Oil has experienced a tumultuous week, with news from China shaking up the already fragile balance of the markets. The Chinese economy seems to be cooling down, an odd thing to say given that China’s GDP growth amounted to 6.6 percent last year, yet several factors are pointing to the inevitability of a slowdown. For the first time in the last 27 years car sales have fallen by 2.8 percent in 2018 year-on-year, with CNPC expecting Diesel fuel demand to descend into negative territory in the upcoming 12 months.

(Click to enlarge)

This does not mean China will take in less crude, pipeline-supplied natural gas and LNG than previously, yet a more palpable slowdown is definitely in the cards. The oil market has reacted by falling 3 percent on Tuesday, recovering somewhat the following day after the Chinese finance ministry has vowed to ramp up fiscal spending to boost the economy. Global benchmark Brent traded at 62 USD per barrel on Wednesday afternoon, whilst WTI moved in the 53.5-54 USD per barrel interval.

1. US Commercial Stocks Fall Modestly, Products Surge

(Click to enlarge)

- US commercial crude stocks decreased by 2.7 MMbbl, roughly double of what analysts have predicted, to 437.1MMbbl.

- For the week ended January 18, analysts predict a further draw, to the extent of 1MMbbl, due to a bounce-back in refinery utilization and more robust exports.

- The East Coast’s inventories (PADD 1) were the main downward pressure factor,…

Oil has experienced a tumultuous week, with news from China shaking up the already fragile balance of the markets. The Chinese economy seems to be cooling down, an odd thing to say given that China’s GDP growth amounted to 6.6 percent last year, yet several factors are pointing to the inevitability of a slowdown. For the first time in the last 27 years car sales have fallen by 2.8 percent in 2018 year-on-year, with CNPC expecting Diesel fuel demand to descend into negative territory in the upcoming 12 months.

(Click to enlarge)

This does not mean China will take in less crude, pipeline-supplied natural gas and LNG than previously, yet a more palpable slowdown is definitely in the cards. The oil market has reacted by falling 3 percent on Tuesday, recovering somewhat the following day after the Chinese finance ministry has vowed to ramp up fiscal spending to boost the economy. Global benchmark Brent traded at 62 USD per barrel on Wednesday afternoon, whilst WTI moved in the 53.5-54 USD per barrel interval.

1. US Commercial Stocks Fall Modestly, Products Surge

(Click to enlarge)

- US commercial crude stocks decreased by 2.7 MMbbl, roughly double of what analysts have predicted, to 437.1MMbbl.

- For the week ended January 18, analysts predict a further draw, to the extent of 1MMbbl, due to a bounce-back in refinery utilization and more robust exports.

- The East Coast’s inventories (PADD 1) were the main downward pressure factor, falling by 2.5MMbbl week-on-week.

- Gasoline stocks rose by an emphatic 7.5MMbbl to 255.6 MMbbl against the background of refinery runs dropping by 343kbpd (to 17.223mbpd) and refinery utilization rates falling by 1.5 percent to 94.6 percent.

- The hefty product build, coupled with a new US crude production record of 11.9mbpd, has generated an overwhelmingly bearish sentiment with regards to the US market.

- The week ended January 18 will most likely wield another product stock increase, with S&P Global Platts expecting a 2.9MMbbl gasoline buildup.

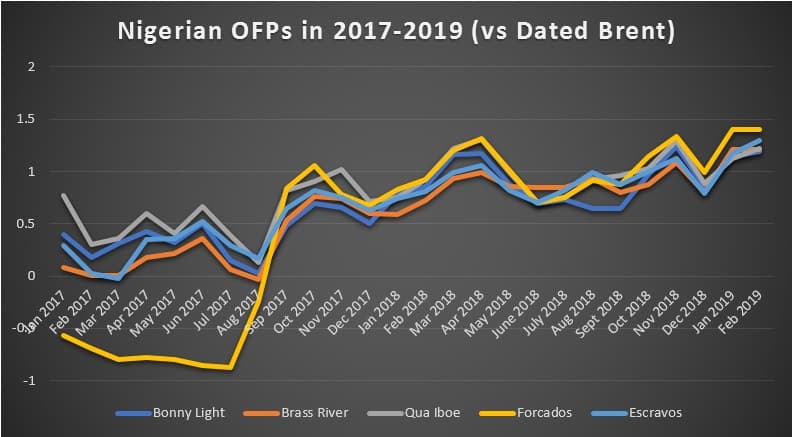

2. Nigeria Rises Most of its February OFPs

(Click to enlarge)

- The Nigerian state oil company NNPC has issued its official formula prices for February 2019 loadings, with most of Nigerian grades being hiked month-on-month.

- Bonny Light, Escravos, Qua Iboe and Pennington were all lifted by 5-15 US cents per barrel, whilst Erha and Bonga witnessed 14 and 6 US cent per barrel cuts.

- The latest addition to the NNPC list, Jones Creek, was estimated at a 1.40 premium over Dated Brent, whilst Egina, production on which started in early January, remains to be assessed.

- Escravos (33° API, 0.16-0.18 percent Sulphur) has reached the highest pricing level since at least 2015, hitting +1.30 USD per barrel vs Dated Brent this February.

- Similarly, the advances of medium sweet Forcados (31° API, 0.22 percent Sulphur) are of significance, having risen from an average -0.75 US cent discount in H1 2018 to +1.4 in February 2019.

3. Sonatrach Poised to Buy Another European Refinery

- Following the 2018 acquisition of ExxonMobil’s 175kbpd Augusta refinery in Sicily, Sonatrach is poised to buy into another Mediterranean refinery, this time jointly with leading trading house Vitol.

- Vitol and Glencore were shortlisted by the Greek state development fund to buy 50.1 percent of Hellenic Petroleum, one of the key assets to be sold within the Greek privatization program.

- Glencore has teamed up with one of the world’s largest private equity companies Carlyle Group to face the Vitol-Sonatrach consortium.

- The two trading giants will not be jousting for Hellenic’s upstream segment which shall remain under the control of Athens.

- The privatization of Hellenic is long overdue as the initial completion deadline set by the Greek state was June 2018.

4. Nigerian Government Helps Out Dangote

- The Government of Nigeria has pledged to provide some 350 million USD (125 billion Nigerian naira) for the construction of the Dangote refinery and petrochemical complex outside Lagos.

- The 650kbpd refinery, expected to become Africa’s largest when it starts operating in 2021-2022, is being built by the Dangote Group, the Aliko Dangote-owned conglomerate.

- The refinery will produce EURO5 quality gasoline and diesel – 50 and 15 million litres per day, respectively – and export up to 35 percent of its refined products.

- As soon as the $15 billion Dangote hits commercial operation, the world’s largest single-train refinery will put an end to Nigeria’s gasoline imports and swing it into exporter status.

5. Japan Buys Iranian Crude Again

(Click to enlarge)

- Japan has bought its first Iranian cargo since the onset of US sanctions on November 5, with oil refiner Fuji Oil bringing 2.1 MMbbl to Kawasaki aboard MT Kisogawa.

- Throughout October-December 2018, Japan has stopped taking in Iranian crude altogether, with the last cargo (MT Yufusan) having departed for Kashima on September 11.

- Another VLCC, MT Tsugaru, is arriving at Kharg Island on Thursday to load another 2 million barrels for Fuji Oil.

- Having cleared most of the shipping, banking and insurance issues, JXTG Nippon and Cosmo Oil, too, intend to resume Iranian imports by the end of January.

- With three months left, Japanese refiners wonder how many cargoes can they fit in safely before the first waiver period winds down.

- In the meantime, the Japanese Petroleum Association has already signalled that it would an extension of US waivers for the May-November 2019 period.

6. Russia Expected to Claim More of the Arctic Shelf

- Russian authorities hope that the special UN subcommittee on Russia’s continental shelf extension claim would articulate a position as soon as 2019 in its quest to add some 460 000 square miles of Arctic territory.

- According to Russia’s deputy Natural Resources Minister Denis Khramov, the subcommittee has confirmed the structural continuity of the Lomonosov and Mendeleev ridges, now all that remains is to confirm the morphologic connection between Russia’s continental shelf and the ridges in question.

- Russia has already submitted a claim over the Mendeleev and Lomonosov ridges back in 2001, which the United Nations turned down due to data insufficiency.

- Thereupon Russia has organized several oceanographic expeditions to the Arctic, most notably the Arctic-2007, and refiled its claim in 2015.

- The overall oil and gas resource potential of the territory in question has been estimated to amount up to 5 billion boe.

7. Saudi Aramco Plans US Gas Expansion

- One of the most interesting bits of the unusually unassuming Davos Summit in Switzerland was Saudi Aramco’s declared interest in boosting its US gas portfolio.

- Amin Nasser, CEO Saudi Aramco and the leading Saudi top official in Davos (neither Khaled al-Falih, nor Russian Energy Minister Alexander Novak travelled there), pledged to commit 150 billion to its gas expansion strategy over the next decade.

- Saudi Aramco deems the US gas market very lucrative both in its conventional and unconventional segments.

- With much of Saudi gas production currently reinjected and flared, Aramco is seeking to ramp up production from 14 billion Scf now to 23 billion Scf in 10 years so as to free up more oil to petrochemicals and exports.