Breaking News:

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

Coal Share of China's Power Output Drops to Record Low

China reached a momentous milestone…

Court Allows Tesla Shareholders To Proceed With SolarCity Lawsuit

A Delaware court on Wednesday allowed Tesla shareholders to move forward with a lawsuit claiming that Elon Musk and Tesla’s board used their influence and reputation to dupe shareholders into backing the US$2.6-billion acquisition of SolarCity, making a rough week for Tesla even worse.

The Delaware judge denied Musk’s legal team motion to dismiss, instead siding with the shareholders who have challenged the SolarCity deal after finding that they presented in their complaint “sufficient facts to support a reasonable inference that Musk exercised his influence as a controlling stockholder with respect to the Acquisition.”

The shareholders claim that Musk, as Tesla’s controlling stockholder, used “his control over the corporate machinery to, among other things, orchestrate Board approval of the Acquisition,” and that the acquisition “bail[ed] out” SolarCity thereby “spread[ing] across all of Tesla’s stockholders the loss that would otherwise be experienced only by” five individuals.

Tesla said that it does “not agree with the decision and will be taking appropriate next steps.”

“It’s important to emphasize that this was a motion to dismiss in which the court was required to assume as true all of the allegations that are made in the complaint,” CNN quoted a Tesla statement as saying. “We of course contend the allegations in the complaint are false,” Tesla said.

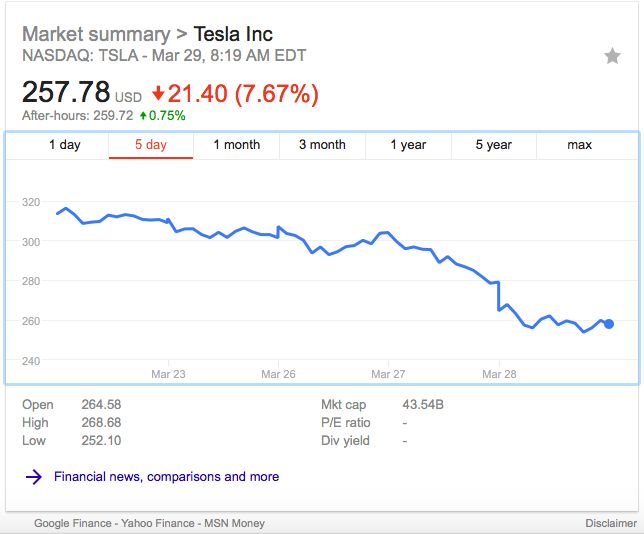

The court decision piles onto Tesla’s other woes this week, which had already battered the stock.

Earlier this week, Moody’s downgraded Tesla’s corporate family rating to B3 from B2 and cut its outlook on the company to Negative from Neutral in a blow made more severe by the launch of an investigation into a fatal Tesla crash.

Tesla’s stock is on track to post its worst monthly market performance ever, with shares down 24.86 percent month-to-date as of market closure on March 28.

Morgan Stanley warned on Wednesday that the stock is set for more volatility, but noted that “we are looking at one of the buying opportunities that many investors have been waiting for.”

“We see Tesla as modestly undervalued with very high risk,” Morgan Stanley analyst Adam Jonas wrote in a note to clients.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Petroleum Imports Could Fall To Zero In 2020

- Oil Prices Fall As EIA Confirms Inventory Build

- $9.5B Deal Creates Biggest Player In The Permian

Tsvetana Paraskova

Tsvetana is a writer for Oilprice.com with over a decade of experience writing for news outlets such as iNVEZZ and SeeNews.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B