Breaking News:

Inside the High-Stakes Battle for Nuclear Fusion Supremacy

China is rapidly closing the…

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

China May Ramp Up Gasoline Exports In H2 2019

China may ramp up gasoline exports in the second half of 2019 amid a glut of the fuel in its domestic market and higher export quotas, JLC analysts said.

China’s gasoline exports are expected to have risen in July. Gasoline export margins in the month averaged higher at CNY73/mt from minus CNY328/mt in June, according to JLC monitoring data. A domestic supply glut prompted some state-owned refiners to sell more gasoline abroad.

China set its third batch of export quotas for ordinary-trade refined oil products for 2019 at 6 million mt, according to market sources. The new batch raised the total export quota to 56 million mt in 2019, which was more than the annual quota in 2018.

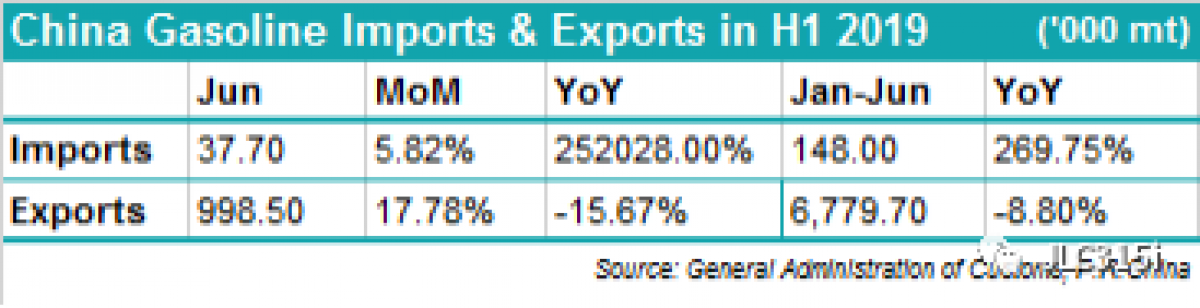

The country exported 998,500 mt of gasoline in June, up 17.78% month on month and down 15.67% year on year. The total exports in the first half of 2019 dropped by 8.8% from a year earlier to 6.7797 million mt, according to data from the General Administration of Customs (GAC).

The month-on-month increase in June exports was attributable to a looming domestic supply glut and better export margins, despite a spike in refinery maintenance. But the total exports in January-June dropped due to low exports in the first five months.

Singapore was the largest buyer of gasoline cargoes from China in June, importing 598,800 mt, up 13.97% from May. The United Arab Emirates came in second, receiving 105,000 mt. Indonesia rose to the third place as its imports from China more than doubled to 89,900 mt.

China’s June gasoline imports rose to 37,718 mt from 35,650 mt in May and 14.96 mt a year earlier. The total imports in the first half of 2019 more than tripled from the same period of last year to 148,000 mt, GAC data shows.

By JLC International

More Top Reads From Oilprice.com:

- The Revival Of A $53 Billion Megaproject

- Germany’s Big Bet On Hydrogen

- Trump Pushes Venezuela To The Brink

JLC

JLC with headquarters located in Beijing, and branch offices in Shanghai, Shandong, Guangzhou and Singapore, is a leading provider of market intelligence and pricing solutions…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B