Friday August 17, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil prices testing lows

(Click to enlarge)

- WTI fell to $65 per barrel on Wednesday, flirting with the 200-day moving average.

- WTI traded above that threshold for much of the past year.

- The 200-day moving average is a key resistance point. It offers some support when prices are above the line, as is the case here. But the risk to prices is significant, from a technical trading perspective, if prices dip below that line.

- When prices fall below the 200-day average, the resistance gives way, setting off some automatic selling.

2. Permian legacy decline rate swells

(Click to enlarge)

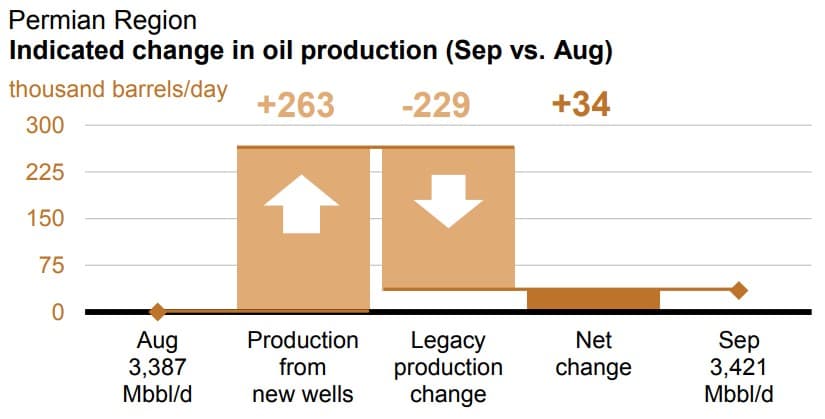

- Shale drilling requires companies to constantly drill new holes to offset the sharp decline in output that comes in the first year of a previously drilled well. The more wells brought online means that this “legacy decline rate” grows over time as the wells age.

- The legacy decline rate in the Permian is enormous because there are so many wells in the region. But that makes the industry’s task daunting – more wells need to be brought online to offset the scores of older wells.

- The EIA estimates that the Permian’s legacy decline…

Friday August 17, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil prices testing lows

(Click to enlarge)

- WTI fell to $65 per barrel on Wednesday, flirting with the 200-day moving average.

- WTI traded above that threshold for much of the past year.

- The 200-day moving average is a key resistance point. It offers some support when prices are above the line, as is the case here. But the risk to prices is significant, from a technical trading perspective, if prices dip below that line.

- When prices fall below the 200-day average, the resistance gives way, setting off some automatic selling.

2. Permian legacy decline rate swells

(Click to enlarge)

- Shale drilling requires companies to constantly drill new holes to offset the sharp decline in output that comes in the first year of a previously drilled well. The more wells brought online means that this “legacy decline rate” grows over time as the wells age.

- The legacy decline rate in the Permian is enormous because there are so many wells in the region. But that makes the industry’s task daunting – more wells need to be brought online to offset the scores of older wells.

- The EIA estimates that the Permian’s legacy decline rate will hit 229,000 bpd in September, up from 223,000 bpd in August. The number creeps up with each passing month. For example, a year ago, the decline rate was only 158,000 bpd. In August 2016, the decline rate was only 82,000 bpd.

- As a result, the shale industry has to bring more and more volumes of new supply online to offset older wells. For now, they are up to the task. An estimated 263,000 bpd of new supply is set to come online in September, for a net gain of 34,000 bpd.

- At some point in the future when all the best acreage is picked over, the legacy decline rate will overwhelm new production, and the basin will go into decline. Many analysts see that as far off into the future, but there is debate around this issue.

3. Refineries running at record levels

(Click to enlarge)

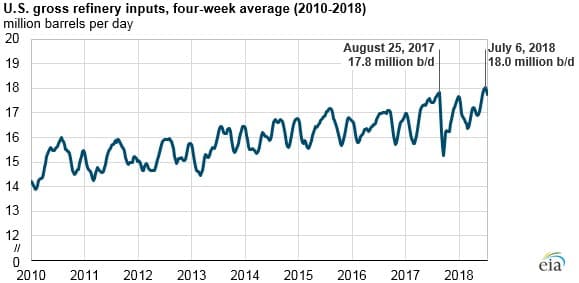

- For the week ending on July 6, 2018, the four-week average of refinery runs jumped to a record high, above 18 million barrels per day.

- But high runs are also the result of an increase in refining capacity, which has climbed by 862,000 bpd since 2011.

- More than half of all refining capacity is located along the U.S. Gulf Coast.

- High refining runs reflect strong demand for gasoline, both domestically and around the globe.

- U.S. gasoline demand in the first week of August was 9.7 mb/d, just shy of the highest figures on record at 9.8 mb/d hit in the last two years. Distillate demand is also strong at 4 mb/d over the past four weeks.

4. Turkish lira crisis

(Click to enlarge)

- Turkey’s currency suffered a meltdown over the past week, raising fears of an emerging market downturn.

- The reason why a seemingly minor country like Turkey matters is that the Federal Reserve has been hiking interest rates, which has strengthened the dollar, and led to losses to a long list of emerging market currencies.

- Already destabilized, the plunge in the Turkish lira has led to steep losses for other currencies this week, including Argentina’s peso, India’s rupee, and the Mexican peso.

- The flight of capital from emerging markets, which has pushed down their currencies, could make oil painfully expensive to millions of motorists and businesses.

- The potential for financial contagion could upend oil demand forecasts, just as it did during the Asian Financial Crisis in 1998. The IEA has demand growing at 1.4 mb/d this year, but if the Turkish lira problem spreads, that figure will likely be revised down.

5. Shale companies dial back dense drilling

(Click to enlarge)

- Over the last few years, U.S. shale drillers have packed wells closer and closer together, a practice cited as one way in which they have grown more efficient. Using the same wellpad, companies have scaled up the number of wells drilled, saving time and money.

- But the practice may have gone too far. Drilling too close together can impact the recovery of oil and gas. The “parent-child” problem has become more notable, in which subsequent wells negatively impact the productivity of the original well drilled nearby.

- Rystad Energy says the portion of wells drilled at less than 400 feet away from each other in the Eagle Ford increased from 23 percent to 58 percent between 2012 and 2016. In short, the majority of wells were drilled close together by 2016.

- But since then, the portion of <400 feet spacing has declined, dipping to just 51 percent of wells by 2018.

- The data suggests that shale companies have decided that packing wells too densely has its costs, and they have apparently pulled back a bit from the trend towards more density.

6. Oil companies return to megaprojects

(Click to enlarge)

- After years of restraint, and ongoing promises of strict capital discipline, the oil industry is on the verge of returning to hefty expenditures, notably on megaprojects.

- According to Wood Mackenzie, the industry is set to greenlight $300 billion in new spending in 2019 and 2020, which is more than the preceding three years combined.

- Before the 2014 downturn, the oil industry blew $80 billion on cost overruns on 15 large projects.

- They have promised that the return to higher levels of spending will be done on profitable projects, but that remains to be seen.

- For instance, Royal Dutch Shell (NYSE: RDS.A) says that it can breakeven on offshore drilling at $30 per barrel, and says that offshore projects are more profitable than shale.

- It is hard to overstate the significance of this market development, as most companies have been flocking to shale and shunning major offshore development.

7. U.S. oil production still expected to grow

(Click to enlarge)

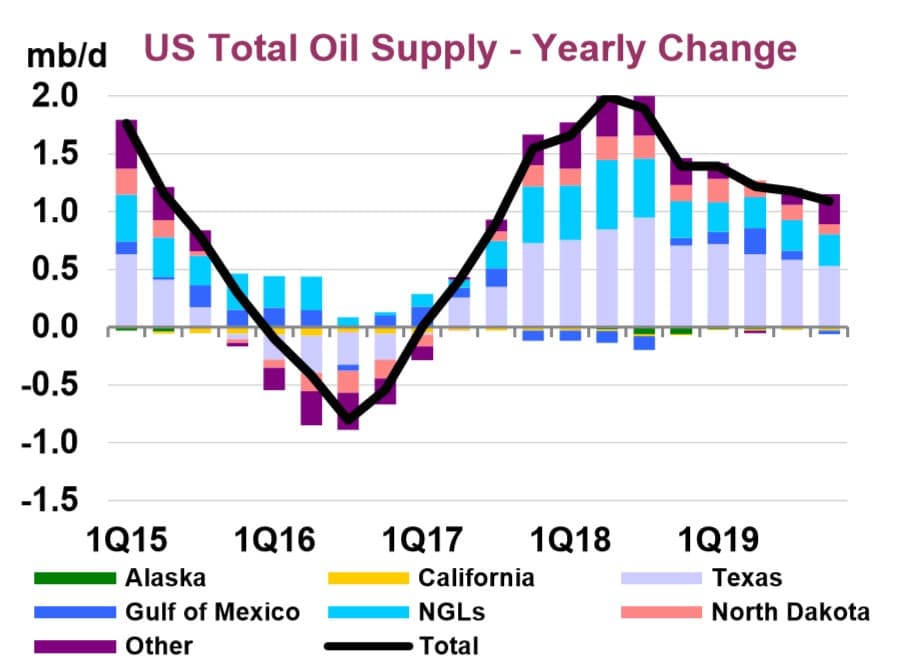

- The IEA still sees robust supply growth for the United States.

- But the forecast ignores some glaring problems, including the fact that U.S. oil production fell in May by 30,000 bpd. The gains from Texas have slowed dramatically, with monthly increases falling to half of the rate seen earlier this year.

- In May, Permian output rose by 20,000 bpd, a monthly increase that is down from over 70,000 bpd routinely seen at the start of 2018.

- The IEA still sees overall U.S. production growth at 1.2 mb/d this year, a staggering sum. A slower but still enormous 1 mb/d is expected for 2019. Time will tell, but the Permian pipeline problems raise questions about the accuracy of that forecast.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.