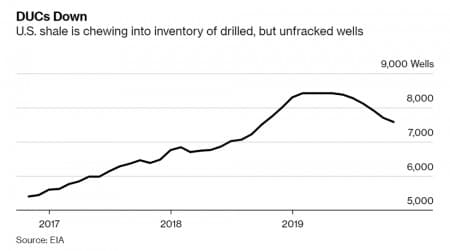

1. Frackers working through frack-log

- After years of adding drilled but uncompleted wells (DUCs) to the field, the shale industry began working through the backlog in earnest in the second half of 2019.

- The decline in the DUC list by about 10 percent can be interpreted as a sign of financial stress because it suggests that the industry is not drilling new wells as fast as they are completing already-drilled wells. Or, put more simply, the rate of drilling has declined.

- As Bloomberg points out, this trend is horrible for oilfield services companies like Halliburton (NYSE: HAL), which makes money on activity, regardless of the price of crude.

- Wall Street analysts predict a 29 percent decline in earnings for Halliburton in the fourth quarter.

- U.S. production could also flatten out once the DUC list is worked through, absent a renewed wave of drilling.

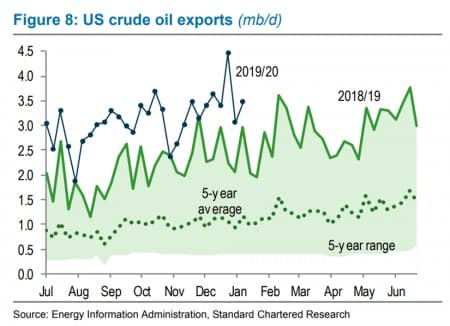

2. U.S. exports continue to rise

- U.S. oil exports continue to trend higher, with demand remaining flat at a time when production has steadily climbed.

- Exports topped 4 million barrels per day in late 2019, a record high. That may have been a one-off spike, at least for now. Still, exports consistently exceeded 3 mb/d last year, and are on an upward trend.

- That has allowed the U.S. – for the first time in decades – to become a net exporter of petroleum products.

- The Phase 1 trade deal between the U.S. and China could lead to more Chinese purchases…

1. Frackers working through frack-log

- After years of adding drilled but uncompleted wells (DUCs) to the field, the shale industry began working through the backlog in earnest in the second half of 2019.

- The decline in the DUC list by about 10 percent can be interpreted as a sign of financial stress because it suggests that the industry is not drilling new wells as fast as they are completing already-drilled wells. Or, put more simply, the rate of drilling has declined.

- As Bloomberg points out, this trend is horrible for oilfield services companies like Halliburton (NYSE: HAL), which makes money on activity, regardless of the price of crude.

- Wall Street analysts predict a 29 percent decline in earnings for Halliburton in the fourth quarter.

- U.S. production could also flatten out once the DUC list is worked through, absent a renewed wave of drilling.

2. U.S. exports continue to rise

- U.S. oil exports continue to trend higher, with demand remaining flat at a time when production has steadily climbed.

- Exports topped 4 million barrels per day in late 2019, a record high. That may have been a one-off spike, at least for now. Still, exports consistently exceeded 3 mb/d last year, and are on an upward trend.

- That has allowed the U.S. – for the first time in decades – to become a net exporter of petroleum products.

- The Phase 1 trade deal between the U.S. and China could lead to more Chinese purchases of American crude. The terms of the trade deal call for sales of energy products on the order of $18.5 billion in 2020 and $33.9 billion in 2021.

- However, analysts have repeatedly questioned these figures, as well as the broader numbers for agricultural purchases. Chinese tariffs on crude (5 percent) and LNG (25 percent) remain.

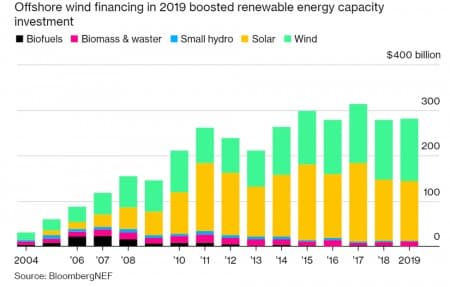

3. Global renewables investment edges up, but still not high enough

- Total investment in renewables around the world rose to $281 billion last year, up slightly from $277 billion a year before, but down from the record high $313 billion in 2017.

- But because of falling costs with each passing year, a dollar goes further than it used to. Although investment only rose by 1 percent in 2019, the installed capacity of renewables rose by 13 percent to 180 GW.

- The U.S. reached a new record high of $55.5 billion, up 28 percent from the year before.

- Impressive investment totals are still roughly half of what they need to be for the world to reach climate targets. BNEF says investment needs to rise to $600 billion annually through 2025.

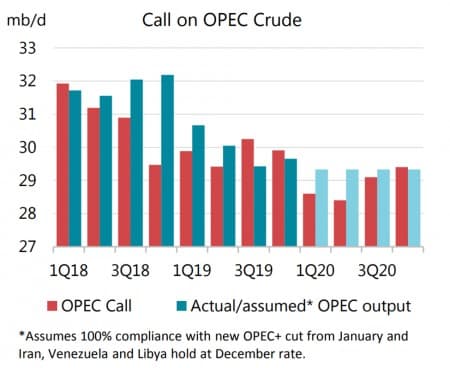

4. OPEC+ still staring down surplus

- The OPEC+ deal announced in December increased the cuts by another 300,000 bpd, plus additional voluntary cuts by Saudi Arabia.

- However, even with those cuts in hand, the oil market still faces a supply surplus. “Even if they adhere strictly to the cuts, there is still likely to be a strong build in inventories during the first half of 2020,” the IEA said.

- OPEC production is expected to average 29.3 mb/d in January, which is still about 0.7 mb/d above the “call on OPEC,” or the amount the group would need to produce in order to balance the global market.

- In the second quarter, OPEC is on track to produce 0.9 mb/d above the “call on OPEC.”

- In other words, there is a good possibility that the market suffers from a significant surplus in the first half of this year.

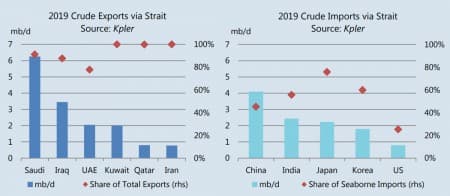

5. Strait of Hormuz as important as ever

- Unrest in the Middle East always puts the spotlight on the Strait of Hormuz, and the potential for a U.S.-Iran war is no different. Roughly 20 mb/d of oil and refined products passes through the Strait. So does about 25 percent of the world’s LNG.

- Iran’s oil exports have plunged due to sanctions, but Iraq’s importance to the global market has increased in recent years, with oil exports doubling from 2 to 4 mb/d since 2010.

- Saudi Arabia relies on the Strait to move 90 percent of its oil.

- Asian countries are the most dependent on the Strait, with Japan sourcing about three-quarters of its imports from the region. On an absolute basis, China imports 4 mb/d from the Strait, with 1 mb/d alone coming from Iraq.

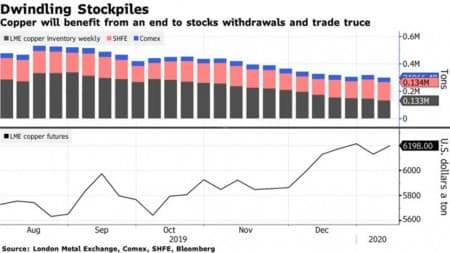

6. Copper prices expected to rise

- The conditions are ripe for an increase in copper prices this year, according to analysts.

- The U.S.-China trade war is now on hold, and last year’s interest rate reduction has steadied the global economy. Copper prices closely reflect swings in economic conditions.

- For the copper sector specifically, upstream capex is down and inventories are depleted.

- In fact, inventories are down by 37 percent since July, and now only represent about 1.2 percent of global consumption, according to Bloomberg. Mining output declined by 0.4 percent in 2019 from a year earlier.

- Investment banks are making bullish calls on copper. Goldman Sachs predicts copper prices rising to $7,000 per metric ton this year, up from $6,174 last year.

- “Europe and developed Asia have been destocking pretty aggressively over the past six months or so,” Colin Hamilton, an analyst at BMO Capital Markets, told Bloomberg. “You can’t do that forever.”

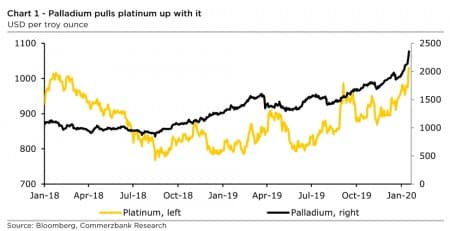

7. Palladium continues to defy gravity

- Palladium was the best-performing commodity in 2019, for the third straight year.

- The upward rise continues, despite deep problems in the global auto market.

- “The price differential [of platinum] to palladium has widened to $1,280 despite the rise in the platinum price because palladium appears unstoppable on its upward advance,” Commerzbank said in a note. Prices surpassed $2,300 per troy ounce for the first time on Thursday.

- “From a technical perspective, palladium is clearly overbought – and to a greater extent even than gold was a few days ago,” the investment bank added, and it is “due for a correction.”

- “However, it is impossible to say whether this will happen and, if so, how long it will last. The correction phases in recent months have become shorter and shorter, the price subsequently rising to ever new heights,” Commerzbank concluded.