President Biden’s $2.25 trillion infrastructure bill proposed last week has placed conventional infrastructure stocks into the spotlight again.

Out of that massive amount of proposed funding, the largest part of the plan, with a budget of $650 billion, focuses on American homes, school buildings, and underground water infrastructure.

The plan would also make a massive investment of $621 billion in the country's roadways, railways, and bridges.

The plan doesn’t just aim at a massive overhaul of the country’s infrastructure; it also aims to create nearly 19 million jobs.

In order to fund the plan, President Biden plans to raise the corporate tax rate from 21% to 28%. That would pretty much unwind the lower corporate rate at 10.5% placed by the previous Trump administration.

The plan, the centerpiece of Biden’s agenda to rebuild the economy, will now need to pass Congress, with Republicans lining up against what they call a “Trojan Horse” for social welfare spending and excessive tax increases.

President Biden said he will meet with the Republicans to negotiate the plan in the coming weeks but warned that inaction is not an option.

“Debate is welcome. Compromise is inevitable. Changes are certain … We’ll be listening. We’ll be open to good ideas and good faith negotiations but here’s what we won’t be open to. We will not be open to doing nothing,” President Biden said.

But assuming this plan will go forward, here are some stocks that will benefit greatly--and they’re not shiny new tech stocks that have been stealing everyone’s attention. This is where we get by to the tried and true giants ...

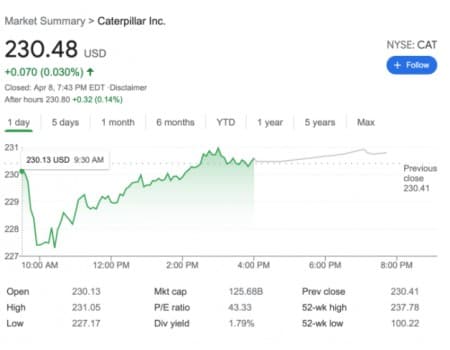

#1 Caterpillar (NYSE:CAT)

Caterpillar, the maker of construction and mining equipment, saw its stocks start to climb as soon as Biden was elected.

In the last couple of years, Caterpillar had traded in a range. Last March, the shares of the company found a bottom but have already climbed nearly 130% since then.

But what will speak to the masses of retail investors is this: CAT is a pretty consistent earnings topper and is poised to beat earnings estimates once again.

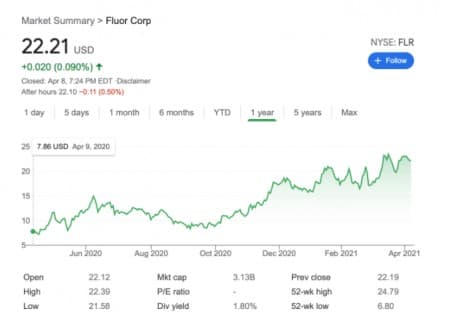

#2 Fluor Corp. (NYSE:FLR)

Fluor Corp, the top construction firm in the petroleum and industrial sector, had a good run in the last two quarters with its stock up 151% and analysis believes that the stock could rise up to 80% more this year amid the country’s industrial recovery.

The company also offers support services to several US federal agencies, including the Department of Energy, the National Nuclear Security Administration, and the Department of Homeland Security.

During the third quarter of last year, the company’s fell 17.6% year-over-year to $3.8 billion while the mentioned agencies segment was its only one to see an uptick in revenue.

Last year the company landed a government contract for the nationwide deactivation, decommission, and removal of selected nuclear facilities.

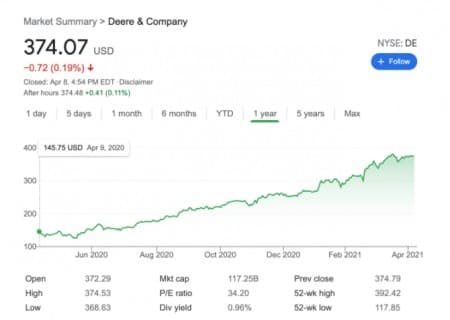

#3 Deere & Co. (NYSE:DE)

Besides lawn and agriculture equipment, the company manufactures construction equipment, as well.

In the first quarter of this year, Deere revenues and sales increased by 19% to $9.112 billion year-over-year but more significantly it has outperformed in the profit segment, with net income of $1.2 billion, up 137%.

Improved conditions in the farm and infrastructure sector helped the company’s income to more than double. And earnings beat expectations.

To keep up with demand, the company has ramped up production in the United States and South America.

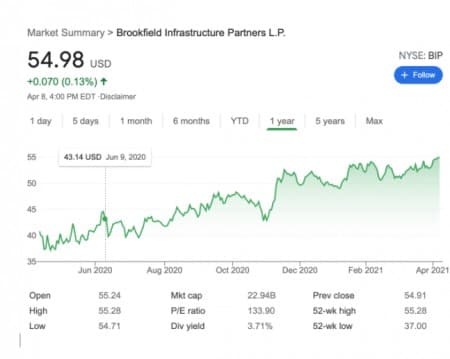

#4 Brookfield Infrastructure Partners (NYSE:BIP)

If you want something ultra-safe that pays a nice dividend, this is the one for you to play the Biden infrastructure wave.

The utilities, transport, energy, and data infrastructure company is set for positive 2021 even without President Biden’s push. Last year, the company's net income reached $394 million, up from $233 million in 2019.

With seven out of nine analysts rating BIP as a buy, this company is likely undervalued at its current trading price of ~$54.

More Top Reads From Oilprice.com:

- Forget OPEC Production Cuts, It’s Exports That Matter

- World’s Largest Lithium Producer: Get Ready For A Mega-Rally

- U.S. Oil Production Is About To Climb