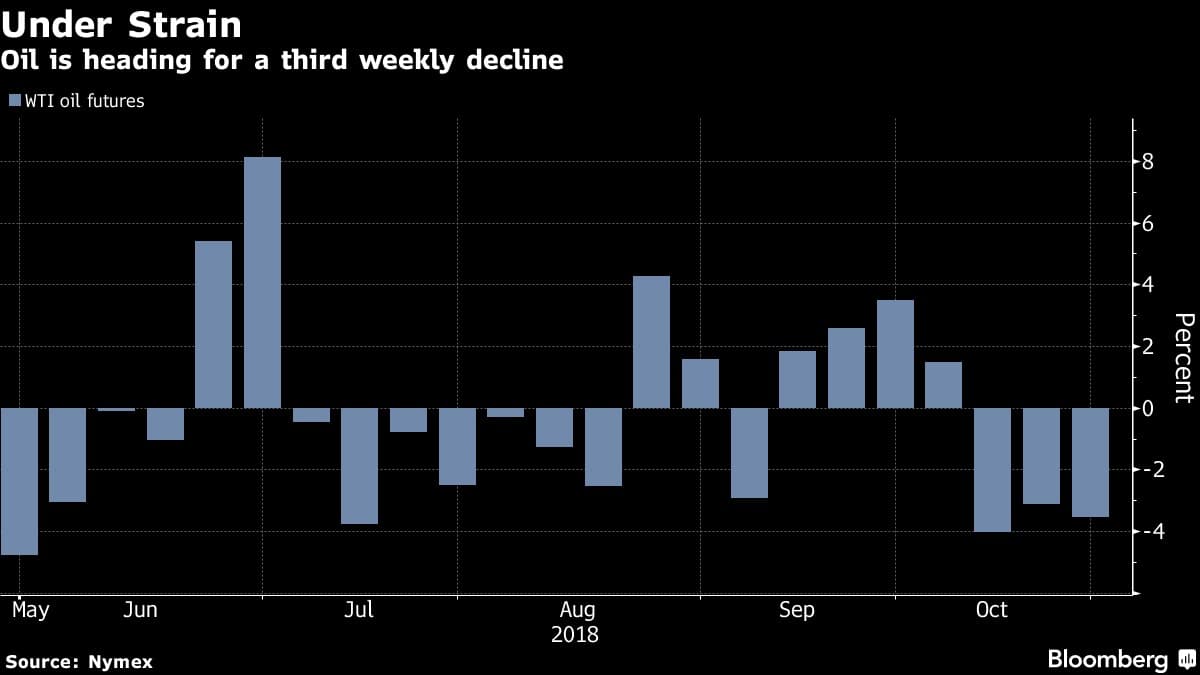

Crude prices have fallen roughly $10 per barrel in the past three weeks, with a 4 percent drop across regional markets this week alone. WTI ended the week at $66 per barrel, whilst Brent slid to $76 per barrel by Friday. The overall market sentiment is increasingly bearish, with Wall Street’s worst week since 2011 sending ripples through European and Asian stock markets. Global trade is also slowing down, with freight rates decreasing after an extensive period of growth.

OPEC has started sending mixed signals, too, with Saudi Energy Minister forecasting that the global oil market would shift to oversupply in Q4 2018 amid high stockpile rates. It seems that OPEC+ is comfortable with a $75-85 per barrel price corridor and will cut short its production ramp-up as soon as necessary.

1. US Oil Stocks Soaring Higher Still Amid Some Product Relief

(Click to enlarge)

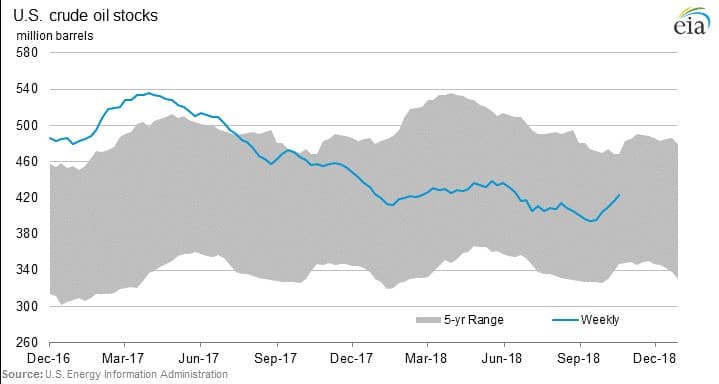

- US commercial stocks soared again last week for the fifth consecutive week, as inventories rose w-o-w by a further 6.3 MMbbl.

- In total, commercial stocks have risen to 422 million barrels – not including the US strategic reserve stock which currently comprises 656 million barrels of oil.

- The stock buildup against reasonably stable crude export numbers is a relatively risky development as looming pipeline bottlenecks might obstruct the free flow of exports even further.

- After last week’s 1.8 mbpd median, crude exports bounced back to 2.1 mbpd, roughly to the level…

Crude prices have fallen roughly $10 per barrel in the past three weeks, with a 4 percent drop across regional markets this week alone. WTI ended the week at $66 per barrel, whilst Brent slid to $76 per barrel by Friday. The overall market sentiment is increasingly bearish, with Wall Street’s worst week since 2011 sending ripples through European and Asian stock markets. Global trade is also slowing down, with freight rates decreasing after an extensive period of growth.

OPEC has started sending mixed signals, too, with Saudi Energy Minister forecasting that the global oil market would shift to oversupply in Q4 2018 amid high stockpile rates. It seems that OPEC+ is comfortable with a $75-85 per barrel price corridor and will cut short its production ramp-up as soon as necessary.

1. US Oil Stocks Soaring Higher Still Amid Some Product Relief

(Click to enlarge)

- US commercial stocks soared again last week for the fifth consecutive week, as inventories rose w-o-w by a further 6.3 MMbbl.

- In total, commercial stocks have risen to 422 million barrels – not including the US strategic reserve stock which currently comprises 656 million barrels of oil.

- The stock buildup against reasonably stable crude export numbers is a relatively risky development as looming pipeline bottlenecks might obstruct the free flow of exports even further.

- After last week’s 1.8 mbpd median, crude exports bounced back to 2.1 mbpd, roughly to the level of the rolling monthly average.

- Refinery maintenance has bottomed out this week and the current 16.3 MMbbl per day refinery run average should gradually rebound back in the upcoming weeks.

- Gasoline stocks dipped for a second week in a row, this time by 4.8 MMbbl w-o-w to 229.3 MMbbl, largely a result of decreasing production, which should bounce back with maintenance season ending soon.

2. Saudi Arabia Defies Critics With Record Investment Deals

- In an oddly timed Riyadh-held conference labelled Future Investment Initiative, Saudi Arabia claimed to have secured $50 billion in energy sector investments from top global energy companies.

- Despite mounting international pressure over the Khashoggi murder, Riyadh is trying its hardest to delineate politics and energy.

- Aramco and Total agreed to build an integrated petrochemical complex and downstream park in Jubail, as a second development phase of the 400 kbpd SATORP refinery.

- Swiss trader Trafigura signed on to build a copper, zinc and lead integrated smelting and refining complex in Ras al-Khair.

- Oil services companies Schlumberger, Halliburton and Baker Hughes also landed hefty deals.

- Despite Muhammad bin Salman’s assurances that Saudi Arabia is drifting away from being an oil-dependent nation, two-thirds of contracts (worth $34 billion) were on Saudi Aramco’s books.

- Saudi Aramco is edging in on joining the NOVATEK-led 19.8 mtpa Arctic LNG-2 project, expected to become the first Saudi investment in Russia’s expanding LNG sector.

3. Most importantly, Saudi Arabia Moves Into Petrochemicals

(Click to enlarge)

- In a week that was unusually heavy on Saudi-related news, Saudi Aramco CEO Amin Nasser stated that the company intends to allocate 2-3 million barrels of oil per day to petrochemical activities.

- Factoring in the commitments stated above, Saudi Arabia’s refining capacity is set to rise to 8-9 mbpd from its current level of roughly 5 mbpd.

- Throughout the 2000s, oil exports accounted for 92-97% of total Saudi hydrocarbon exports.

- Against the background of rising product exports, crude’s share has fallen in the past few years to 80-85%, and will likely be followed by further declines.

- Aramco will boost its own investment into petrochemicals primarily by buying into SABIC, the largest public firm in the Middle East.

- The fully state-owned oil giant wants to buy a 70 percent stake in the company, basically buying out the part of the Public Investment Fund of Saudi Arabia.

- Amin Nasser also tied the conclusion of the SABIC acquisition with Saudi Aramco’s own initial public offering, saying that it could take place only after SABIC is swallowed up.

4. Algeria Raises Saharan Blend Price for November

(Click to enlarge)

Source: OilPrice data, set against Dated Brent.

- The Algerian national oil company Sonatrach has hiked its retrospective OSP price for light-sweet crude Saharan Blend.

- Saharan Blend, which is priced against Dated Brent, has moved to positive premium levels for the first time since June this year.

- The price hike seems not to reflect current market conditions as Argus has reported a late November cargo being traded at a $-0.35 per barrel discount to Dated Brent.

- Saharan Blend has been under a double squeeze lately as rival CPC Blend has ratcheted up volumes to 1.5 mbpd in November.

- The grade has also been adversely affected by relatively weak refinery margins for naphtha in the Mediterranean region, its most common outlet.

5. Iraq goes back to exchange trading

- Iraq has reverted to its practice of trading cargoes on the Dubai Mercantile Exchange, with at least three cargoes traded at a premium to November OSPs.

- The state oil marketer has sold two 1 million-barrel cargoes of Basrah Light and Basrah Heavy, with an 18 USD cent per barrel and 12 cent per barrel premium to OSP respectively, as well as one 2 million-barrel cargo at a 11 cent per barrel premium.

- On all three cargoes the destination clause was narrowed to Asia or Europe.

- This marks the first time SOMO has marketed Iraqi crude via Dubai auctions since January, the break was due to a lack of required volumes.

- The auctioning restart coincides with the start of maintenance works on Basrah Oil Terminal’s Jetty No.3, which will be out for approximately 45 days.

- Thus, Basrah Light flows, which are regularly loaded at Jetty 3 averaging around 200 kbpd, are expected to decrease as the back-up port for Basrah grades, Khor al-Amaya is still not onstream.

6. Soaring Shale Gets Exxon Refiners Wired

(Click to enlarge)

- Rapidly increasing US shale oil output is compelling refiners to substantially upgrade their refining capacity in the US Gulf Coast.

- Exxon took the lead this week by declaring it wants to almost double the capacity of its Beaumont refinery from the current 365 kbpd.

- The more than 300kbpd increase would result in Exxon constructing a third crude distillation unit.

- With this, the now flood-safe Beaumont refinery will become the largest in the US when it comes online in 2022, surpassing Motiva’s Port Arthur 603 kbpd refinery.

- Endowed with 6 billion barrels worth of Permian Basin reserves, the incremental volumes to be refined will be fully supplied from Exxon-controlled fields.

- Exxon has previously stated it aims to triple its Permian production by 2025; reaching 600 kbpd by that time.

- Chevron is expected to announce the acquisition of another US Gulf refinery, namely the 110kbpd Pasadena refinery owned currently by Petrobras, in the next few months, with Motiva similarly looking either to buy or to build a new one.

7. Amid Soaring Output, Argentina to Start Phasing Out US LNG Next Year

(Click to enlarge)

- Argentina is looking likely to end one of its LNG import contracts with Excelerate Energy in the country’s first move to fully rely on its own gas production.

- Moreover, Argentina wants to start the construction of the nation’s first LNG liquefaction terminal in the second half of 2019.

- The terminal is expected to have six trains and be able to export as much as 40 MCm per day (1.4 BCf per day) from 2023 onwards.

- The LNG liquefaction plant will most likely be built in Bahia Blanca, roughly equidistant from the Neuquen province (where Vaca Muerta gas is produced) and Buenos Aires.

- By 2030, Argentinian gas output is expected to triple from the current level of 132 MCm per day to 400 MCm per day (4.6 BCf per day to 14 BCf per day).

- Argentina aims to fully phase out LNG imports by 2023 and cut its pipeline supply from Bolivia by 2026.

- It is estimated that domestic output is twice as cheap as the Bolivian piped gas and 2.5 times as cheap as US LNG.