings aside, we think it’s a nice time to think about how the health of the global economy could look in 2019 and the impact that it may have on oil prices.

The normal newswires and business periodicals have all penned stories over the past two weeks describing the mood at the forthcoming event as somber. Take for example a few choice excerpts from a Bloomberg story which ran on Friday-

Those still going will do so as their economies lose momentum just a year since they enjoyed a rare synchronized upturn. While few predict a recession, companies are the most bearish since 2016 as economic data falls short of expectations and political risks mount amid an international trade war, U.S. government shutdown and Brexit. “The mood is going to be much darker than a year ago,” said Nariman Behravesh, IHS Markit’s chief economist…. A recession isn’t imminent, but as economies slow it wouldn’t take much to topple growth.” “The evidence is consistent with a slowdown rather than slump, but downside risks have increased,” said Tom Orlik, chief economist at Bloomberg Economics.

Ouch! This passage does a good job of encapsulating the attitude towards the global economy which is increasingly negative and worsening due to the nonstop flow of U.S. and British political folly. Let’s imagine for a moment that a…

The World Economic Forum’s annual Davos gathering is occurring this week and once again your beloved author’s invitation seems to have been lost in the mail. Hurt feelings aside, we think it’s a nice time to think about how the health of the global economy could look in 2019 and the impact that it may have on oil prices.

The normal newswires and business periodicals have all penned stories over the past two weeks describing the mood at the forthcoming event as somber. Take for example a few choice excerpts from a Bloomberg story which ran on Friday-

Those still going will do so as their economies lose momentum just a year since they enjoyed a rare synchronized upturn. While few predict a recession, companies are the most bearish since 2016 as economic data falls short of expectations and political risks mount amid an international trade war, U.S. government shutdown and Brexit. “The mood is going to be much darker than a year ago,” said Nariman Behravesh, IHS Markit’s chief economist…. A recession isn’t imminent, but as economies slow it wouldn’t take much to topple growth.” “The evidence is consistent with a slowdown rather than slump, but downside risks have increased,” said Tom Orlik, chief economist at Bloomberg Economics.

Ouch! This passage does a good job of encapsulating the attitude towards the global economy which is increasingly negative and worsening due to the nonstop flow of U.S. and British political folly. Let’s imagine for a moment that a slowdown does sour into recession in 2019. Common sense would dictate that oil prices would slump alongside risk assets like stocks and base metals, right?

We’re not so sure. Loads of oil market commentary has suggested that slowing global growth in 2019 would sink oil prices and we’re guilty of highlighting this risk in recent commentary. Over the last year there has been a nonstop flow of stories talking about how ‘demand concerns are keeping a lid on prices’ coming from governments, money managers, oil companies and sell side researchers. However, recent history suggests this might not be the case and there are important lessons to learn from the current macro cycle which hint the opposite could come true.

In 2010, a weak global economy was still very much wheelchair bound following the 2008/2009 global financial crisis. Nevertheless, Brent crude oil prices averaged $80 throughout the year as the US Fed lowered rates and increased its balance sheet while Arab Spring began to take hold in the Middle East. Similar economic and geopolitical circumstances took oil prices to a $110 average in 2011 and $111 average in 2012 as Europe and Japan’s central banks joined the US in easing their respective monetary policies. Iranian barrels were consistently under threat as were Libyan supplies. Sound familiar?

We understand that current oil market dynamics are different than they were in 2010-2012 but it’s worth noting that 2012 supported the highest oil prices of the last eight years while also suffering from what was tied-for the lowest global GDP growth of the last eight years of just 2.51% (average global GDP growth during this period was 3.0%.) 2019 may be in its infancy but its easy to see the potential for increased central bank easing and lost crude oil production due to Middle East geopolitical tensions. We don’t intend to argue that a global slowdown would increase the odds of higher prices but merely to point out that it would not eliminate upside risk for oil. It doesn’t take a Davos invitation to see that crude prices can rise even if the global economy stutters!

Quick Hits

- Oil prices were mostly flat to begin the week with Brent trading near $62 while WTI traded near $53. The IMF lowering its global growth forecast for 2019 from 3.7% to 3.5% was a key source of bearish pressure.

- US crude oil rigs fell w/w by 21 to 852 for their largest weekly decline in two years. Nevertheless, US crude output continues to stretch to new records hitting 11.9m bpd last week. Meanwhile in China’s crude production fell to 3.8m bpd in 2018 which was its lowest mark since 2007.

- Brent spreads continue to tighten and point to an increasingly healthy physical market. This week the June/December delivery spread traded at three cents backwardation per month. The corresponding WTI spread remained in contango of eight cents per month due in part to the tidal wave of crude oil being produced by US frackers.

- Hedge fund net length for ICE Brent futures and options increased by 9% w/w from 158k contracts to 173k contracts. The 15k net buying effort was the largest buying spree from funds since September. Fund net length is still 59% below its 1yr average. A large part of last week’s buying was a covering of short positions. ICE Brent gross shorts fell by about 12k contracts to 89k which is more than three times higher than three times higher than they were in October.

- Recent US/China talks have shown progress on a plan to reduce China’s existing trade surplus. Unfortunately, news outlets continue to report that progress on China’s treatment of US intellectual property has been minimal.

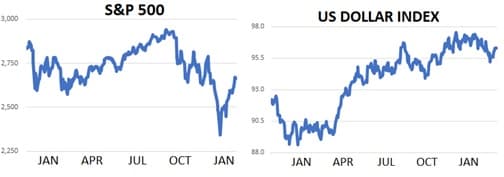

- The S&P 500 traded near 2,630 this week which is higher by about 12% since December 24th and 11% below its all-time high.

- Brexit and the US government shut down continue to weigh on markets. In Britain, Theresa May told Parliament she could not take a No Deal scenario off the table. In the US the shutdown continues to eat at economic activity and is expected to have a significantly negative impact on employment and GDP data for the US in Q1. In terms of market impact, the effect of the financial stress on the US labor force due to the shutdown appears to be substantial as expressed by the 28% gain in the stock price of the US’s largest payday lender (Enova) over the last four weeks.

- The US Dollar index continues to trend lower on expectations that odds of further Fed rate hike increases are declining.

DOE Wrap Up

- US crude stocks declined by 2.7m bpd last week with help from recent export cuts from OPEC+.

- Overall stocks fell to 437m bbls and are higher y/y by about 5%.

- Cushing stocks fell by about 740k bbls to 41.5m bbls. The draw was the largest in the WTI delivery hub since September.

- US crude oil imports averaged 7.5m bpd last week whish was 300k bpd below its 1yr average.

- Crude oil exports jumped almost 1m bpd w/w to 3m bpd which is about 1m bpd above its 1yr average.

- US refiner inputs fell 343k bbls w/w to 17.2m bbls. Inputs have averaged 17.4m bpd so far in 2019 for a 300k bpd (2%) jump versus 2018.

- Refiner inputs continue to plod at multi year lows. This week the WTI 321 crack traded near $13.50/bbl which is 25% below its 5yr average. The gasoline part of the barrel is still driving margin weakness with RBOB/WTI offering just $8/bbl. Heating oil / WTI currently pays refiners $27/ bbl.

- Overseas refining margins are slightly better. The gasoil/brent crack currently yields $15/bbl which is $2.50 above its 5yr average.

- As for products, US gasoline stocks jumped more than 7m bbls last week to 256m bbls and are 5.5% higher y/y.

- Distillate stocks climbed by 3m bbls last week to 143m bbls and are flat y/y.

- Domestic gasoline demand + exports are averaging 9.4m bpd so far in 2019 which is lower by about 200k bpd y/y

- US distillate demand + exports jumped sharply to 5.4m bpd last week and is roughly flat y/y.