Breaking News:

Net-Zero Ambitions Hit Major Roadblocks in Europe, UK, and US

Net-Zero transition targets touted so…

South Korea Could Lead the Way in a Successful Nuclear Renaissance

Despite all the recent hype…

Rio Tinto Dumps $4B In Coal Assets

Just as a new government in Australia looks set to breathe fresh life into the coal industry, mining giant Rio Tinto has finalized its exit agreement from the controversial natural resource, securing the last of $4 billion in deals in a week.

On Wednesday, Rio Tinto—the world’s second-largest miner—sold its 80-percent stake in the Kestrel coal mine in Queensland, Australia, for $2.25 billion, closing the last in a string of coal-exiting deals totaling $4 billion.

This last coal mine on Rio’s dump list will go to private equity manager EMR Capital and Indonesian coal company Adaro Energy.

It’s the third asset sale deal Rio has struck in a week.

Last week, Rio announced the sale of its Hail Creek mine and resources to Glencore Plc for $1.7 billion, and right before that, it announced the sale of its Winchester South coal development to Whitehaven Coal for $200 million.

The past week’s sale agreements are part of a coal exit strategy that also saw Rio sell its Hunter Valley mine in New South Wales to China-backed Yancoal last year for $2.69-billion.

All told, since 2014, Rio has sold more than $8 billion in coal assets, according to Bloomberg.

Rio Tinto is now officially the only mining giant in the world that doesn’t have coal. It also makes it one of the few that are no longer bullish on coal, despite the widespread sentiment that our future is much cleaner.

The new Rio Tinto will focus on iron ore, aluminum, copper and bauxite, and hopes to be more attractive to investors who are shying away from the dirty resource, prompting some analysts to call the company “leaner and greener”.

Related: The End Of The Status Quo In LNG Markets

But the sentiment for coal may be set to improve in Australia, for one, as the industry eyes a hoped-for comeback based on political change following elections 20 days ago. The previous government heavily supported renewables, but the change in regime might be friendlier to the country’s abundant coal resources.

The value of coal exports in 2017 was at AUS$56.5 billion (US$44.21 billion) which is 35% higher than 2016 and the highest level in the country’s history.

It was also the second largest export last year, behind iron ore, which reached AUS$63.3 billion.

Most of the coal was exported to Asia, and Southeast Asia is a significant new market for Australian coal due to its recent investments in high efficiency, low emission coal-fired power plants. Exports to this market were worth about AUS$2 billion in 2017.

Globally, some say that coal seems to be in the midst of a revival of sorts, which puts Rio’s exit in a rather contrarian position.

According to the Bloomberg, prices at Australia’s largest export harbor for thermal coal used in power generation, have kept above $90/metric ton for the most part for eight months running—a level it hasn’t seen since 2012.

While it’s gunning for “leaner and greener”, other major miners remain bullish on the resource, and some analysts believe China and India will “continue to rely on coal for years to come”, Reuters reports.

Mining M&A activity totaled US$96.8 billion during 2017, a 10 percent increase over the value of deals the previous year, according to Thomson Reuters Deal Intelligence. More than US$92 billion of the 2017 total was spent on coal, iron ore and steel deals.

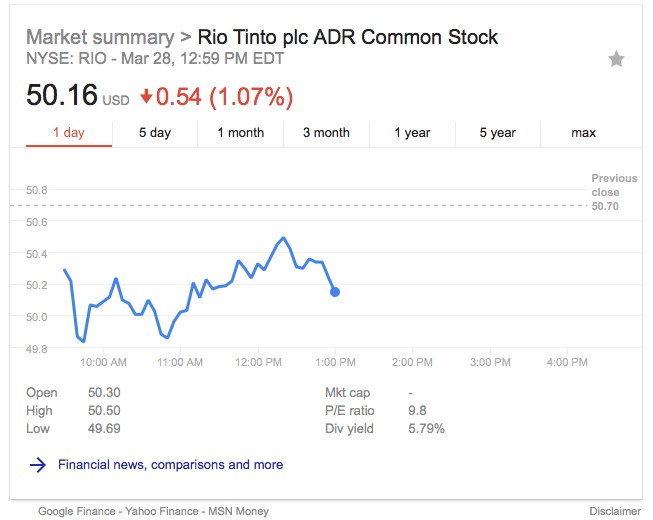

Rio Tinto stock was trading down 1.07 percent mid-day Wednesday:

(Click to enlarge)

By Fred Dunkley for Safehaven.com

More Top Reads From Oilprice.com:

- Barclays: Expect $51 Oil This Year

- Oil Prices Fall As EIA Confirms Inventory Build

- Why Natural Gas Prices Will Rise This Summer

Safehaven.com

Safehaven.com is one of the most established finance and news sites in the world, providing insight into the most important sectors in the business and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B