Iranian forces made front page oil market news yet again since our last note by seizing a UK-flagged tanker and a British owned tanker in the Strait of Hormuz as a retaliatory measure for the Royal Marines’ seizure of an Iranian cargo earlier in the month. This is an important trend to watch as six tankers and a US military drone have now been attacked, seized or somehow disturbed in the region over the last two months by Iranian forces generating a ten-fold increase in the price of vessel insurance in the Strait of Hormuz. Everywhere we looked early this week we saw headlines of how oil prices and volatility were rallying on the Iran news. Iran also arrested 17 alleged CIA-linked spies this week and sentenced some to capital punishment.

However, we think it’s important to put the recent price gains in context and if we zoom out even just a little bit from the daily headline feed we think the market seems more concerned with China/US relations than Iran/US relations. The first place to look is at Brent prices which, yes, have strengthened in recent trading, but are still lower by about $9- with Brent currently near $64/bbl- since the string of incidents with oil tankers in the Strait of Hormuz started. In the options market, the NYMEX/CBOE WTI volatility has similarly strengthened in recent trading but its current mark near 33.85 is still significantly lower than its run in the mid 40’s back in early June. Lastly, in time spread markets the prompt Brent 1-month spread…

Iranian forces made front page oil market news yet again since our last note by seizing a UK-flagged tanker and a British owned tanker in the Strait of Hormuz as a retaliatory measure for the Royal Marines’ seizure of an Iranian cargo earlier in the month. This is an important trend to watch as six tankers and a US military drone have now been attacked, seized or somehow disturbed in the region over the last two months by Iranian forces generating a ten-fold increase in the price of vessel insurance in the Strait of Hormuz. Everywhere we looked early this week we saw headlines of how oil prices and volatility were rallying on the Iran news. Iran also arrested 17 alleged CIA-linked spies this week and sentenced some to capital punishment.

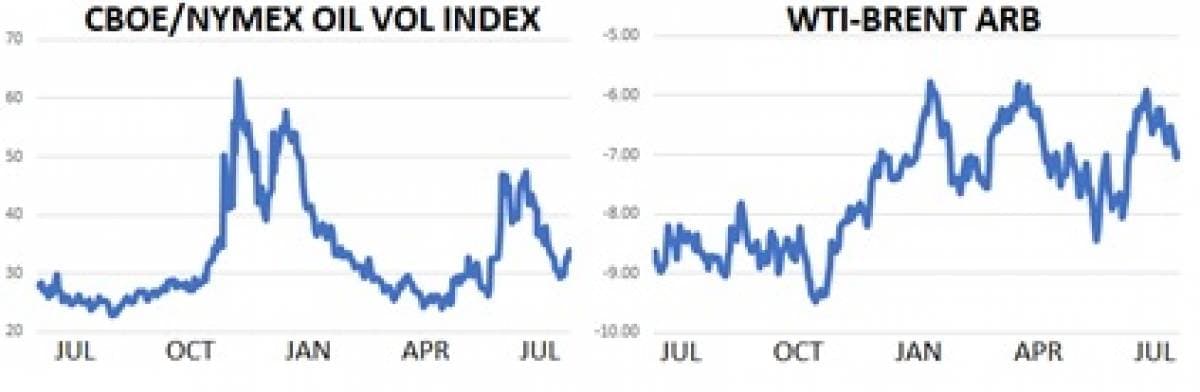

However, we think it’s important to put the recent price gains in context and if we zoom out even just a little bit from the daily headline feed we think the market seems more concerned with China/US relations than Iran/US relations. The first place to look is at Brent prices which, yes, have strengthened in recent trading, but are still lower by about $9- with Brent currently near $64/bbl- since the string of incidents with oil tankers in the Strait of Hormuz started. In the options market, the NYMEX/CBOE WTI volatility has similarly strengthened in recent trading but its current mark near 33.85 is still significantly lower than its run in the mid 40’s back in early June. Lastly, in time spread markets the prompt Brent 1-month spread traded near 22 cents backwardation this week which was lower by nearly 50 cents over the last two months.

So yes, there has been a modest uptick in prices due to Iran’s growing conflict with the West and particularly the US, but it looks to us like weak fundamentals are still what’s driving oil markets. The modest upward move in prices has been enabled by dovish communications from Iranian, US and British leadership pointing to a desire to ‘talk’ out the current dispute rather than elevate and further disrupt tankers. Moreover, a recent IEA note suggests that member supplies are more than adequate to cover global crude demand even in the event of a heightened conflict in the oil market’s most important shipping lane.

Away from Iran, a more important trend could be developing for oil with a large recent Chinese purchase of US agricultural goods and a visit of the US officials Robert Lighthizer and Steve Mnuchin to Beijing next week for the first in-person meeting between the two sides since May. Equity markets show a somewhat conflicted outlook for US/China trade relations for now with the US stock market trading right near record-highs while the Shanghai Composite is lower by about 5% in July and by 11% over the last three months. In our judgment an increased thaw in US/China relations could actually be more bullish for oil than continued trade disruptions in the Strait of Hormuz. It’s an unusual state of affairs for the oil market to be in, but as long as non-OPEC supply booms and global demand is weak, central bank moves and trade relations might pack more of a bullish punch than Middle East skirmishes.

Quick Hits

- The CBOE/NYMEX WTI volatility index traded near 33.0 this week which is about 3 points high on the month but still slightly under its 2019 average of 33.4. We mention this not to suggest that the current oil environment is volatility-free, but to put the recent Iran events in context. Using a wide lens, it appears that options traders are not overly worried about tensions and skirmishes in the Strait of Hormuz.

- In spread markets, WTI’s discount to Brent widened from $6/bbl in late June to $7/bbl this week as US fundamentals grew increasingly soft. Elevated US production, high levels of crude and distillate inventories and weak refiner demand all remain bearish for US supply/demand balances.

- In politics, Boris Johnson became the UK’s next Prime Minister as was expected. Mr. Johnson has a roughly three-month window to negotiate a deal to leave the European Union with a deadline of October 31. Mr. Johnson’s stated plan is that the UK will engage a Hard Brexit if he can’t make a deal by the end of October. The USD has gained sharply against the GBP since Theresa May’s announcement that she we could be stepping down as PM, and as for as the oil market’s concerned we’re bearishly anxious about the ability of Brexit to spill into macro sentiment at a time when US/China relations are so poor.

- Crude production In Libya’s Sharara field (290k bpd capacity) restarted this week after a brief shut down. Bloomberg estimated Libya’s crude output at 1.15m bpd in June but the last week’s production had the tally at less than 1m bpd.

- The yield on the US 2yr bond has been mostly flat near 1.80% for the last month ahead of the Fed’s rate decision next week. Bond traders still expect the Fed to cut rates by 25 basis points following Chairman Powell’s perceivably dovish testimony to Congress last week. The spread between the 2yr bond and 10yr bond remains virtually flat which continues to raise alarms on the health of the global economy. Similarly flat yield curves predicted economic and market distress in 2000 and 2007.

DOE Wrap Up

- US crude stocks fell 3.1m bbls last week with help from decreased US production. Overall US crude stocks stand at 456m bbls and are higher y/y by 12% over the last four weeks.

- Crude oil production fell from a record high of 12.3m bpd to 12.0m bpd last week due to hurricane activity in the USGC which shut in production as a precautionary measure. We didn’t find any reports of long-term production damage and expect output to rebound swiftly.

- The US currently has 26.3 days of crude oil supply on hand and has averaged 26.9 days of supply over the last four weeks which is higher y/y by 15%.

- US imports slowed from 7.3m bpd to 6.8m bpd last week and have averaged about 7.1m bpd so far this year.

- Crude exports fell from bpd to 2.5m bpd last week as the hurricane slowed trade activity into Houston, leaving net imports at 4.3m bpd. Exports have averaged 2.9m bpd in 2019 and net imports have averaged 4.2m bpd.

- More bullishly, crude oil stocks in the Cushing delivery hub fell 1.9m bbls last week to 50.3m and are lower by about 3m bbls over the last five weeks.

- Unfortunately, US refiner demand remains unimpressive and hasn’t revealed the type of Summer Driving Season numbers we’d need to see to generate bullish enthusiasm. Refiners processed 12.27m bpd last week and have averaged 17.3m bpd over the last four weeks which is lower y/y by about 300k bpd. US refiner demand is lower by about 230k bpd YTD.

- US gasoline stocks climbed 3.6m bbls last week and are higher y/y by 3% over the last month.

- US heating oil stocks jumped 5.7m bbls last week and are higher y/y by 9% over the last month.