Tensions over oil movements in the Strait of Hormuz and a sizable decrease in the amount of crude oil being held in storage have managed to lift oil prices this week. Fears persist, however, around the unknown oil that may be lurking in China, as well as lackluster demand growth forecasts, putting a ceiling on the gains. OPEC’s tenacity in sticking with its production quotas is having little impact, pointing to its weakening influence in oil markets.

Welcome to the Oil’s No-Man’s Land

There is a buildup of Iranian oil in what is considered an effective no-man’s land in the ports of China - the country with the most buying power to sway global oil demand.

The build up in inventory could prove problematic to OPEC as the cartel has been struggling along with Russia and other agreeable allies to tamp down production and draw down global crude inventories. We are now entering the third year of OPEC’s latest crusade to control the state of the oil market, but American shale has proven a worthy adversary.

One of the ways OPEC has tried to alter the perception of just how much oil is still overhanging demand is by changing the five-year period from which it calculates the five year average. Historically, this has been the last five years. Now, it is considering using 2010 to 2014 instead, which may paint a rosier picture of global inventories.

A true global inventory figure doesn’t actually exist, in part because several oil markets are opaque, the biggest…

Tensions over oil movements in the Strait of Hormuz and a sizable decrease in the amount of crude oil being held in storage have managed to lift oil prices this week. Fears persist, however, around the unknown oil that may be lurking in China, as well as lackluster demand growth forecasts, putting a ceiling on the gains. OPEC’s tenacity in sticking with its production quotas is having little impact, pointing to its weakening influence in oil markets.

Welcome to the Oil’s No-Man’s Land

There is a buildup of Iranian oil in what is considered an effective no-man’s land in the ports of China - the country with the most buying power to sway global oil demand.

The build up in inventory could prove problematic to OPEC as the cartel has been struggling along with Russia and other agreeable allies to tamp down production and draw down global crude inventories. We are now entering the third year of OPEC’s latest crusade to control the state of the oil market, but American shale has proven a worthy adversary.

One of the ways OPEC has tried to alter the perception of just how much oil is still overhanging demand is by changing the five-year period from which it calculates the five year average. Historically, this has been the last five years. Now, it is considering using 2010 to 2014 instead, which may paint a rosier picture of global inventories.

A true global inventory figure doesn’t actually exist, in part because several oil markets are opaque, the biggest of which is China. This has been a long-time concern, but the newest developments here is particularly worrisome. Technically, this oil hasn’t gone through customs yet, so technically it is not in violation of any sanctions. But this buildup of oil in what the industry refers to as “bonded storage” will have a profound effect whenever it is released. And if oil prices get too high, or if oil flows are disrupted in the Strait of Hormuz, this oil most certainly will be released.

This is not just convenient for China because it allows the country to hedge its bets on oil prices, but it is also convenient for Iran, it’s oil positioned strategically near the largest oil buyer in the world after it lost some prime Asian market share due to the sanctions.

Rough estimates are that this storage is holding 14 million barrels of oil.

There WILL be a Battery Metals Shortage, but Nickel will be the First Beneficiary

Lithium miners are suffering, and Woods Mackenzie (WM) is now providing some analytical clarity in its H1 2019 battery raw materials long-term outlook. The supply crunch will come much sooner than many anticipated.

In fact, WM is expecting it by mid-next year for cobalt, lithium and nickel. The key driver is, of course, EV sales, which were up 24% over the same period last year. But it’s also because battery pack sizes are getting bigger and bigger, further adding to increased demand.

More specifically, WM notes the beginning of the commercialization of NMC 811 cells in EVs. These are now being mass produced in China, and South Korea is expected to start mass-producing them by the end of this year.

The biggest winners will be nickel and cobalt, while lithium will see benefits - but on a lower level.

Since June last year, lithium carbonate spot prices have fallen by almost $7,000/t. Cobalt prices have also lost their footing this year.

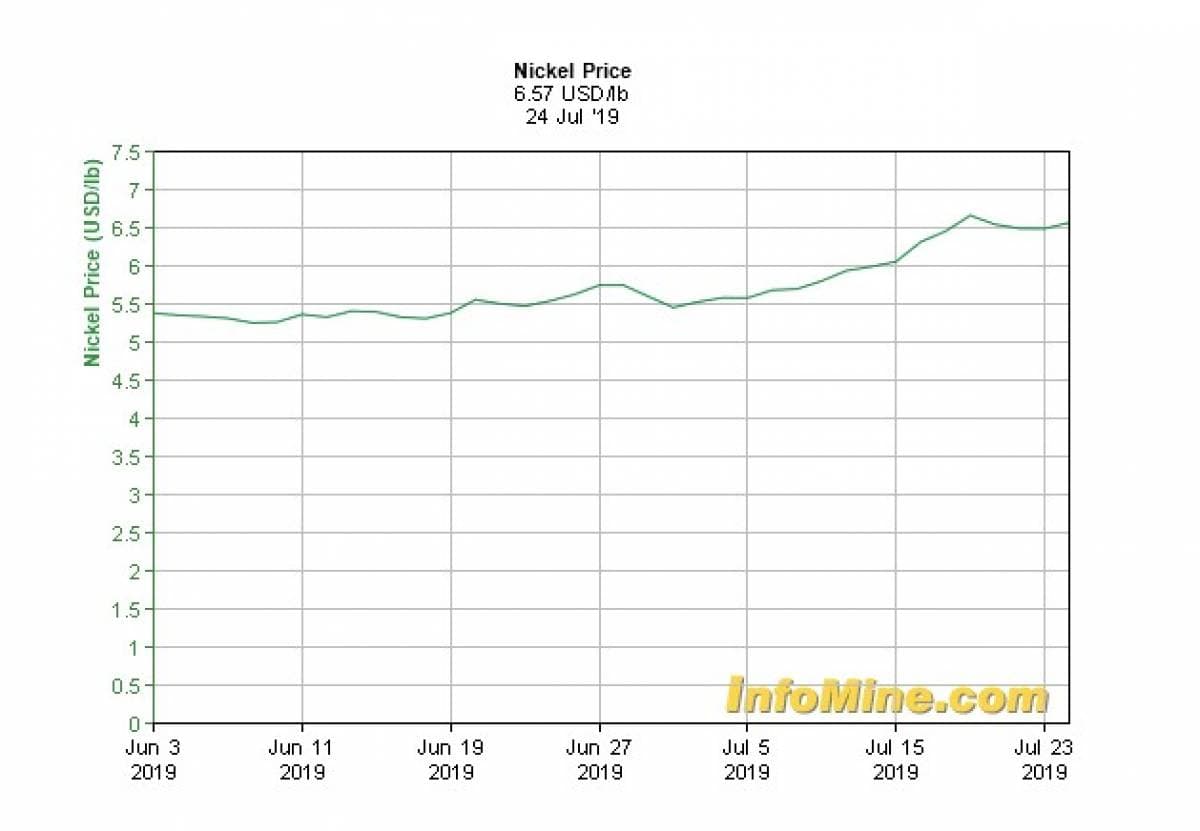

Nickel is a different story. While it doesn’t enjoy as big a share in the battery makeup as cobalt and lithium do, it’s also harder to come by in the large quantities needed for EVs. And this is where the real opportunities come to light. Low nickel prices have kept new mining project development down and this is probably the best play for early-in investors.

On Thursday, nickel prices plunged 3%, but this was because of a slowdown in euro zone factory activity and it doesn’t paint the full picture. On July 18, nickel hit $15,115/t - the highest price it’s reached this year before paring some gains to land at around $14,500/t.