Soaring inflation, Russia’s war on Ukraine, sanctions, uncertainty over global economic contraction and a pandemic that still hasn’t disappeared have investors playing a dubious guessing game as to what sector is going to come out on top.

That volatility and uncertainty now seems to be leading money into exchange-traded funds (ETFs) as one of the key hedges.

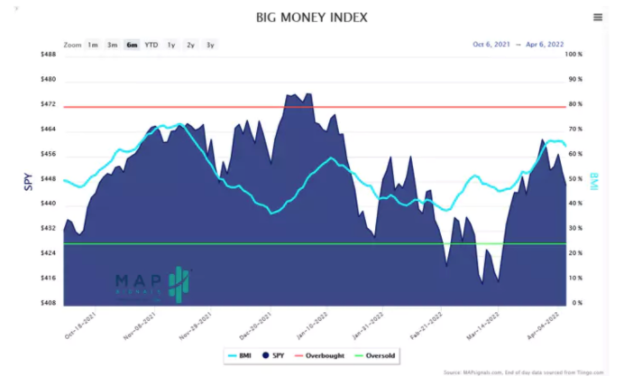

No one’s been scared away. Instead, they're just shifting. And big money is still pouring into stocks:

That said, the first quarter did see plenty of losses, with the S&P 500 shedding nearly 5%, the Nasdaq 100 declining 9% and the Russell 2000 down 7%.

ETFs performed well throughout, in specific categories. Energy, of course, won the quarter, but even that is still a guessing game going forward, with a complete lack of consensus as to where it’s headed. The market can’t get a handle on the full impact of the Russian war on Ukraine and the sanctions that have been put in place.

Out of the 30 top performing ETFs for Q1 2022, 26 of them were from the energy sector.

For Q2, investors are having a bit of a rethink, and the top performing ETFs might not be dominated by energy–at least so thoroughly.

One ETF segment that we expect to emerge as a major winner is in the area of semiconductor chips, where long-running shortages have been wreaking havoc in the auto industry, where inventories are extremely low and prices are soaring.

This is a bet, according to Bloomberg, on the semiconductor industry recovering from its supply chain problems. Shortages haven’t meant huge riches for the semiconductor sector because that only works when you can actually race to meet soaring demand. The money is made in the balance.

Investors are now seriously hedging on brighter days ahead, pouring some $6.8 billion into chipmaker ETFs in Q1 2022. They didn’t put that much into it for the entire year of 2021, according to Bloomberg.

Try VanEck Semiconductor ETF (SMH) on the dip. It’s lost over 21% YTD, but if big money is right, the rebound could be rewarding.

Another shift we could see on the ETF arena is towards “inflation-fighting” funds. With inflation pushing prices to 40-year high levels, this could be a good way to hedge against rising costs.

The Horizon Kinetics Inflation Beneficiaries ETF (INFL) intends to do exactly this. The goal of this ETF is to basket a bunch of very carefully curated stocks that are more likely to outperform their peers when costs of energy and raw materials rise in an inflationary environment. It’s a fund you might not have heard of, but it’s plenty liquid.

Year-to-date, it’s up over 9% but Q2 is when we expect the inflationary pressures to really kick in, so this could have considerable room to run further.

It’s time for a rethink of investment portfolios, and going all-in on energy isn’t protection enough.

"Markets got more complicated," Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds, told Investors.com. "2021 was really marked by a single theme and response, which was Covid and what the policy response would be. So, while it didn't feel like things were relatively simple, in hindsight it was. And that's why risk assets did spectacularly well. Now, we've got multiple narratives that are rocking markets and volatility is much higher."

By Josh Owens via Safehaven.com

More Top Reads From Oilprice.com:

- Oil Sands Financing From Canadian Banks Doubles

- India’s Russian Dealings Have Left Biden’s Geopolitical Oil Strategy In Tatters

- Tight Oil Markets Are Sending Fuel Margins Through The Roof