Oil prices inched higher on Tuesday morning as OPEC-driven optimism returned to markets with the cartel announcing the date of its December meeting

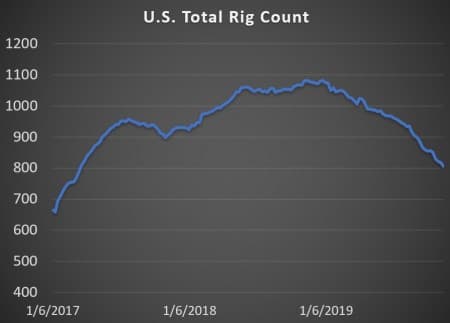

Chart of the Week

EIA increases U.S. crude oil production forecast for 2019 and 2020

- IEA chief Fatih Birol called upon OPEC to ‘make the right decision for the global economy’

- The International Energy Agency continues to see a lot of supply in the market as a result of slowing economic growth, especially in China.

- Birol says that his agency isn’t expecting to see continued explosive growth in U.S. shale, citing ‘financial difficulties’ of some major shale producers as the reason rather than depleting shale deposits.

- On a final note, Birol said that the U.S. will make up most of global oil supply growth, as both shale drillers and Gulf of Mexico deepwater output continue to grow.

Market Movers

- Brokerage Scotiabank upgraded Chesapeake (NYSE:CHK) to ‘sector outperform’ as its balance sheet relief looks set to come sooner than expected thanks to a combination of asset sales and consolidation of its Brazos Valley operations. Its stock was trading 2.53% higher on Tuesday morning.

- Norwegian Equinor (NYSE:EQNR) unveiled its 2020 exploration program on Tuesday, saying it plans to drill around 30-40 oil and gas exploration wells globally in 2020, with Brazil being a "hotspot" for its international efforts. The stock fell 2% on Tuesday morning.

- Teamsters Canada says it has reached a tentative agreement with Canadian National Railway Co. (NYSE:CNI), a deal that could end the strike that has caused billions in damage for the oil & gas and agricultural sectors. Expect WCS crude prices to rise when a firm agreement is presented.

November 26th 2019,

Oil edged back from two-month highs this week as ambiguous signals from the US-China trade talks continue to hinder global trade prospects. News of an OPEC+ production cut extension into the mid-2020s and a more stringent export control system for Nigeria and Iraq added some short-term bullish sentiment to oil markets, but both Brent and WTI have since fallen back into their respective comfort zones. Prices were up slightly on Tuesday morning as a little OPEC-driven optimism returned to markets.

President Trump Still Keen on Opening up Alaska. The US Bureau of Land Management has issued a draft environmental impact statement on opening up 30 percent of protected areas in the Alaskan National Petroleum Reserve (NPR). The Trump Administration seeks to rekindle North Slope oil field development as production rates went into decline. Previous lease sales in Alaska’s NPR were largely unsuccessful as companies were frightened off by prolonged environmental permits. If pushed through, this legislation would revise 2013 Obama-era protections for the nature reserve.

EU Promotes Carbon-Neutral Green Deal. As the European Parliament braces for a series of votes on new EU commissioners this Wednesday, the political pressure intensifies for EU members to embrace the New European Green Deal which seeks to make Europe the world’s first-ever “climate-neutral continent”. In addition to fulfilling its Paris Agreement commitments, Brussels wants to use Emission Trading income to fund the fossil-dependent countries’ transformation, simultaneously intending to issue a carbon border tax on imported goods. Interestingly, nuclear energy will be considered clean under the Green Deal.

European Wind Industry Needs More Space. Acting upon the European Commission’s Green Deal, Europe’s wind energy associations have asserted exclusion zones ought to be curbed in order to accommodate more wind farms. WindEurope CEO Giles Dickson told Reuters that Europe would need to reassess its maritime spatial planning approach and take on resolving the compatibility of wind energy with fishing and shipping lanes if it wants to speed up its current rate of 3 GWh annual capacity additions.

Plans To Expand The Houston Ship Channel. Port Houston is actively courting private investors in a 1 billion expansion of the Houston Ship Channel that could increase the waterway’s capacity by up to 50 percent. Wary of delays in Congress fund allocations, Port officials envision private investors, mostly major pipeline operators active in Texas, covering up to 65 percent of total costs. The expansion would see the Houston Ship Channel widened to 700ft and deepened to 45ft so as to allow for a higher export traffic rate for the ever-increasing volume of Permian Basin barrels.

India to Divest Refinery Stakes. The Indian government agreed to divest its controlling stakes in Bharat Petroleum and Hindustan Petroleum, as well as the national Shipping Corporation (SCI) and other energy assets. Middle Eastern majors Saudi Aramco and ADNOC are seen as top contenders yet even they are wary of overpaying as New Delhi seeks to meet its hefty $15 billion divestment plan for 2019-2020.

Russia to Stick with OPEC+ Deal. Russian President Vladimir Putin stated that Moscow will continue to work with OPEC in what he sees as their common task, stabilizing oil markets. Russian officials have recently started to raise the possibility of increasing the amount of gas condensate exports being exempted from the country’s production quota. Labelling the US shale growth’s environmental consequences “barbaric”, Putin has pledged to maintain Russia’s oil output without resorting to shale drilling.

Chevron Leading the Way in Upstream Cost-Cutting. Chevron (NYSE:CVX) CEO Michael Wirth stated the US major is preparing sweeping changes in streamlining upstream operations in order to boost profitability. Chevron is pushing ahead with plans to carve its global upstream group into individual units, to be effectuated in parallel to its divestment plans on mature conventional assets.

Swiss Authorities Search Vitol and Trafigura. The Swiss Public Prosecutor’s Office has searched the offices of top trading houses Vitol and Trafigura, acting upon the request from the Brazilian Lava Jato task force that investigates corruption schemes at Brazilian NOC Petrobras (NYSE:PBR). Most international trading houses remain barred from dealing with Petrobras. Brazilian authorities contend that the two Swiss-based companies were complicit in handing out millions of dollars in bribes to Petrobras employees in return for below-market prices on the Brazilian NOC’s black products.

Pirates Attack Exxon’s Zafiro Project. In the offshore waters of Equatorial Guinea pirates have attacked one of the ExxonMobil-led (NYSE:XOM) project’s support vessels, kidnapping 7 out of the 15 people crew. Production at the 70kbpd oil field has so far been stable. ExxonMobil was previously reported to reassess its petroleum operations in Equatorial Guinea, with a full exit remaining a real possibility.

China Gasoline Exports Hit All-Time High. Buttressed by this year’s downstream capacity additions of two 0.4mbpd oil-to-chemicals refineries in Hengli and Zhejiang, China’s gasoline exports have reached a record level of 1.73 million tons in October 2019. Year-on-year gasoline exports are up 16.7 percent.

Icahn Seeks Oxy Board Takeover. Activist investor is reported to nominate a slate of 10 directors to Occidental Petroleum’s board of directors in an attempt to intercept the Oxy-Anadarko merger, Bloomberg reports. Occidental Petroleum (NYSE:OXY) has been one of the worst S&P 500 performers this year, with its stock dropping almost 40% since the first news on the merger sprang up. OXY shares rose more than 2 percent over the weekend, while still cognizant of Icahn’s unsuccessful previous attempts to revamp the directors’ lineup.

Qatar Hyping Up LNG Expansion Scope. Qatar Petroleum claims it intends to raise its LNG production capacity by 50mtpa by 2027 from its current level of 77mtpa. Qatar has started work on two new 8mtpa LNG “megatrains”, confident its low production costs would allow it to withstand prolonged LNG market saturation.

Australian Crude Trading at Astronomic Highs. Australia’s heavy sweet crude Pyrenees (19° API, 0.2 percent Sulphur) continues to make history, having been traded at an unseen $17 per barrel premium against Dated Brent last week. Asian demand for crudes that yield substantial volumes of low sulphur fuel oil that might be used for IMO 2020-compliant bunker fuel blending has been pushing Pyrenees prices up for several consecutive months already.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- Reuters Confirms That Iran Was Behind The Saudi Oil Attacks

- IEA Warns Of A Looming Oil Glut Ahead Of OPEC Meeting

- Global LNG Markets Are Circling The Drain