Natural gas inventories plunged by 288 billion cubic feet (Bcf) for the week ending January 19, another massive decline that has tightened supplies and pushed up prices.

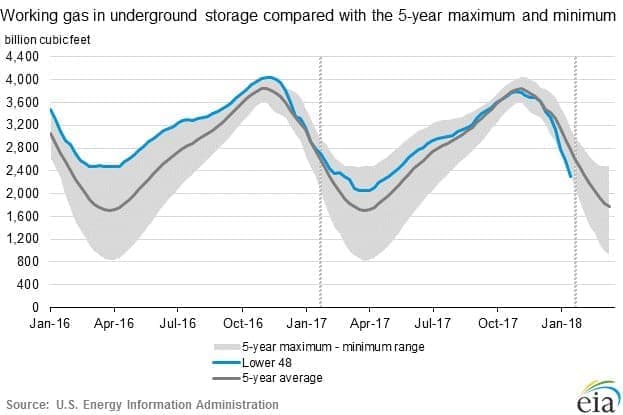

Total gas inventories now stand at 2,296 Bcf, which is 519 Bcf lower than at this point last year, and 486 Bcf below the five-year average. In fact, inventories are below even the lower end of the five-year range.

(Click to enlarge)

The declines took the market by surprise, helping to push Nymex prices up to $3.50/MMBtu. Only a few weeks ago, prices traded below $3/MMBtu. The “bomb cyclone” that hit the eastern half of the U.S. in the beginning of January led to record levels of consumption. On January 1, total gas consumption in the U.S. hit an all-time single-day high. Still, prices only climbed modestly.

But another round of cold weather is in store, and the consistent declines in inventories for several consecutive weeks has drained U.S. gas storage. New forecasts show cold weather sweeping the country from the Midwest down to Texas and eastward. “The concern is in February, deliverability gets even more constrained versus the January event,” Joel Stier, a trader at StierBull Trading LLC, told The Wall Street Journal.

With inventories already drained from earlier this month, the buffer is getting rather thin. “Storage is low — precariously low,” Bill Perkins, who runs Skylar Capital Management LP, told the WSJ.

Gas inventories rise and fall according to the season, with inventories filling up between March and October, then drawing down in winter months. The last few weeks of sharp declines in storage put the U.S. on track to exit the winter season at about 1,320 Bcf, according to the median estimate of eight analysts and traders surveyed by Bloomberg. That figure would be 23 percent below the five-year average.

Nevertheless, while regional natural gas prices have spiked — gas at the New York hub briefly hit $175/MMBtu in early January — Nymex prices remain subdued. At $3.50/MMBtu, prices are still reasonable given where they have gone in the past during previous weather events. Related: Why Oil Prices Could Dive

During the “polar vortex” in early 2014, for instance, Henry Hub prices surpassed $8/MMBtu. Although prices fell back, they still hovered in the $4.00-$4.50 range until mid-summer 2014.

In that context, the current situation is rather striking — the U.S. is consuming record levels of gas and inventories have plunged below the five-year average, yet prices are only trading at $3.50/MMBtu.

Why?

The reason is pretty simple: Gas production continues to rise, and 2018 is set to be a record year for output. The EIA predicts that natural gas production will surge by 6.9 Bcf/d this year, compared to the 2017 average, which would represent the single largest year-on-year increase in history. Most of the increase will come from shale gas drilling in the Marcellus and Utica shales, plus higher associated gas output from the Permian. Dry natural gas production will average about 80 Bcf/d this year, a new record high.

The surge in output will be the result of new pipeline capacity. A handful of projects are expected to come online in 2018, connecting shale gas regions to markets further away. Not only do new pipelines offer more space for more gas to exit the region, but they also reduce the discount for regional prices relative to Henry Hub. In short, gas producers can fetch higher prices because of the new pipeline capacity, which makes drilling more attractive. An estimated 8.4 Bcf/d of new pipeline capacity is set to come online by the spring.

Related: What Could Push Oil To $100?

At the end of the day, the EIA predicts that despite surging consumption levels, gas production will exceed consumption both this year and next — the first time that has occurred since 1966.

As a result of surging output, the EIA predicts prices will remain flat, averaging $2.88/MMBtu this year and $2.92/MMBtu in 2019.

So, despite frigid temperatures, the EIA says there’s not much to worry about.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- An Unsolvable Natural Gas Dilemma

- Saudi Oil Minister Tired Of Shale Hype

- Weak Dollar Drives The Oil Rally