President Trump spent part of his July 4 holiday shouting at OPEC on twitter, demanding lower gasoline prices.

The OPEC Monopoly must remember that gas prices are up & they are doing little to help. If anything, they are driving prices higher as the United States defends many of their members for very little $’s. This must be a two way street. REDUCE PRICING NOW!

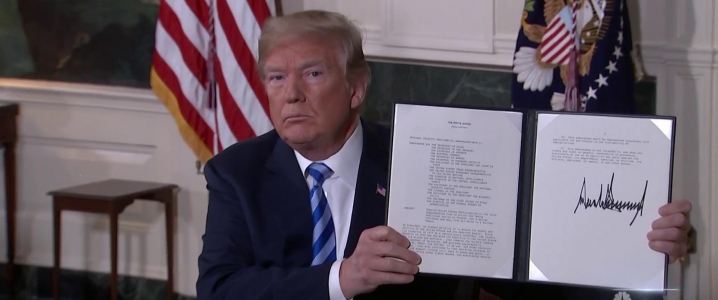

— Donald J. Trump (@realDonaldTrump) July 4, 2018

The tweets are coming more frequently these days, an indication of the political peril that Trump feels because of rising gasoline prices. The logic is odd though. Trump wants lower oil prices while at the same time his administration is trying to zero out 2.5 million barrels per day of Iranian oil exports.

“It does not occur to the U.S. president that it is Trump himself who is driving prices up through his Iran policy,” Commerzbank wrote in a note. If the U.S. succeeds in blocking Iran from exporting its oil, OPEC would struggle to offset the missing barrels. “Perhaps one of the U.S. president’s advisors should explain this to him,” Commerzbank added.

Trump’s advisers are clearly failing at their task, but Iranian officials tried to lend a helping hand by explaining the situation. “You impose sanctions on major producers, founders of OPEC, and yet you are asking them to reduce the prices?! Since when did you start ordering OPEC!” Iran’s OPEC governor Hossein Kazempour Ardebili said in a statement. “Your tweets have driven the prices up by at least $10/b. Pls stop it, otherwise it will go even higher!” Related: The New Oil Cartel Threatening OPEC

Meanwhile, the U.S. Congress has revived legislation that would remove the immunity that sovereign nations have from being sued from antitrust violations. The so-called “NOPEC Act” would make OPEC subject to antitrust law, allowing the U.S. to go after OPEC for manipulating the oil market. The legislation has floated around Washington for years, typically going nowhere because past presidents have consistently opposed the measure.

The legislation still probably won’t go anywhere, but OPEC could be forgiven for being confused by the mixed signals coming from Washington, which can essentially be boiled down to: “Stop your anti-competitive behavior” but “intervene in the markets to manipulate prices to our benefit,” and “nobody is allowed to buy oil from Iran” and “why are oil prices so high?! Do something about it!”

Leaving aside the inherently contradictory objectives from Washington, it isn’t clear that OPEC could stop the oil price rally even if it wanted to. The group is starting to lose control of the oil market now that the supply outages are piling up.

President Trump wants Saudi Arabia to add 2 million barrels per day (mb/d) of fresh supply, but the Kingdom would struggle to ramp up by that much. Saudi Arabia’s all-time record high output level stands at about 10.7 mb/d. Using its entire spare capacity would mean producing at around 12.5 mb/d, but most analysts believe that would take more than a year to achieve, and some analysts question whether it’s even possible at all. Related: Do Crude Producers Really Want Higher Oil Prices?

Producing at that level would require more drilling and expanding existing fields – it isn’t as simple as just opening the taps.

Moreover, in the past few years, OPEC’s spare capacity has dwindled both in absolute terms and as a share of the oil market, reducing its influence. Excluding new members Gabon and Equatorial Guinea, OPEC’s effective spare capacity has declined by 800,000 bpd over the past five years even as global demand has climbed by 10 mb/d, according to Energy Intelligence.

That leaves very little firepower to call upon. The potential outage in Iran alone could swamp the group’s spare capacity. The U.S. is hoping to take 2.5 mb/d of Iranian exports offline, which is about as much as the theoretical spare capacity that Saudi Arabia has left. “The spare capacities in OPEC countries are just sufficient to offset this amount, but will not be enough if supply is additionally reduced by outages elsewhere – such as in Libya and Canada at present – and by falling oil production in Venezuela. Prices will rise as a result,” Commerzbank concluded.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Permian Bottlenecks Come At The Worst Moment

- Oil Prices Slide On Small Crude Build

- U.S. Sour Oil Sellers Panic, Cut Prices To Asia

These are the signs of a president presiding over an indispensable superpower whose indispensability is eroding fast.

His motivation for calling for lower oil prices emanates from his fear that the Republicans could lose the coming midterm elections of the US Senate and the US House of Representatives in November if high oil prices offset the benefits from his tax cuts.

Moreover, calling on the world to refrain from buying Iranian oil is contradictory to his asking OPEC to raise its production and reduce prices. President Trump is well advised to take a crash course in the economics of oil to learn about the machinations of the global oil market. If he is ill-advised by his advisors, then he should replace them with ones who do truly understand the workings of the global oil market.

President Trump should be aware that OPEC members (other than Saudi Arabia kowtowing to the US) have no motive whatsoever, to reduce prices. Their aim is and should be to maximize the return on their finite assets to the highest level the global economy could tolerate.

He also should be made aware of a few myths in the global oil market. The first one which is known to the CIA and the American companies who established Saudi Aramco and discovered all the oil it has, is that Saudi Arabia lives a huge lie vis-à-vis its claims about its proven oil reserves, oil production capacity and spare capacity. Contrary to claims that it has proven reserves of 266.2 billion barrels (bb), its remaining proven reserves range between 53-70 bb according to many experts including my own research. The Saudi claim that they can produce at least 12.5 mbd if needed doesn’t stand scrutiny. Saudi Arabia’s oil production peaked at 9.64 mbd in 2005 and has been in decline since. Moreover, its claim that it has a spare production capacity of 2 mbd is highly questionable.

Another myth fact is that US sanctions will lead to the loss of 1 million barrels from Iran’s oil exports. Nothing is further from the truth. Iran will not lose a single barrel of oil as a result of US sanctions. Iran’s trump card is the petro-yuan which has virtually nullified the effectiveness of US sanctions. Major customers like the EU, China, India, Turkey, Russia and Japan are still committed to continue importing Iranian crude. If the EU countries succumb to US pressure, then China and the petro-yuan will come to the aid of Iran. Given the current tense political and trade relations between the US and China, the Chinese will be more than happy to oblige. Moreover, Iran now may rely on a fleet of Chinese supertankers, properly insured, to export its own oil.

The fact that US Congress has revived the so-called “NOPEC Act” which would make OPEC subject to antitrust law is churlish and of no relevance to OPEC as OPEC members’ exports to the US have dwindled very significantly of recent years with more than 70%-80% of OPEC’s oil exports going to the Asia-Pacific region.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Free markets? Democratic President? America is better?