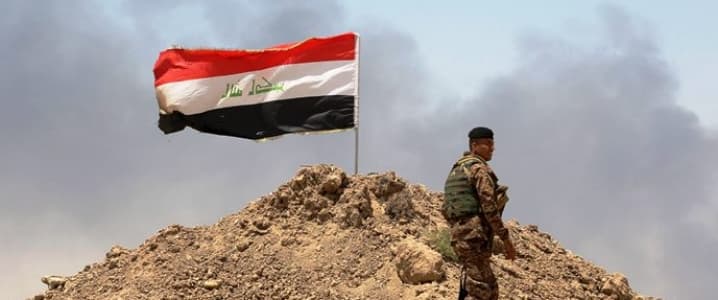

The standoff between the Iraqi government and Kurdistan over the past month helped push up oil prices, due to the idling of a sizable portion of the country’s crude oil exports. But Iraq probably won’t be the spark that starts a new bull run for crude oil.

The seizure of the Kirkuk oil fields a few weeks ago, coming on the heels of the Kurdish referendum for independence, led to a temporary sidelining of some 400,000 bpd. The oil fields near Kirkuk—the Bai Hassan and Avana fields—are still reportedly not exporting crude, but that could soon change.

In a humiliating climbdown, the Kurdistan Regional Government (KRG) has proposed a ceasefire with Baghdad, offering to freeze the results of the independence referendum. It’s largely an admission of defeat for the semi-autonomous region in Iraq—a recognition that the drive for independence has backfired.

Kurdistan has become internationally isolated and has antagonized not just Baghdad, but also its neighbors in Turkey and Iran. Worse, without the Kirkuk oil fields, Kurdistan would never have the revenue base upon which it could build an independent nation. With few friends, and the loss of the oil fields, the KRG has few cards left to play.

That led it to seek an accord with Baghdad. And that means that Iraq probably won’t be the bullish catalyst for the oil market, because the outage in the northern part of the country will almost certainly be temporary. Already, there are reports that exports from Kirkuk and Kurdistan have increased to 300,000 bpd, up from 200,000 bpd a few days ago.

Related: Kurdistan Proposes Immediate Ceasefire With Iraq

Those volumes could rise substantially in the near future. Bloomberg reports that Iraq’s North Oil Company, under the control of the central government, is cooperating with the Kurdish Kar Group to resume production and export at the two oil fields, Bai Hassan and Avana. The two fields combined represent 275,000 bpd of production. Kar Group also operates the pipeline that runs from Kurdistan to Turkey, a conduit that was constructed a few years ago to bypass the pipeline owned by Baghdad.

The fact that the Iraqi and Kurdish companies are working together suggests that full production could soon be restored.

As such, the bullish effect on the market from Iraq could be fleeting. The case for higher oil prices was predicated on Baghdad and Erbil heading for a lengthy and potentially violent standoff. With the pipeline controlled by the Iraqi government still unrepaired after suffering damage from ISIS years ago, oil flows will need to continue to run through the Kurdish pipeline. That means that some sort of cooperation from the KRG is necessary. If the KRG is essentially laying down arms, there is a much smaller chance of an outage at the country’s oil fields.

Moreover, the outages in Iraq’s north were always going to be capped at 600,000 bpd, even in the worst-case scenario. That represents the volume that is sent through the pipeline to Turkey for export. On the other hand, the vast majority of the country’s output comes from the massive oil fields in the south near Basra, where international firms—BP, ExxonMobil, CNPC, Lukoil, to name a few—help produce more than 3 million barrels per day. The Basra fields are far from the conflict zone in the north.

Iraq made some moves in recent days to step up crude shipments through the Persian Gulf in order to offset the outage in Kirkuk. Iraq opened up a new loading point on its southern coast, a move that the country’s oil minister said would allow for an additional 200,000 bpd of exports. “The government started the [new loading point] earlier than planned because they want to raise exports from Basrah to compensate for the losses at Kirkuk,” Jaafar Altaie, managing director at Abu Dhabi consulting firm Manaar Group, told Bloomberg.

Related: Which Of These 3 Hotspots Will Be The Next Big Thing In Oil?

Meanwhile, across the border in Syria, U.S.-backed forces reclaimed control of Syria’s largest oil field from ISIS militants, who held the field since 2014. It’s a pittance in the context of the global market, but the 30,000 bpd will no longer be under control of ISIS. The recent ouster of ISIS from its de facto capital in Raqqa also bodes well for improving security in the region.

The pending ceasefire that could emerge between Kurdistan and Baghdad offers some hope that violence could be averted. However, the conflict is too complex to hope that it will be resolved anytime soon. The Center for Strategic and International Studies proposed a revenue sharing agreement that would consist of making Kirkuk and its surrounding oil fields a “neutral zone,” along with an agreement to jointly manage the oil fields.

This sort of approach is far from assured, and would likely take time to implement. Conflict could still reignite at any time. But for now, the ceasefire offered by the KRG is a strong indicator that the recent outages in northern Iraq have likely peaked.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Tesla Looks To Dominate China’s EV Market

- Are Petrocurrencies Heading For Extinction?

- Two Undeniable Shifts In Today’s Energy Markets

I personally would be concerned, there's a lot of guns and bad blood in the region. To say things are fine in Northern Iraq is like saying Kim Jong Un has been nominated for the Nobel peace prize.