Breaking News:

Unaffordable Prices and Elevated Interest Rates Impact New Car Demand

Amid rising inventories and lackluster…

The West Aims to Rebuild Influence in Middle East Energy Hub with LNG Deals

The last few days have…

Larger Than Expected Crude Draw Fuels Oil Price Rally

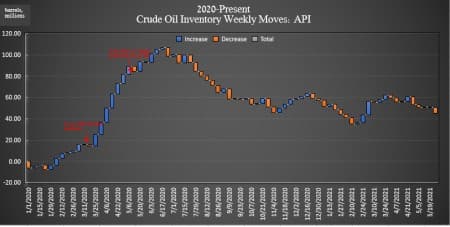

The American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 5.36-million barrels for the week ending May 28.

Analysts had predicted a draw of 2.114 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 439,000 barrels after analysts had predicted a draw of 1.050 million barrels. Since the start of 2020, crude oil inventories have grown by more than 46 million barrels, according to API data.

Oil prices were trading up on Wednesday afternoon, on bullish signals from OPEC that saw the group stick to its output plans for the coming month. The bullish OPEC news, combined with a lack of new developments regarding the Iran/U.S. nuclear deal, saw prices climb by more than 1% by noon. At 12:32 p.m. EST, WTI was trading up $0.89 (+1.31%) at $68.61 prior to the data release—up $2.50 per barrel at that time. Brent crude was trading up $0.87 per barrel (+1.24%) at $71.12 per barrel.

While crude oil inventories fell again this week, U.S. oil production continued at an average of 11 million bpd for the week ending May 21, according to the latest data from the Energy Information Administration.

The API reported a build in gasoline inventories of 2.51 million barrels for the week ending May 28—compared to the previous week's 1.986-million-barrel draw. Analysts had expected a 1.385-million-barrel draw for the week.

Distillate stocks saw an increase in inventories this week of 1.585 million barrels for the week, after last week's 5.137-million-barrel decrease.

Cushing inventories rose this week by 741,000 barrels.

Post data release, at 4:42 p.m. EDT, the WTI benchmark was trading at $6872 while Brent crude was trading at $71.26 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Rises After ‘Cataclysmic’ Boardroom Showdown

- Moody’s: Credit Risk Is Growing For Big Oil

- Activist Investor Wins Exxon Board Seats In Day Of Reckoning For Big Oil

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B