Breaking News:

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Net-Zero Targets Could Double Yearly Copper Demand by 2035

Copper shortage fears return as…

Oil Rises On Bullish API Inventory Report

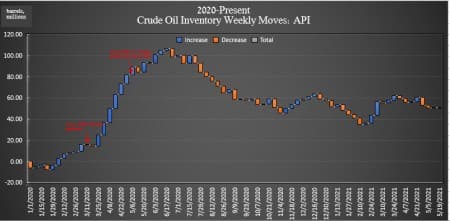

The American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 439,000 barrels for the week ending May 21.

Analysts had predicted a draw of 1.050 million barrels for the week.

In the previous week, the API reported a modest build in oil inventories of 620,000 barrels after analysts had predicted a larger build of 1.680 million barrels. Since the start of 2020, crude oil inventories have grown by more than 50 million barrels, according to API data.

Oil prices started off the day trading slightly down but returned to the previous day’s levels by 10:30 EST as both bearish and bullish signals were keeping prices from moving too much. At that time, WTI was trading up $0.10 (+0.15%) at $66.15 were trading down on the day prior to the data release. Brent crude was trading up $0.09 per barrel (+0.13%) at $68.55 per barrel. WTI is up about $1 week over week, with Brent up just $0.15 on the week.

While crude oil inventories fell again this week, U.S. oil production came in again for the second week in a row at 11 million bpd on average for the week ending May 14, according to the latest data from the Energy Information Administration.

The API reported a draw in gasoline inventories of 1.986 million barrels for the week ending May 21—compared to the previous week's 2.837-million-barrel draw. Analysts had expected a 775,000 barrel draw for the week.

Distillate stocks saw a decrease in inventories this week of 5.137 million barrels for the week, after last week's 2.581-million-barrel decrease.

Cushing inventories fell this week by 1.153 million barrels.

Post data release, at 4:34 p.m. EDT, the WTI benchmark was trading at $65.83 while Brent crude was trading at $68.44 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Shale Is Finally Giving Shareholders A Payday

- The $87 Billion Chinese Car Maker That Hasn’t Sold A Single Car

- Oil Prices Fall As Iran Claims Sanctions Will Be Lifted

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B