U.S. tariffs are set to take effect on China on Friday, with China promising immediate retaliation, kicking off the next phase of the trade war. But it remains to be seen if the trade war will derail a particularly bullish looking oil rally.

U.S. tariffs on $34 billion worth of imported Chinese machinery, auto parts and medical devices begins on July 6, and China’s tariffs on U.S. soybeans and SUVs will begin as well. With little sign of de-escalation, the trade war could barrel forward with more tariffs coming down the pike. The timing is not great, as global trade in general is showing signs of slowing down. Economists are proclaiming the end to “global synchronized growth,” which helped bolster strong economic performances around the world in 2017.

The cooling of global trade has contributed to an emerging market selloff, with steep declines in bonds, equities and currencies in much of the developing world.

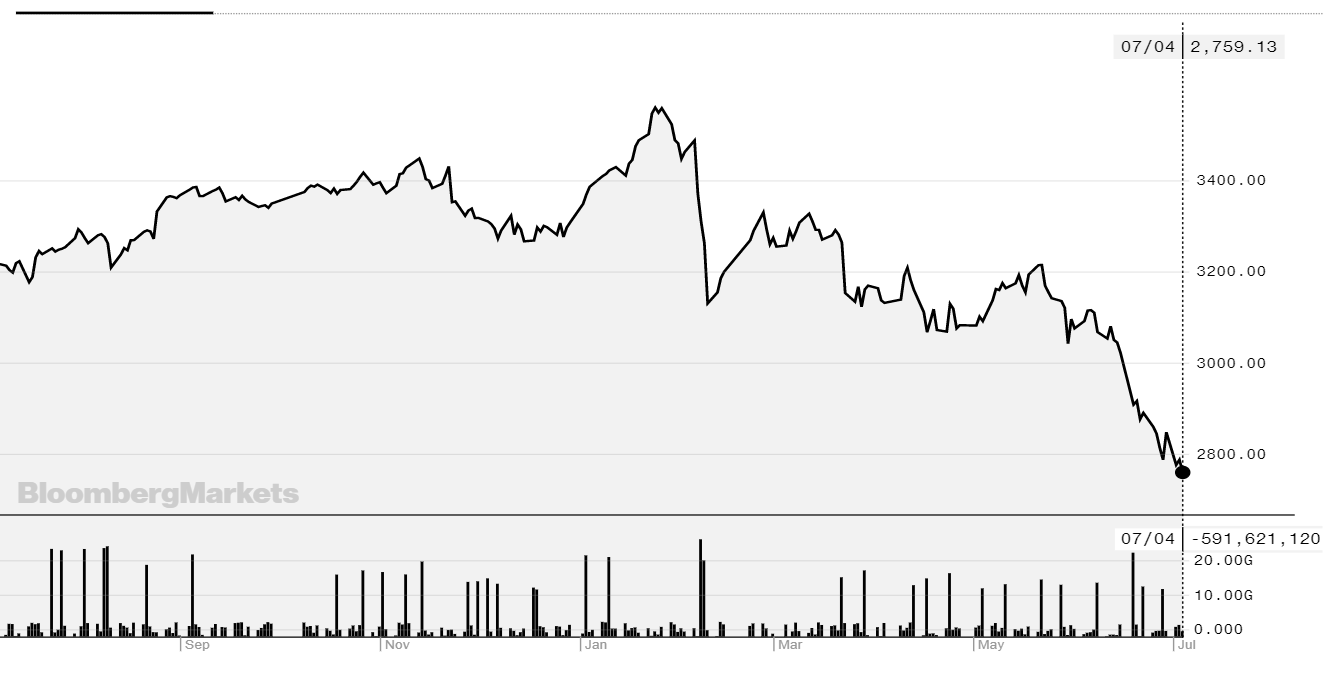

China is not immune to these trade and economic headwinds. The Shanghai Composite Index, China’s main stock index, entered bear market territory recently, and Beijing is trying to curb panic selling. China’s currency has also come under intense pressure.

(Click to enlarge)

Shanghai Composite Index

The trade war and the global economic slowdown, should it accelerate, could start to drag down oil demand. China has also proposed tariffs on U.S. crude oil, which could curtail purchases of oil from U.S. shale fields (although that oil would likely be rerouted elsewhere).

Nevertheless, it isn’t at all clear that these economic headwinds will upset the oil price rally, which is climbing inexorably towards $80 per barrel, perhaps higher. The supply outages, which are growing in both size and in number, might overshadow any dip in demand. Related: The New Oil Cartel Threatening OPEC

Goldman Sachs has maintained a bullish outlook on commodities for much of this year, and it downplayed the threat to its forecast this week. “Although commodities maintain their status as the best performing asset class in 2018, the month of June was a substantial setback driven by [emerging market] demand weakness, trade war concerns and the exit of OPEC+ from supply cuts,” Goldman Sachs wrote in a July 4 note.

But the investment bank was unbowed. “We believe all of these concerns have been oversold.”

Goldman reiterated its forecast for a 10 percent gain in commodities over the next 12 months. The outlook comes down to several factors, including strong GDP growth, outages in “key oil and metal markets which are exacerbated by recent sanctions,” and falling inventories.

Moreover, Goldman dismissed some threats to this outlook. The recent weakness in Europe and Japan has mostly stabilized. The slowdown in China is being countered by the central bank, which has cut interest rates. Turmoil in other emerging markets such as Argentina, Brazil and Turkey “remain small isolated events from a commodity perspective.” Also, various asset classes have been beaten down, which presents a buying opportunity.

Goldman Sachs argues that the combination of higher interest rates, rising commodity prices and a stronger dollar is “unsustainable.” These forces, which don’t normally go together, will put too much pressure on emerging markets if they keep up. They make debt too painful, commodities such as fuel become too expensive in local currencies, and they end up sparking unrest, such as the recent trucker’s strike in Brazil. Related: U.S. Sour Oil Sellers Panic, Cut Prices To Asia

That means that while commodity prices could, in theory, collapse, Goldman thinks it will be one of the other two factors. “The bottom line is that something has to give, and we agree with our FX strategists that the dollar will likely weaken from here.”

The bank also dismissed Chinese tariffs on U.S. crude, arguing that markets will quickly adapt. China will end up buying more oil from Russia, the Middle East, West Africa and the North Sea. U.S. exporters will initially have to discount their crude in order to attract other buyers, but “this period would likely be short lived,” Goldman said.

In short, the investment bank does not believe that the trade war will end the upswing in commodities. “We believe that the trade war impact on commodity markets will be very small, with exception of soybeans where complete rerouting of supplies is not possible.”

In other words, there is plenty of room to run for oil prices.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Confirmed: ISIS Sold Oil To Assad & Turkey

- Mexico’s Oil Crescent Faces A Perfect Storm

- The Biggest Risk For Natural Gas Markets

Even enemies of NATO should be concerned by such a move from the US. Certainly those in the average population. I have to wonder why anyone, whether that is Russia, China, the US or whoever else, can think that we can afford another global conflict. It is beyond comprehension.

My suggestions to all parties is to get a grip and instead of trying to derail global stability and development, turn the tide and make the UN what it should have been from the start, a combined effort to prevent further global catastrophes in the wake of not 1 but 2 world wars. Strengthen the worldwide decision processes there and try to find a middle ground for all involved.