“Feel” is a concept that, in analysis at least, doesn’t get the respect it deserves. We are all supposed to have only logical, analytical reasons for believing something is about to happen, but if the last few weeks has told us anything it is that when markets get the bit between their teeth, logic is the first casualty. U.S. stocks dropped over ten percent from their highs on fears that the Fed may make a miscalculation and that growth may be a bit slower than previously anticipated. For comparison, by the time the same thing had happened in 2008, it was clear that the financial system was in trouble and we were heading to an actual recession. Oil has fared even worse, dropping over twenty percent on the same growth fears, price driven supply increase in the U.S., and exceptions to the Iran sanctions. In both cases, the move has gone way beyond logic, so I make no apologies for saying that this morning, it feels like things are finally changing.

(Click to enlarge)

Figure 2: WTI Futures since 08/01/2018

(Click to enlarge)

(Click to enlarge)

Figure 1: S&P 5 Day Chart

(Click to enlarge)

Figure 2: WTI Futures since 08/01/2018

(Click to enlarge)

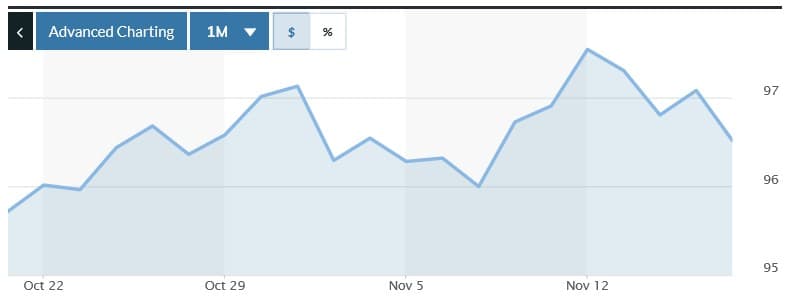

Figure 3: Dollar Index 3 Month Chart

The stock market (figure 1) has reversed recent trends in price action, dropping early and recovering strongly as the day progresses rather than giving up early gains collapsing during market hours. The dollar (figure 3), after flying high in its role as a safe-haven, is losing ground, and even WTI (figure 2), where supply is still high, looks like posting three successive higher closes, often a signal that a reversal is real. Of course, there have been a few false signals on the way down and this could be another, but the fact that everything is shifting together makes this feel different, so it is time to look for something that would benefit from all three of those moves.

The answer lies in an overseas energy stock, where gains in stocks and oil, and a drop in the dollar, all help. That brings in Total S.A., and the French multinational has the advantage of being close enough to 52-week lows to make that a logical level off which to set a stop-loss order. At the time of writing, TOT is trading just above $57, so a stop ten percent away would be at around $52, a level not seen for over a year, when WTI was below $50.

(Click to enlarge)

Total has been punished even harder than most energy stocks in recent weeks, in part because it has been hurt by the trends in all three markets, but also because it made significant investments in Iran last year. If one of the drivers in lower oil is the exceptions made to the Iran sanctions though, that will have a lot less effect than was previously thought. All in all, everything that has driven the stock lower to this point looks to be changing.

As I said, this is a trade based on the feeling that stocks, oil and the dollar are going to start paying attention to fundamentals and are pivoting simultaneously. There are good reasons why all three should do so, but that has not mattered up to this point. That is where feel comes in. If that bothers you, feel free not to get involved, but if I feel it and you do too, the likelihood is that there are plenty of others feeling the same thing. If enough people act on that feeling, the small bounce we are seeing now will gather momentum and stocks like TOT will be the big beneficiaries so, given the limited downside, it feels like a good trade.

By Martin Tillier for Oilprice.com