It is that time of the year again. Just as parents are assiduously picking the best presents for their kids, as kids are eagerly anticipating the onset of the winter break, as people all across the globe are readying their New Year resolutions, the global oil community raises the inevitable question – how will 2019 look like? The usual swings and roundabouts or are we finally to get a tranquil year that would make future at least temporarily more predictable? The odds are 2019 will be just as chaotic as 2018, with the Iran issue crying out for a long-term solution, the U.S. ramping up production to heights unseen and the Middle East boiling as usual. We have selected 7 main trends to look out for – trends that will shape the forward curve of oil and alter the geopolitical standings of oil-producing giants.

1. U.S. Crude Production Skyrocketing Further

The astounding rise of U.S. crude production will continue next year, stretching America’s lead in the top oil producers’ race. After U.S. output averaged 10.88 mbpd this year, it is expected that next year it would surpass the annual 12mbpd threshold to reach 12.06 mbpd. Improved drilling technology is making operations more efficient, bringing down breakeven costs generally to the 35-45 USD per barrel interval – against this background, oil companies retain more from the dollars they earned from selling the crude and can ramp up further investments. Yet there is a catch to U.S. production ramp-up next year, namely,…

It is that time of the year again. Just as parents are assiduously picking the best presents for their kids, as kids are eagerly anticipating the onset of the winter break, as people all across the globe are readying their New Year resolutions, the global oil community raises the inevitable question – how will 2019 look like? The usual swings and roundabouts or are we finally to get a tranquil year that would make future at least temporarily more predictable? The odds are 2019 will be just as chaotic as 2018, with the Iran issue crying out for a long-term solution, the U.S. ramping up production to heights unseen and the Middle East boiling as usual. We have selected 7 main trends to look out for – trends that will shape the forward curve of oil and alter the geopolitical standings of oil-producing giants.

1. U.S. Crude Production Skyrocketing Further

The astounding rise of U.S. crude production will continue next year, stretching America’s lead in the top oil producers’ race. After U.S. output averaged 10.88 mbpd this year, it is expected that next year it would surpass the annual 12mbpd threshold to reach 12.06 mbpd. Improved drilling technology is making operations more efficient, bringing down breakeven costs generally to the 35-45 USD per barrel interval – against this background, oil companies retain more from the dollars they earned from selling the crude and can ramp up further investments. Yet there is a catch to U.S. production ramp-up next year, namely, global refinery appetite. The average refinery in the world (the same counts for the U.S. in particular) is tooled for a 32-33 API crude, thus leaving the 40-44 API WTI a bit out of scope. Moreover, medium sour crudes are getting increasingly difficult to get on the market, hence expect U.S. crudes to be heavily discounted against their Middle Eastern and Russian counterparts (WTI already trades at a discount to heavier and sourer Brent in Europe).

Source: OilPrice data.

2. Saudi Arabia Goes Aggressive on China

Pressurized by the inflow of light sweet American crude into regions previously deemed under Saudi control, Saudi Aramco has started to play hardball in Asia. If throughout 2018, Arab Extra Light for Asian markets oscillated in the 2.5-3 USD per barrel premium vs the Oman/Dubai average, in January 2019 Aramco dropped it to 0.75 USD per barrel. All indications point towards a more aggressive core market defense strategy from the Saudis, who, given their minimal production costs, can withstand such price decreases. Riyadh has managed to capitalize on the Iran sanctions, becoming the most important crude exporter to China. If in January-October 2018 the average monthly export volume amounted to 1.07mbpd, since then it averages 1.55mbpd. To corroborate the case for a more extensive Saudi presence in China, the IEA estimates that Aramco’s exports would increase to 1.67mbpd next year, on the back of a 400kbpd demand increase on the Chinese market.

Source: OilPrice data.

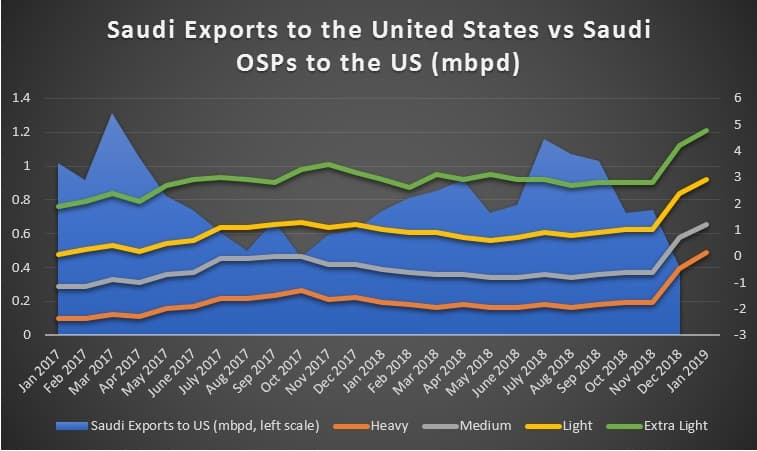

3. Saudis Counteracting the United States

Let me start by saying that you will most likely not see a movie-like standoff between Saudi Arabia and the United States and the developments stated below would happen without any fanfare. Yet the Khashoggi murder and the U.S.’ recalcitrance to curb output to keep oil prices at a palatable level creates a dilemma for Riyadh – it does not want to antagonize its long-time strategic partner, however has to get its point across. Thus, Saudi Arabia will try to edge out U.S. crude out of Asia and would simultaneously curtail its own exports to the United States. One can already notice the latter – against the background of a steep price hike for December 2018 and January 2019 loadings, Saudi exports dropped to a mere 400kbpd, even though in January-November 2018 they averaged 866kbpd.

Source: OilPrice data.

4. Iraqi Reconciliation with the KRG

After more than 14 months of seemingly hopeless deadlock, this autumn saw palpable developments in the Iraqi-Kurdish relationship. With a new government generally dovish to the Kurdish cause, coupled with the first-ever Kurdish national finance minister, Baghdad is on a good way to clinch a deal with the Barzanis. The sides have already agreed to market some 100kbpd of Kirkuk crude in Ceyhan through the federal oil marketer SOMO (three Aframax cargoes were successfully tendered out) and are under US and Russian pressure to reach an all-encompassing volume (and income) distribution deal. Washington wants to have more crude on the market, whilst Russia has a direct financial interest in Kurdish transportation as it has bought out the KRG pipeline system. Against a setup like this, a full reconciliation is a matter of months.

Source: OilPrice data.

5. Russian Tax Maneuver to Disbalance Russian Majors

Russia, currently the world’s second largest oil producer after the United States, has benefited greatly from the OPEC/OPEC+ production cuts, with the federal budget cashing in an additional 5 trillion rubles (74 billion USD) and oil companies taking in 2 trillion rubles more than expected (30 billion USD). With healthy cash flow indicators throughout 2018, one could expect that Russian companies would be investing that money into new projects abroad, however, the majors would most likely see their energy constrained by a complicated tax reform at home. The Energy Ministry seeks to gradually eliminate export duties and simultaneously increase the mineral extraction tax rate, yet the danger of rising fuel prices around Russia remains a significant threat. Even though the majors would stand to gain the most from this move, they would have to wait out the first shaky years, all the while the Russian government effectively called for a gasoline price freeze.

6. Iran Dropping Production

Iran will be the biggest uncertainty factor in 2019 – even though it expects to be exporting around 1.5 mbpd in 2019, the possibility remains that the fate of Iranian crude will turn suddenly very tragic. Although 8 countries were granted waivers, only India and China imported Iranian crude in the past 50 days overtly. Iranian media outlets report that talks with China and Russia allowing for higher crude imports are ongoing, the end result would still depend to a large extent from U.S. foreign policy decisions. The EU’s special purpose vehicle is nothing but Europe’s effort to put up a brave front even though everybody understands not one European company would risk being sanctioned by the US (and its banks). As of today, it seems unlikely that the waivers for India and China would not be extended in May 2019, yet the others would most likely opt to fully comply with U.S.’ unilateral sanctions. Consequently, expect a hefty drop in Iran’s crude production to 2.5-2.7 mbpd (from the pre-sanction average of 3.7 mbpd) and its crude exports to 0.9-1 mbpd.

7. Number of Oilmen Decreasing

The oil industry has been anticipating a “great generational change” for some time already. Yet its configuration might be a bit different than expected – namely, an oil sector with significantly less people working in it. In the years since 2015, the overwhelming majority of oil majors has cut headcount (only Total managed to increase headcount by 2 percent), with Chevron and BP landing double-digit headcount “optimizations”, the former by a whopping 17 percent. Regardless if it is a private company or national oil champion, the shrinking risk persists - Venezuela, where some 20-25 000 oil workers leave the country to feed themselves and their families, presents an intimidating example of oilmen’s exodus. However, challenges do not come down to mere political risks, digitalization and “blockchainization” of commerce have led most majors to trim their headcount to create a more efficient and streamlined modus operandi.