Friday March 30, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. China launches oil futures

(Click to enlarge)

- China launched its highly-anticipated yuan-denominated oil futures contract on the Shanghai International Energy Exchange on Monday. This will allow foreigners to buy and sell contracts denominated in the Chinese currency.

- The new oil benchmark is a coup for China, giving its currency both prestige and pricing power. The contract will also give China more influence and predictability over its hefty oil import costs.

- This development makes sense because China is now the world’s largest oil importer, surpassing the U.S. in 2017.

- Still, there are plenty of roadblocks preventing the Chinese oil benchmark from truly rivaling Brent and WTI, not the least of which is some capital controls. Volatility and a greater influence of speculators might also deter international trading volumes.

2. Vitol trading profits plunge

(Click to enlarge)

- Vitol Group, the world’s largest independent oil trader, saw its annual profits fall by 25 percent in 2017, a sign that the trading environment has deteriorated significantly.

- OPEC production cuts started to really take a bite in the second…

Friday March 30, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. China launches oil futures

(Click to enlarge)

- China launched its highly-anticipated yuan-denominated oil futures contract on the Shanghai International Energy Exchange on Monday. This will allow foreigners to buy and sell contracts denominated in the Chinese currency.

- The new oil benchmark is a coup for China, giving its currency both prestige and pricing power. The contract will also give China more influence and predictability over its hefty oil import costs.

- This development makes sense because China is now the world’s largest oil importer, surpassing the U.S. in 2017.

- Still, there are plenty of roadblocks preventing the Chinese oil benchmark from truly rivaling Brent and WTI, not the least of which is some capital controls. Volatility and a greater influence of speculators might also deter international trading volumes.

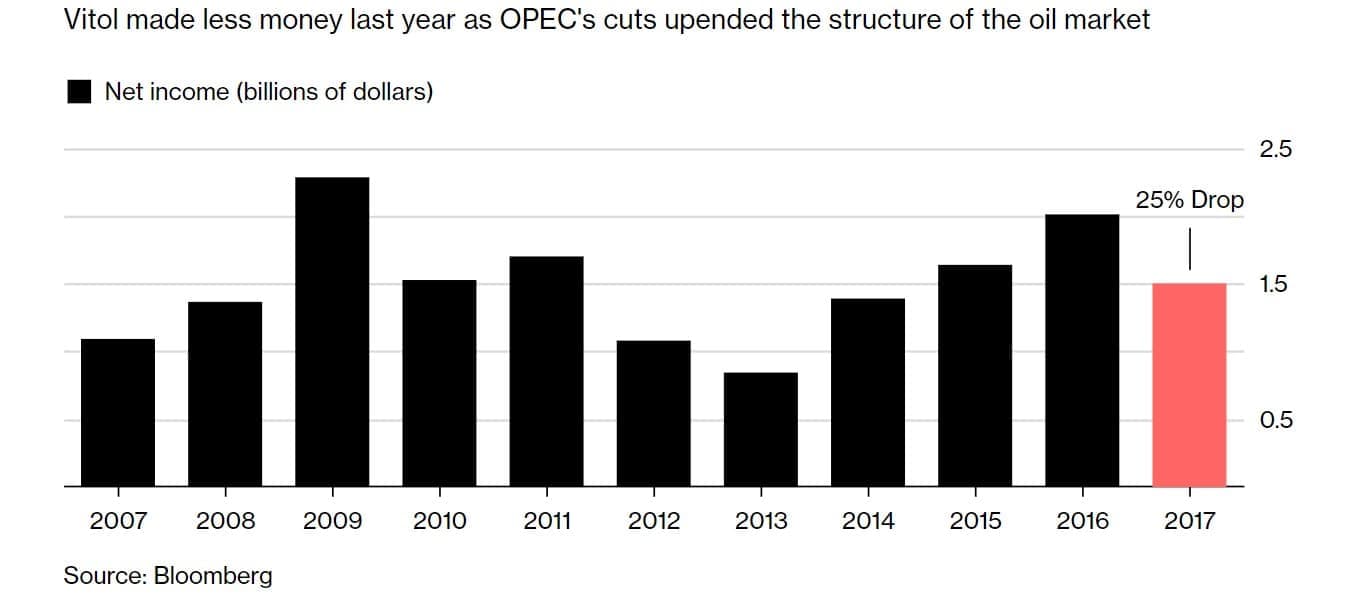

2. Vitol trading profits plunge

(Click to enlarge)

- Vitol Group, the world’s largest independent oil trader, saw its annual profits fall by 25 percent in 2017, a sign that the trading environment has deteriorated significantly.

- OPEC production cuts started to really take a bite in the second half of the year, curbing shipments.

- More importantly, the cuts started to drain inventories and reverse the shape of the futures curve, pushing Brent into a state of backwardation, in which front month contracts trade at a discount relative to longer-dated oil futures. That pricing structure makes it unprofitable to buy, store and sell oil at a later date since the price point in the future will be lower than the near-term price.

- “It is pretty bloody tough,” Vitol Chairman Ian Taylor said in a Bloomberg interview. “And I don’t think anybody is making a lot of money.”

- It isn’t clear whether the trading environment will improve, as most analyst expect the market to further tighten in the second half of the year, ensuring a downward sloping futures curve.

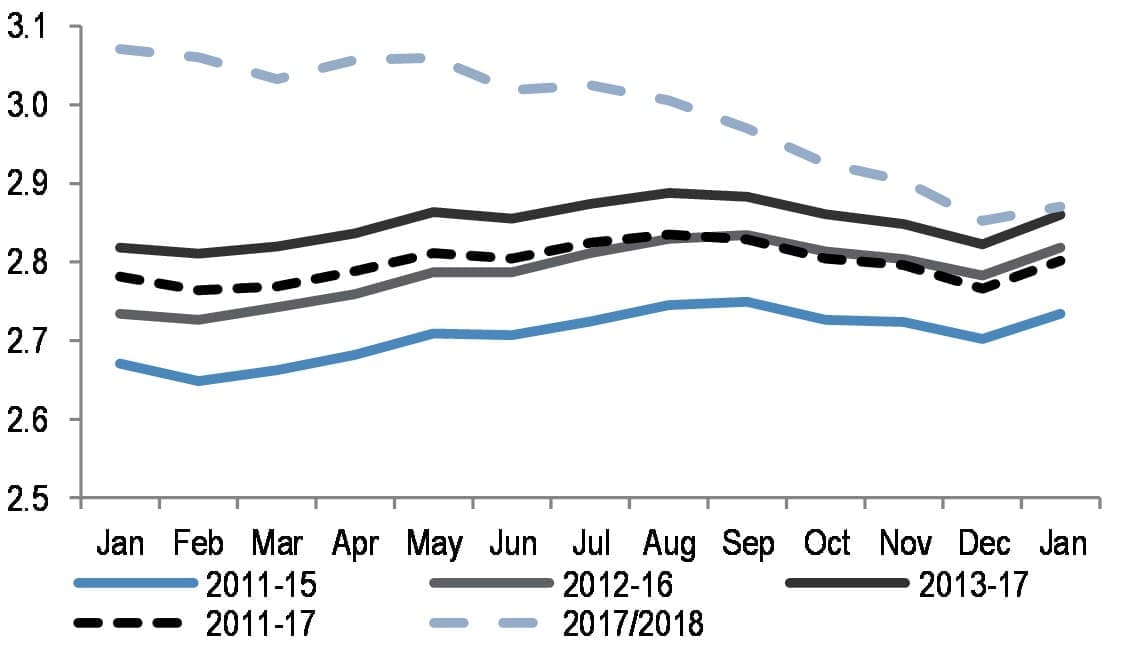

3. OPEC looks at different metrics for measuring “balanced” oil market

(Click to enlarge)

- The surplus of OECD inventories is closing in on the five-year average, despite the hiatus in drawdowns for much of the early part of 2018. By OPEC’s count, the stocks are roughly 44 million barrels above the five-year average. JPMorgan’s estimate puts it at just 11 million barrels.

- But OPEC officials are not willing to simply scrap the production cuts and they are looking at alternative ways of measuring success. Part of the problem is that the “five-year average” has been inflated over the past few years because the measurement included the surplus years.

- As such, OPEC is considering looking at a seven-year average for inventories. If that was the metric, the range would include 2011 and 2012 figures, stretching back to a period of time when the market was tighter.

- JPMorgan says that if OPEC used the 2011-2017 seven-year average (the dotted line above), that would mean that the oil market today is 69 million barrels in surplus, rather than just 11 million barrels. That would offer a justification for the cartel to keep the cuts in place longer.

4. Canada’s oil-by-rail shipments rise on pipeline bottlenecks

(Click to enlarge)

- Canada’s pipeline woes are forcing more oil onto the nation’s railways.

- But many rail companies are operating below capacity, either because of their own bottlenecks in shipping other commodities, or because some oil producers are balking at signing the long-term contracts desired by rail firms.

- Still, oil-by-rail shipments topped 500,000 bpd in December, the highest monthly average in years.

- Western Canada Select, a heavy oil benchmark in Alberta, continues to trade at an enormous discount to WTI. This week, the discount exceeded $25 per barrel.

- Canada’s oil production could exceed the nation’s pipeline capacity by 338,000 bpd by the end of 2018, according to Genscape, ensuring a longer period of steep discounts for Canadian oil.

- Rail shipments will likely increase, although the rail industry probably won’t be able to resolve the midstream bottleneck entirely.

5. Smaller shale drillers not benefitting from rebound

(Click to enlarge)

- Some shale drillers that faced bankruptcy and have since restructured their debt still have not emerged from the wreckage.

- Bloomberg pointed to several shale drillers who have posted steep losses to their share prices even after they shed some of their debt.

- For instance, SandRidge Energy (NYSE: SD) has seen its stock fall by 37 percent since October 2016, even after it restructured $4 billion worth of debt. Much of the rest of the energy industry has rallied since then, particularly at the end of 2017.

- The experience demonstrates the difficulty of emerging from bankruptcy and springing back into action.

- It also demonstrates that investors are choosier than they once were, weeding out the weaker companies and opting for stronger ones. The shakeout has left the weaker companies for dead.

- “The bottom line is a lot of these companies didn’t have very good assets to begin with," Leo Mariani, an analyst at NatAlliance Securities, told Bloomberg. “You can go through bankruptcy and wipe away debt and that’s all well and good, but the assets they ended up with are still not very attractive."

6. Oil breakeven prices

(Click to enlarge)

- A new survey from the Federal Reserve Bank of Dallas finds that the Permian basin has a breakeven price of between $47 and $52 per barrel, with the Midland basin at $47, the Delaware at $49 and other parts of the Permian at $52.

- The survey of 136 oil and gas companies said that existing wells breakeven at between $25 and $37 per barrel in the Permian. That is, they need an oil price that high to cover operating expenses.

- Meanwhile, the survey also found that most shale companies would either keep their headcount flat or planned to hire more people this year.

- At the same time, a lot of shale companies are starting to see rising costs for labor, and oilfield service companies are expected to demand higher rates for their services. Cost inflation could cut into those breakeven prices and force them higher.

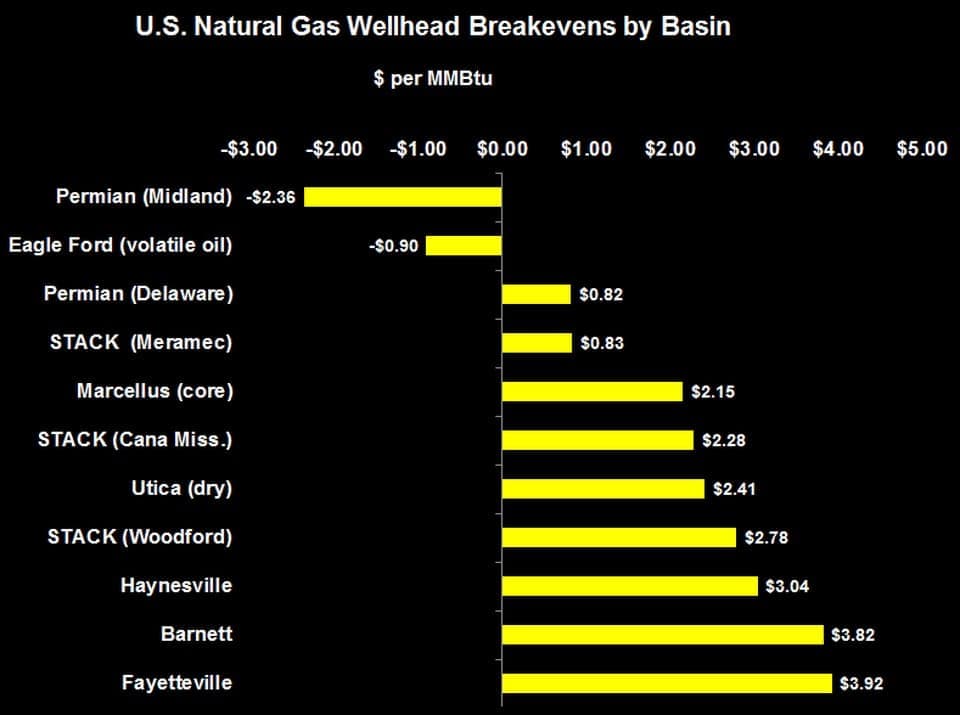

7. Natural gas breakeven prices

(Click to enlarge)

- The Marcellus Shale has routinely been one of the cheapest places to produce natural gas, and thus it has long been the most prolific shale gas basin.

- However, the drilling boom in the Permian for oil is turning up a wave of natural gas. The associated gas is essentially a free byproduct for oil drillers.

- The Permian is producing about 10 billion cubic feet per day (Bcf/d), or about 13 percent of the U.S. total, despite having no rigs specifically targeting natural gas.

- As a result, the gas breakeven price in the Permian is essentially negative. In fact, it is becoming a bit of problem for the region because of a lack of pipeline capacity. Some drillers are under pressure to throttle back on oil production because they have too much gas on their hands.

- More pipelines are under construction but will take time to reach completion.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.