In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we dig into some data and provide a bit of explanation on what drives the numbers.

Crude rose to a 4-year high this week as fears of falling Iranian demand took center stage. Despite a significant buildup in U.S. crude stockpiles, the largest since March 2017, Brent December futures broke the $86 per barrel mark whilst WTI surpassed $76.

(Click to enlarge)

Were it not for Iran’s faltering exports, crude prices would likely have gone down. U.S. commercial crude stocks increased a hefty 8 million barrels while U.S. crude exports plummeted 910 000 bpd week-on-week to 1.7 mbpd, a result of highly volatile loading schedules (the average September 2018 U.S. export figure stands at 2.1 mbpd). The WTI-Brent Dated spread reached $10 per barrel by the end of the week, a major buttress to potential U.S. exports. Crude imports to the United States increased by 163 kbpd week-on-week. Gasoline and distillate stocks dropped by 0.5 million barrels and 1.8 million barrels, respectively, even though refinery runs have begun to level off ahead of maintenance-heavy October and November.

1. China increases non-state refiners’ import quota

(Click to enlarge)

- The Chinese Commerce Ministry has granted non-state independent refiners an annual 202 million ton (4.06 mbpd) quota for importing crude,…

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we dig into some data and provide a bit of explanation on what drives the numbers.

Crude rose to a 4-year high this week as fears of falling Iranian demand took center stage. Despite a significant buildup in U.S. crude stockpiles, the largest since March 2017, Brent December futures broke the $86 per barrel mark whilst WTI surpassed $76.

(Click to enlarge)

Were it not for Iran’s faltering exports, crude prices would likely have gone down. U.S. commercial crude stocks increased a hefty 8 million barrels while U.S. crude exports plummeted 910 000 bpd week-on-week to 1.7 mbpd, a result of highly volatile loading schedules (the average September 2018 U.S. export figure stands at 2.1 mbpd). The WTI-Brent Dated spread reached $10 per barrel by the end of the week, a major buttress to potential U.S. exports. Crude imports to the United States increased by 163 kbpd week-on-week. Gasoline and distillate stocks dropped by 0.5 million barrels and 1.8 million barrels, respectively, even though refinery runs have begun to level off ahead of maintenance-heavy October and November.

1. China increases non-state refiners’ import quota

(Click to enlarge)

- The Chinese Commerce Ministry has granted non-state independent refiners an annual 202 million ton (4.06 mbpd) quota for importing crude, a 42 percent increase y-o-y.

- With this move alone, Beijing will increase its crude intake in 2019 by a hefty 1.3 mbpd.

- Since 2015, the quota, which does not involve CNPC, Sinopec, CNOOC, Sinochem and Zhuhai Zhenrong (they have a separate quota system), has increased fivefold.

- The quota hike is good news for Russian and Middle Eastern suppliers.

- Existing quota holders have rushed to buy the Russian ESPO grade, loading at Kozmino port, a staple diet of Chinese independent refineries.

- Second-month ESPO differential to front-month Dubai skyrocketed to $7/barrel, a feat unseen since October 2013.

- Two new refineries will go fully onstream in 2019: Hengli Petrochemical and Zhejiang Petrochemical (both with a capacity of 20mtpa).

- Both already signed term contracts with Saudi Aramco for 2019, presumably covering Arab Heavy and Arab Medium supplies, with the Brazilian Marlim crude perceived as a suitable supplement to Saudi crude.

2. Canada’s Oil Woes Grow Bigger by the Day

(Click to enlarge)

- Western Canadian Select (WCS) reached a five-year low in the first days of October, trading at a $40/barrel discount for November.

- Late September trading even witnessed a single bid discounted to a record $50/barrel.

- Oil sands maintenance is expected to tail off, leaving Canadian producers with no evident solution to avoid heavy discounting.

- Canada’s pipelines are fully utilized, with the national average utilization rate at 98 percent, extending the heavily negative impact to other Canadian crudes, too.

- Canadian light oil benchmark Mixed Sweet Blend plummeted to $24/barrel, even though its traditional discount to WTI stands at a mere $4-6/barrel.

- Synthetic crude (SCO), an upgraded and pipeline-transportable form of oil sands making up largely two-thirds of Western Canada’s refinery intake, similarly dropped to a $21/barrel discount.

- Despite an increase in crude-by-rail transportation to roughly 200 000 bpd from 140 000 bpd in the first months of 2018, producers are at great pains to have their oil sands marketed properly.

3. EU’s Trump-defying Iran payments system falling short

(Click to enlarge)

- Facing an increasingly unilateralist White House, representatives of the European Union, China and Russia agreed late September to create a special-purpose vehicle to circumvent U.S. sanctions and facilitate trade with Iran.

- The SPV was expected to balance out Iran’s liabilities, largely creating a multilateral barter system which would avoid the usage of U.S. financial entities.

- The EU wants the SPV to have a banking license so as to move out of the barter trade limitations when conditions are ripe, as well as to be able to hand out export loans.

- European oil companies, however, have largely snubbed the EU’s initiative, either from fear of damage to their U.S. production assets or of hefty fines from U.S. financial regulators.

- Total CEO Patrick Pouyanné, representing the company that operated South Pars 11 and imported an average 200 000 bpd of Iranian oil in 2017, stated the SPV does not shield oil companies from potential U.S. retributions.

- Two frequent Iranian crude buyers, the Spanish CEPSA and Italy’s ENI also vowed to stop trading with Iran notwithstanding the SPV’s development.

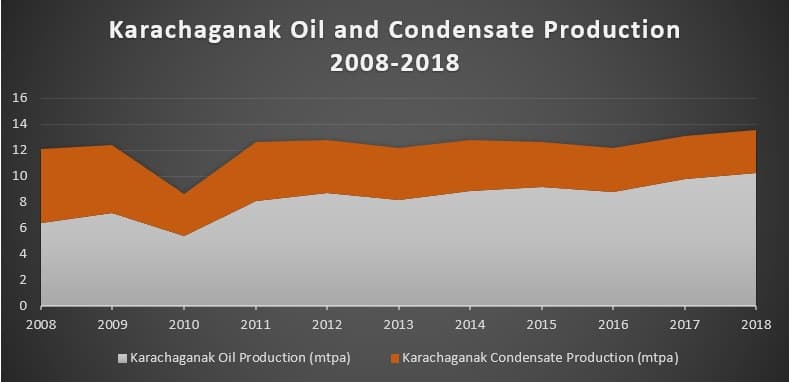

4. Parties reach out-of-court settlement for Karachaganak

(Click to enlarge)

- Kazakhstan and the Karachaganak Petroleum Operating BV have settled their long-standing dispute, whereby KPO would pay $1.1 billion to the Kazakh state.

- The parties also agreed to amend the terms of their PSA, with KPO supposed to transfer an additional $400 million by 2037.

- KPO comprises Shell, Eni (each at 29.25%), Chevron (18%), LUKOIL (13.5%) and KMG (10%).

- The settlement paves the way for Phase III of Karachaganak’s development which was put on hold against the background of state obstructionism.

- This is not the first instance of KPO and Astana clashing – using KPO shareholders’ funds the Kazakh authorities wanted some years ago to construct a gas-processing plant of their own so as not to send it to Russia’s Astrakhan plant, unsuccessfully.

- The Karachaganak field has been in operation since 1979, it has been using advanced oil recovery technologies for more than ten years and is preparing for a third phase of production to start in 2022-2023.

- Phase III will bring an additional 2.6 mtpa of oil and 8 Bcm of gas per year to the Eurasian market.

5. Exxon Mobil Shapes Up Its Refining Ahead of IMO 2020

- Exxon Mobil seems to be taking the impending changes in new maritime fuel rules, limiting Sulphur content from the 3.5 percent to 0.5 percent, very seriously.

- Exxon stepped closer to implementing its “multi-billion expansion project” at its largest refinery with a nameplate refining capacity of 592 kbpd, located in Singapore.

- The expansion, expected to be completed by 2023, will result in the Singapore refinery producing fully IMO 2020-compliant marine fuel.

- The announcement follows Exxon’s commitment to spend 650 million on upgrading UK’s largest refinery in Fawley, Hampshire (current refining capacity stands at 270kbpd).

- A similar development is taking place at Exxon’s Antwerp refinery, where a new delayed coker unit that is expected to be fully operation by the end of the year will facilitate the bunker fuel – ULSD switch.

6. US Majors Bet Big on Latest Pre-salt Brazil Oil Auction

- The Brazilian National Agency of Petroleum, Natural Gas and Biofuels cashed in $1.7 billion in signing bonuses for just four offshore blocks in Brazil’s 5th Production Sharing round.

- Bids were offered as a percentage of profit oil that would be granted to the Brazilian government, i.e. how much of the oil after the cost of recovery would be allocated to it.

- The most intense bidding was for the Saturno block (unrisked reserves in place stand at 2.8 billion barrels) and was won by a joint bid from Shell and Chevron’s Brazilian units in a 50%-50% ownership structure.

- Shell and Chevron offered 70.2% of profit oil for Saturno, the BP-CNOOC-Ecopetrol consortium bid 63.8% for the Pau block, whilst Exxon Mobil-Qatar Petroleum won the Titã block by putting forth 23.49%.

- The success of the 5th round further underscores interest in Brazil’s pre-salt fields after the erstwhile obligation that Petrobras be an operating partner was abolished in 2017.

- This round was the last before Brazil’s presidential elections on October 7, 2018, which could bring about a reversal in the country’s more liberal stance towards its natural resources.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.