1. Futures depict emerging oil supply glut

(Click to enlarge)

- Oil futures slipped into contango in the fourth quarter, a sign of an emerging glut of supply. Contango – when futures trade at a discount relative to longer-dated contracts – often accompanies a short-term supply surplus.

- But the OPEC+ cuts helped boost near-term pricing, and Brent has been in a state of backwardation since February.

- Front-month contracts recently traded at a higher than $5-per-barrel premium to contracts 13 months out, the highest premium in six months.

- The U.S. announcement not to renew Iran sanctions waivers resulted in a brief spike in near-term pricing. But after last years’ experience, OPEC+ will likely be cautious before making any rash decisions.

- “Instead, we expect OPEC to keep the market tight and allow prices to drift higher, regardless of the short-term volatility caused by Trump’s oil supply comments,” Standard Chartered wrote in a note this week.

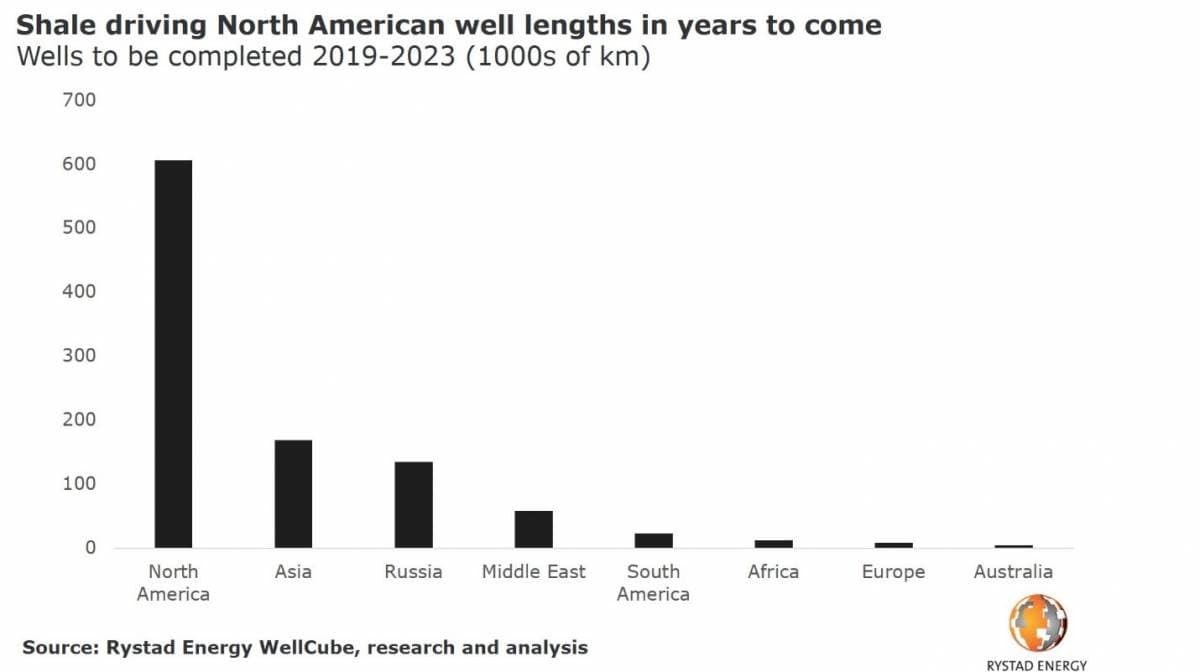

2. More than 1 million kilometers of wells to be drilled

(Click to enlarge)

- The global oil industry is expected to drill more than 1 million kilometers of new oil and gas wells over the next five years, according to Rystad Energy.

- The depth of those wells is equivalent to 2.5 times the distance to the moon, or 25 times around the equator.

- In 2019 alone, around 65,000 new oil and gas wells will be drilled.

- That implies a gargantuan level of steel needed…

1. Futures depict emerging oil supply glut

(Click to enlarge)

- Oil futures slipped into contango in the fourth quarter, a sign of an emerging glut of supply. Contango – when futures trade at a discount relative to longer-dated contracts – often accompanies a short-term supply surplus.

- But the OPEC+ cuts helped boost near-term pricing, and Brent has been in a state of backwardation since February.

- Front-month contracts recently traded at a higher than $5-per-barrel premium to contracts 13 months out, the highest premium in six months.

- The U.S. announcement not to renew Iran sanctions waivers resulted in a brief spike in near-term pricing. But after last years’ experience, OPEC+ will likely be cautious before making any rash decisions.

- “Instead, we expect OPEC to keep the market tight and allow prices to drift higher, regardless of the short-term volatility caused by Trump’s oil supply comments,” Standard Chartered wrote in a note this week.

2. More than 1 million kilometers of wells to be drilled

(Click to enlarge)

- The global oil industry is expected to drill more than 1 million kilometers of new oil and gas wells over the next five years, according to Rystad Energy.

- The depth of those wells is equivalent to 2.5 times the distance to the moon, or 25 times around the equator.

- In 2019 alone, around 65,000 new oil and gas wells will be drilled.

- That implies a gargantuan level of steel needed for well casing. North America alone will account for over 600,000 kilometers of new wells.

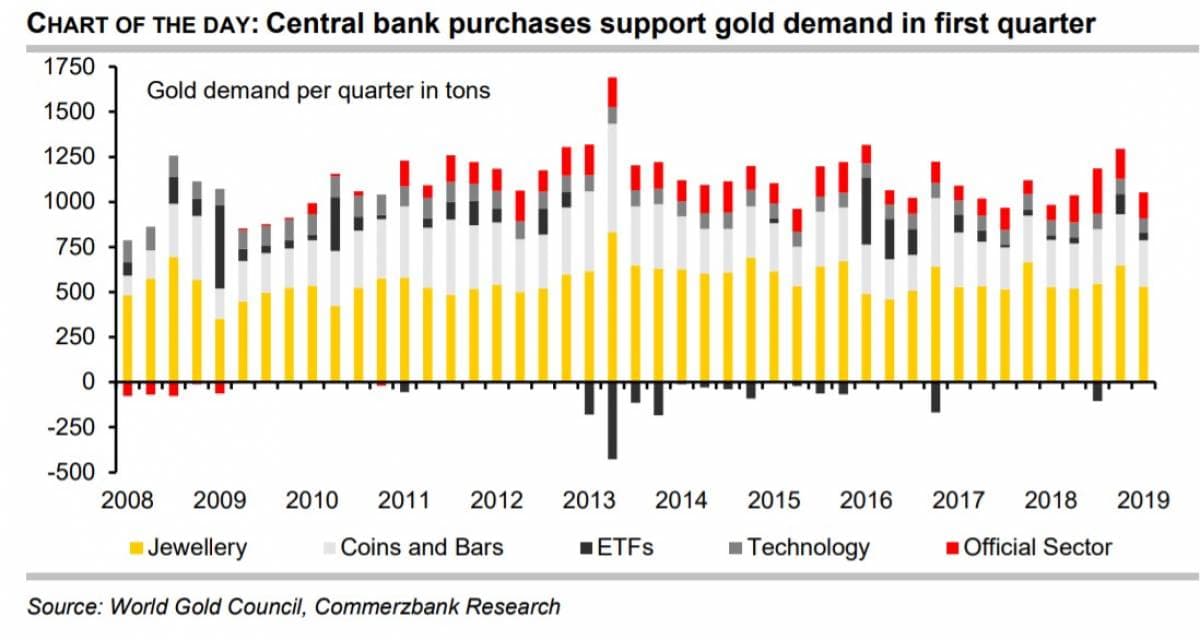

3. Gold under pressure

(Click to enlarge)

- Gold came under pressure this week when the U.S. Fed seemingly brushed off concerns about low inflation, taking a slightly more hawkish stance than the market anticipated.

- “The dollar appreciated in response and the market corrected its rate cut expectations somewhat,” Commerzbank wrote in a note. “That said, a rate cut is still expected in the US before year’s end.”

- Gold demand was up 7 percent year-on-year to 1,053 tons, Commerzbank noted, though from a low base a year ago. Demand from central banks was up 68 percent, largely due to Russia and China.

- ETF inflows also rose by 49 percent.

- Gold prices fell mid-week after the Fed’s comments, trading at around $1,270 per ounce on Thursday.

4. Global auto sales dipping

(Click to enlarge)

- China’s car sales continue to decline, raising fears of an economic slowdown. Retail sales in Chine contracted by 12 percent in March, year-on-year. In February, sales fell by 18.5 percent.

- Tariffs are playing a part, but sales are slowing in the U.S. as well.

- Five of the largest U.S. automakers missed analysts’ estimates for first quarter profits. For instance, Ford (NYSE: F) saw its sales fall 4.7 percent in the first quarter.

- Higher prices and rising interest rates are playing a part, but a broader economic slowdown cannot be ruled out.

- U.S. sales of light trucks and automobiles declined to a seasonally adjusted annual rate of 16.4 million unites, the lowest level since August 2017.

5. Chevron strengthened with Anadarko

- Morgan Stanley is very optimistic on Chevron (NYSE: CVX), arguing that it has “industry-leading cash returns to investors,” low breakevens, and a strong balance sheet.

- Chevron’s “Permian position is a key differentiator, with low royalties and decades of running room in the existing 1.7 [million] net acres,” the investment bank said.

- Yet, the pending acquisition of Anadarko Petroleum (NYSE: APC) would “enhance” Chevron’s portfolio, even though the bank said it’s not needed. Anadarko would offer complementary assets, with contiguous acreage in the Permian. It would also save $2 billion in synergies and boost cash flow by 10 percent.

- Morgan Stanley said that had a “low-risk organic growth plan,” and the “stock remains a compelling investment with or without” Anadarko.

6. U.S. sees China’s control over critical minerals as vulnerability

(Click to enlarge)

- Members of the U.S. Senate, led by Sen. Lisa Murkowski (R-AK), introduced legislation on Thursday to streamline regulation and permitting requirements for mines targeting lithium, graphite and other minerals needed in the production of electric vehicles.

- The U.S. views China’s dominance over these minerals as a strategic vulnerability. Very few of these minerals are produced in the U.S.

- China already produces nearly two-thirds of the world’s lithium-ion batteries, while the U.S. only produces 5 percent, according to Benchmark Minerals Intelligence. China also has most of the world’s lithium processing facilities, and has locked up nearly three-quarters of the world’s lithium supply.

- “We need to find ways to more efficiently develop our nation’s domestic critical mineral supply because these resources are vital to both our national security and our economy,” North Dakota Senator John Hoeven, told Reuters last month.

7. Gas leads global energy consumption growth

(Click to enlarge)

- Global energy consumption grew last year by 2.3 percent, or twice the average rate since 2010, according to the IEA, driven by strong economic growth and higher heating and cooling needs in certain places.

- Natural gas rose by the most – 143 mtoe – capturing 45 percent of the total increase. Renewables came in second place, but fossil fuels on the whole accounted for 70 percent of the increase.

- As a result, global CO2 emissions increased by 1.7 percent, or 33.1 gigatons.

- Gas demand is rising much faster than oil at the global level, rising 4.6 percent in 2018 compared to oil’s 1.3 percent increase. These disparities help explain the increasing pivot by the oil majors into global gas production and export projects.