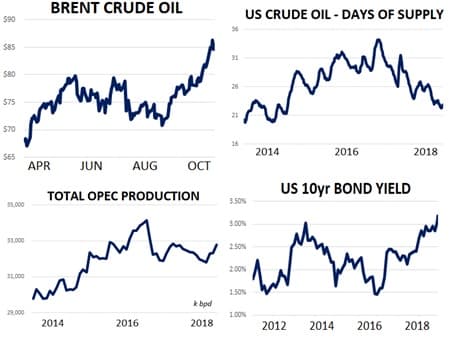

It was a lazy summer for oil markets. From May through early August Brent crude oil prices fell from $80 to $70 as economic growth concerns overruled fears that the market was inadequately supplied. Oil’s rally had cooled- as had talk of $100 oil- and most analysts forecasted moderating prices as the US summer driving season came to a close.

The sideways trend was interrupted in mid-August after the Trump administration took aim at Iran with harsh sanctions which reignited fears that there simply isn’t enough oil being produced globally. This week those fears manifested in yet another leg higher in prices as Brent crude oil futures topped $86 for the first time since 2014. Brent is now higher by about $16 (28 percent) on the year and talk of $100 oil as a risk to consumers and a boon to suppliers is back on.

However, market sentiment indicators are not all screaming Full Speed Ahead on oil’s next leg higher. In terms of positioning, hedge funds are currently carrying a net-long in NYMEX WTI of 4% above the 2-year average and hold a net-long in ICE Brent that’s 12% above the 2-year average. In spread markets the difference between prompt and later-dated contracts is still below YTD highs and in options markets puts and calls are trading at roughly the same volatility premiums (meaning the recent interest in $100 calls is being matched by equivalent put options.) In combination, these market signals suggest to us that large oil traders, while broadly positive on…

It was a lazy summer for oil markets. From May through early August Brent crude oil prices fell from $80 to $70 as economic growth concerns overruled fears that the market was inadequately supplied. Oil’s rally had cooled- as had talk of $100 oil- and most analysts forecasted moderating prices as the US summer driving season came to a close.

The sideways trend was interrupted in mid-August after the Trump administration took aim at Iran with harsh sanctions which reignited fears that there simply isn’t enough oil being produced globally. This week those fears manifested in yet another leg higher in prices as Brent crude oil futures topped $86 for the first time since 2014. Brent is now higher by about $16 (28 percent) on the year and talk of $100 oil as a risk to consumers and a boon to suppliers is back on.

However, market sentiment indicators are not all screaming Full Speed Ahead on oil’s next leg higher. In terms of positioning, hedge funds are currently carrying a net-long in NYMEX WTI of 4% above the 2-year average and hold a net-long in ICE Brent that’s 12% above the 2-year average. In spread markets the difference between prompt and later-dated contracts is still below YTD highs and in options markets puts and calls are trading at roughly the same volatility premiums (meaning the recent interest in $100 calls is being matched by equivalent put options.) In combination, these market signals suggest to us that large oil traders, while broadly positive on the market, aren’t exactly tripping over each other to bet on a return to $100 oil. The mood of the market seems moderately bullish for now.

Physical markets will be in a tug of war for the foreseeable future between falling supplies from Iran and Venezuela and increased supplies from the U.S., Russia, Iraq and of course Saudi Arabia. Healthy OPEC producers are more than making up for losses from their partners at the moment and the cartel’s September production increased to 32.8m bpd in September, representing a 14-month high. We can be sure going forward that the Trump administration will keep pressure on the Saudi’s to pump at full speed to keep gasoline prices in check. Unfortunately, we can’t be sure exactly how much more spare capacity the Kingdom has to offer. The Saudis pumped 10.5m bpd in September – within 150k bpd of their all-time high – and claim to have capacity of up to 12.5m bpd but analysts are entirely undecided on their ability to do that.

Russia and Saudi Arabia- the world’s two largest exporters- reportedly made a pact in September to work to keep oil prices in check by increasing output and we may well find out exactly how much spare capacity they have as Iranian exports plummet and prices continue to rally. Unfortunately for the White House, speculators could also view any increases in Saudi output as posing a bullish risk to the market and drive prices higher as it would diminish any ‘spare supply cushion’ with respect to daily physical balances. This risk highlights the difficulty of Trump’s effort to simultaneously cut Iran off from the global business community and also keep oil prices in check. For now we think Vladimir Putin aptly described the market’s current bullish conundrum at an energy conference this week stating “President Trump considers that the price is high. He’s partly right, but let’s be honest. Donald, if you want to find the culprit for the rise in prices, you need to look in the mirror.”

Quick Hits

- Brent crude oil futures hit a 4-year high $86.74 on Wednesday driven by improving supply/demand fundamentals and the steep drop in Iranian barrels coming to market. From a technical analysis perspective, the only weak point of the current rally could be that the market could simply be rising too far too fast. Oil prices were more than $7 (about 9%) above their 50-day moving average. This last occurred in May and preceded about 3-months of bearish price action.

- US crude oil supplies are exactly at their 5yr seasonal average opposite solid demand growth which has driven the Days of Supply for the U.S. (simply crude oil stocks / daily refiner demand) to less than 23 days. The chart below illustrates the fundamental shift driving prices higher.

- OPEC production is increasing despite shortfalls from Venezuela and Iran. The cartel pumped 32.8m bpd in September which is their best effort since June ’17 and within 1.3m bpd of their all-time high in the fall of 2016 when they were working to put U.S. and Canadian frackers out of business. On a YTD basis Iraq’s production is +230k bpd, Saudi is +650k bpd, Iran is -470k bpd and Venezuela is -450k bpd. Russia also boosted output more than 150k bpd m/m to 11.4m bpd in September representing a post-Soviet high.

- Iranian crude oil production hit a 2yr low of 3.4m bpd in September and traders were surprised by the degree to which China and India were eliminating Iranian purchases. The Trump administration is taking an extremely hard line on the current sanctions regime and Iran’s key trading partners are taking them seriously- for now. Our hunch is that more Iranian barrels may find their way onto the market should global supplies continue to tighten.

- On the macroeconomic front the key trend to outside of the oil nitty gritty is the rise in global interest rates. This week the U.S. 10yr yield reached a 7-year high at 3.19%. U.S. Federal Reserve chief Jerome Powell gave a highly optimistic view U.S. economic fundamentals this week suggesting that unemployment will likely remain low and inflation will likely remain tame for the foreseeable future. On a more negative note, higher interest rates will inevitably be bearish for risk assets (ie stocks, commodities) if the trend continues.

DOE ROUNDUP

- U.S. crude oil stocks rose sharply higher this week but are perfectly in line with their 5yr seasonal average

- Crude inventories in the Cushing, OK trading hub are on the rise and could provide some much needed bearish relief to the market

- U.S. gasoline demand is slightly lower y/y over the last two months

US crude stocks jumped 8m bbls w/w this week and the futures market cooled slightly on the news. The build was driven by record high US output at 11.1m bpd, increased imports, decreased exports and a drop in U.S. refiner demand heading into fall maintenance. Cushing stocks jumped by about 1.8m bbls to 24.5m bbls and can be expected to rise in the short term due to the seasonal drop in crude demand and a lack of pipeline takeaway capacity in regions where US production is booming. On the demand side, US refining margins were generally near $18/bbl this week and should incentivize strong activity in the short term.

Rising US gasoline stocks continue to look like a soft spot in an otherwise extremely tight crude oil market. Overall gasoline inventories are higher y/y by about 7% at 235k bbls and the PADD IB gasoline trading hub is particularly saturated at +38% y/y. At least some fraction of the growing supplies is due to a 200k bpd slowdown in implied gasoline demand in over the last eight weeks on a y/y basis. US distillate stocks are in line with last year’s levels at 136k bbls.