Oil has rallied sharply in recent days to see West Texas Intermediate (WTI) trading at just under $70 per barrel and Brent breaking through the $70 per barrel mark, with crude trading at its highest price since 2014. The surge in oil can be directly attributed to a wide variety of geopolitical risks which are sparking considerable fears that global oil supplies could be sharply constrained in coming months. This has triggered considerable speculation that $100 per barrel is on its way.

According to some pundits, the bearish factors which have weighed on oil prices for some time have been priced in by the market.

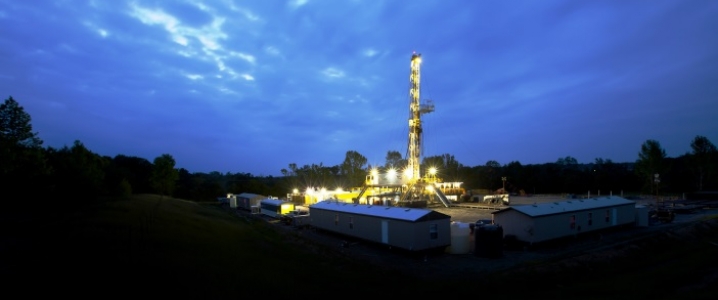

Nonetheless, the perception of geopolitical risk and how it is driving oil higher appears to be overbaked and there are a range of threats to the $100 per barrel oil narrative. Key is that U.S. oil production is expanding at a rapid clip. The U.S. EIA recently estimated that domestic production had hit 10,500 barrels daily, its highest level since starting to provide this data in the early 80s. The International Energy Agency (IEA) believes that the U.S. will overtake Russia to become the world’s largest oil producer by 2019.

The big question is whether this along with a marked expansion in the volume of U.S. drilled but uncompleted wells (DUCs) and rig count, which in early April 2018 reached its highest point in three years, is enough to suppress prices. The answer could surprise investors because fundamentals indicate that higher oil is here to stay, for as long as Saudi Arabia and Russia don’t aggressively unwind the production caps established in November 2016.

This is contrary to the thoughts of some analysts including those at Barclays who believe that oil will weaken once again to $51 per barrel during the second-half of 2018. What many analysts who are betting on lower oil are discounting is the effect of stronger global economic growth on the demand for energy. World gross domestic product (GDP) has been forecast by the International Monetary Fund (IMF) for 2018 to expand at 3.9 percent which is 10 basis points higher than the 3.8 percent projected for 2017.

Emerging markets are also surging with many expected to post significant growth in 2017. When those factors coupled with the improved U.S. economic outlook led by Trump’s corporate tax reform are considered it is likely that the global GDP will expand at a greater than the 3.9 percent projected. That will fuel even greater demand growth for oil.

Already, the IEA has revised its 2018 estimates many times. At its last revision in mid-March 2018, the IEA estimated that demand growth would top 1.5 million barrels daily for the year, which is 200,000 barrels higher than its earlier forecast. There is every sign that the global economic upswing which is underway will boost demand even higher.

Related: IMF: Expect Oil To Fall Below $60

You only need to consider that in 2017 when global GDP expanded by 3.8 percent, which is 10-bps lower than the 3.9 percent forecast for 2018, global energy demand for the year grew by 2.1 percent or double 2016.

OPEC has forecast demand growth for the year of over 1.6 million barrels daily while the U.S. EIA is predicting that it will be even higher at 1.8 million barrels. The upper end of those later forecasts appears more realistic than the 1.5 million barrels predicted by the IEA.

When you add in growing Middle East tensions, volatile security conditions in Nigeria and Libya, Trump’s push to tear-up the nuclear deal with Iran and Venezuela’s oil industry descending into freefall there is every risk of a significant supply outage being triggered by geopolitical risks. It is likely that with Venezuela’s production deteriorating at a greater clip than has been priced in by markets, this along with Trump pushing to reinstate sanctions against Iran could wipe more than 500,000 barrels daily off global supplies.

That could certainly push Brent to the $80 per barrel mark or higher, which appears to be Saudi Arabia’s desired price.

However, it is questionable whether those unexpected supply constraints working with rising demand growth would be enough to push oil to $100, primarily because the rapid growth in U.S. oil output could meet some of that demand.

What is becoming clear is that a range of supply-side factors including geopolitical threats along with stronger than anticipated economic growth driving greater demand for oil, means that the higher oil narrative has some way to playout. That combined with Saudi Arabia flagging that it intends to continue cooperating with Russia on production caps will prevent global oil markets from tipping into oversupply as some analysts’ claim will occur in late 2018.

By Mathew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Venezuelan Oil Enters The Disaster Zone

- Oil Prices Rise On Crude, Gasoline Inventory Draw

- Is Saudi Arabia Losing Its Asian Oil Market Share?

Despite the EIA’s claim that US oil production has hit 10.50 million barrels a day (mbd) this year, the rise of 1.2 mbd in production above the 2017 average of 9.3 mbd is still 600,000 barrels a day (b/d) lower than the OPEC/non-OPEC production cut of 1.8 mbd.

Furthermore, if US shale could offset soaring global oil demand, then why was President Trump attacking OPEC about rising oil prices. He could have left US shale oil do the trick by offsetting the OPEC/non-OPEC production cut and force prices down. His attack confirmed at the highest level that US oil production rises are mostly hype.

While the author like many analysts attributes the surge in oil prices directly to geopolitical risks such as rising tension in the Middle East, the probability of re-introduction of US sanctions against Iran, declining oil production in Venezuela and also declining Libyan oil production, all these concerns have already been factored in by the global oil market. At best, they could add $2-3 to a barrel of oil.

Oil prices are heading to $75 if not higher this year without help from geopolitical concerns because they are underpinned by a robust global economy projected by the IMF to grow at 3.9% this year and next year compared to 3.5% in 2017, fast-growing global demand for oil projected to add 1.7-2.0 mbd in 2018 over 2017, a virtually re-balanced market and a determination by OPEC and Russia to continue with the production cut agreement well into the future. That is why I am projecting that oil prices will reach $80-$85 in 2019 and $100 or higher by 2020.

And contrary to claims by many analysts, a re-introduction of US sanctions against Iran will not cost Iranian oil exports a single barrel. So the impact on oil prices and the global oil supplies will virtually be nil. Two reasons for that: one is that Iran will be paid in petro-yuan since the majority of its exports go to China. Second, it will accept barter trade deals with India, Russia and other countries thus nullifying US sanctions on banking and also bypassing the petrodollar.

The pre-nuclear deal sanctions worked because of a combination of the European Union’s (EU) sanctions on insurance companies insuring Iran’s oil export cargoes and US sanctions on banking affecting Iran’s payment for its exports. The EU is not going to withdraw from the nuclear deal and impose sanctions on Iran and the petro-yuan will nullify US sanctions on banks dealing with Iran.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Fiat currencies are a threat to humans and we intend to get rid of ours the same as Russia and China. American citizens like cheap gasoline in an election year and if the price of oil is being manipulated by a major foreign supplier to suit their financing requirements at the expense of the American middle class, rest assured their bell is going to ring ding ding.

"NO WAY OUT" \

Soooo, if demand is truly surging, permian basin constriction is here now, gulf coast refiners' ongoing issues, saudis not opening up the taps, wars raging / new attacks on oil infrastructure imminent, we're looking at some new, elevated pricing. Maybe even a new, 'firm(er)' bottom.

Common sense, folks.

I struggle even to see too much room for a rational debate on this question by this point of time (speaking about short-term future, not about what happens in several years or decades).