It’s hard to imagine myself writing a more insightful column than the one I wrote last week on the energy markets and how to play them. I invite you to please read that one again before I continue on here:

In that column I foresaw the continued strength that was likely to occur in oil prices, but even more importantly, the beginnings of the end of the strange and unfathomable disconnect that had been occurring between the prices for oil and the prices of oil stocks. This Wednesday’s and Thursday’s action in the markets couldn’t have been a stronger confirmation of this trend, which I believe is only beginning.

We’ve got a great future opening up for us in oil stocks.

And PLEASE – before you read the rest of this column, go back and read last week’s. That optimism for the most part remains for me going forward – but it is crucial to also point out the stumbling blocks that might appear.

And there is one large one you need to be aware of.

I’ve made a profitable career out of connecting the dots of financial interest in oil futures as a major predictor of oil prices. Heck, I even wrote a book on the subject. And while my work in this area has spawned a whole group of observers of this phenomenon, it has become no less as important a tool to keep in the box – we must be laser focused on the speculative interest that enters and leaves the oil futures markets, if we are to stay ahead of the motion of oil prices.

In the last several months there’s…

It’s hard to imagine myself writing a more insightful column than the one I wrote last week on the energy markets and how to play them. I invite you to please read that one again before I continue on here:

In that column I foresaw the continued strength that was likely to occur in oil prices, but even more importantly, the beginnings of the end of the strange and unfathomable disconnect that had been occurring between the prices for oil and the prices of oil stocks. This Wednesday’s and Thursday’s action in the markets couldn’t have been a stronger confirmation of this trend, which I believe is only beginning.

We’ve got a great future opening up for us in oil stocks.

And PLEASE – before you read the rest of this column, go back and read last week’s. That optimism for the most part remains for me going forward – but it is crucial to also point out the stumbling blocks that might appear.

And there is one large one you need to be aware of.

I’ve made a profitable career out of connecting the dots of financial interest in oil futures as a major predictor of oil prices. Heck, I even wrote a book on the subject. And while my work in this area has spawned a whole group of observers of this phenomenon, it has become no less as important a tool to keep in the box – we must be laser focused on the speculative interest that enters and leaves the oil futures markets, if we are to stay ahead of the motion of oil prices.

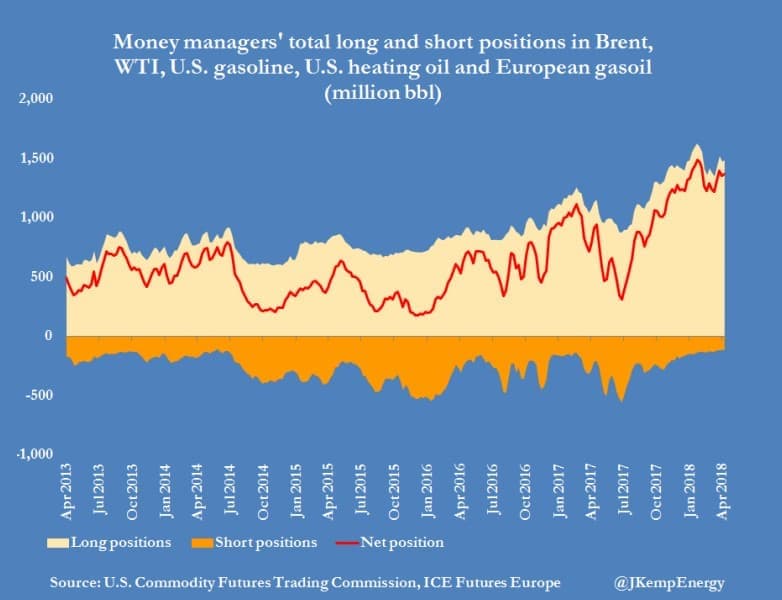

In the last several months there’s been an historic rise in the commitment of speculative interest in oil:

(Click to enlarge)

Normally, I don’t get much concerned about these kinds of trends – at least when they begin forming. The entire world of speculative commodity hedge funds was universally long oil in 2003 and 2006 and 2007, and it didn’t stop oil from continuing to rise.

Until of course, it did.

What made the utter collapse of oil prices in 2008 so complete – from nearly $150 a barrel to nearly $30 – was of course triggered by a looming, greater financial disaster in other derivatives and the credit markets. But that extreme downwards move of a total of more than $110 per barrel was given much added fuel by the complete and overwhelming homogeneity of speculative positions.

Everyone was long then. As they are right now.

What could be even more concerning is the current ‘lack’ of speculative shorts. Have another look at the chart above – not only is speculative length huge, but the difference between that and the net position is tiny, indicating that very, very few speculators are happy being short this market. Now, that also doesn’t usually bother me, as hedge funds are natural buyers of futures and are almost never ‘net short’ oil. But the combination of both the huge length and lack of shorts is worrying – not as a likely cause for a collapse in oil prices, but – as in 2008 – as an explosive box of TNT that could make a downdraft in oil prices far, far more violent – and deep.

For us, I’m going again to refer to last week’s column and reiterate those recommendations: A move from high beta shale players into dividend-paying majors, particularly the euro-majors. And inside of shale producers a continued shading away from Permian and towards some better Bakken E+P’s. As I predicted last week, the rally in oil stocks is catapulting Permian players, while other shale play specialists have momentarily begun to lag. That presents a ‘shale swap’ opportunity for you. And finally - yes, we should start accumulating a small portfolio of dedicated natural gas producers.

The trends for the disconnects between oil prices and oil stocks will, I believe, continue. But there is now a specter of speculative longs that that could dampen its positive effects on our oil stocks. Remember, besides oil prices going up and oil stocks outperforming, the disconnects could also shrink because of a large (if certainly temporary) drop in oil prices, combined with a less catastrophic retreat in the prices of oil company shares.

Both outcomes lead to the same shrinking of the disconnect, but one is far less useful in the profits we are looking for. Keep that in mind as you reallocate your energy portfolio this week.

By Dan Dicker