Last Friday, President Trump tweeted: “Looks like OPEC is at it again. With record amounts of Oil all over the place, including the fully loaded ships at sea, Oil prices are artificially Very High! No good and will not be accepted!”

Record Inventories No More

First off, it is no longer true that there is still record amounts of oil “all over the place.” A couple of years ago, global inventories were indeed at record highs. There was also a tremendous amount of oil in floating storage — the “fully loaded ships at sea.”

That’s no longer the case. The production cuts from OPEC have reduced crude oil inventories back into a normal range. This can be seen in the most recent Oil Market Report from the International Energy Agency:

Further, as Bloomberg reported following President Trump’s tweet, oil in floating storage has declined sharply over the past year:

The amount of crude oil in floating storage globally has declined to 40.7 million barrels as of April 13, from 97.2 million barrels at the end of 2016 — a 58 percent drop — according to data from Vortexa Ltd.

“Our data does not suggest any recent builds in global floating storage volumes,” including in the Middle East, cargo-tracking company Kpler SAS said in a research note. Combined floating storage and oil in transit fell by more than 80 million barrels in the first three months of the year, Kpler said.

Related: Russia Bets Big On Arctic Oil

However, it is true that OPEC’s cuts have helped boost oil prices. One could then argue that oil prices are “artificially very high”, assuming that OPEC would have otherwise continued to overproduce and keep prices in the $30-$40/bbl range.

High Oil Prices: Then and Now

But would that have necessarily been a good thing? Let’s address that.

If a country is a high net importer of crude oil and finished products, then high oil prices will indeed result in a large outflow of dollars. In this case, oil exporters benefit at the expense of oil importers.

The Energy Information Administration (EIA) has explained how oil impacts the U.S. trade deficit:

Crude oil and petroleum products play a significant role in the balance of U.S. trade accounts, and the value of petroleum trade is sensitive to both changes in price and volume. The United States has historically imported more petroleum and petroleum products than it has exported. The deficit reached a maximum of $452 billion in the third quarter of 2008, as a result of a sharp run-up in prices.

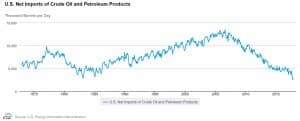

What has happened since 2008? U.S. net exports of petroleum and petroleum products have steadily declined. In 2011, the U.S. became a net exporter of finished products (e.g., diesel, gasoline, etc.) for the first time since 1949. Finished product exports have continued to grow since:

That means that higher oil prices actually decrease our trade deficit of finished petroleum products.

That isn’t yet the case when we include petroleum imports and exports, but the situation is headed in that direction.

Long gone are the days when the U.S. had to import 12 million BPD of crude oil and finished products. At that time, high oil prices were indeed a serious drag on the U.S. economy. But with U.S. net exports plummeting toward zero, this situation is rapidly changing.

The EIA noted as much: “Since 2009, exports of petroleum and petroleum products have played a growing role in reducing the overall merchandise trade deficit.”

Related: Expect Much Tighter Oil Markets

If the U.S. ultimately becomes a net exporter of crude oil and petroleum products, then higher crude oil prices will bring more revenue into the U.S. In that case, the U.S. will be in the position of many OPEC members, with a net benefit to the economy from higher oil prices at the expense of oil importers like China.

Remember the Base

The President might also need reminding that the top three oil-producing states in the country — Texas, North Dakota, and Alaska — all voted for him. Of the Top 25 oil-producing states, only California, New Mexico, Colorado, and Illinois (at No. 16) voted for Hillary Clinton.

Oil country is Trump country and most of the top oil-producing states like high oil prices. Rising oil prices have enabled U.S. shale oil production to rebound from the decline it suffered in 2016.

Low oil prices have historically devastated economies in states like Texas, which delivered more electoral votes to Donald Trump than any other state.

Not All Sectors Benefit

It is important to keep in mind that there are certain sectors that will be harmed by higher oil prices. Companies that rely on transportation, like airlines and shipping companies, could take a hit. Even refiners are susceptible to lower margins from rising oil prices. Higher oil prices can also reduce discretionary income as consumers pay higher fuel bills.

So it is important to understand the impact of higher oil prices on your portfolio. Rising oil prices can be a catalyst for profits, but you have to understand which sectors are likely to benefit.

In any case, the net impact of higher oil prices on the economy is quite different than it was a decade ago. And sometime in the not too distant future, high oil prices could become a net positive for the U.S. just as they are for Saudi Arabia.

Therefore, the notion that high oil prices are necessarily bad for the U.S. should be reevaluated.

By Robert Rapier

More Top Reads From Oilprice.com:

- Expect Much Tighter Oil Markets

- World Bank: Oil Prices To Average $65 This Year

- Oil Majors Are Abandoning Venezuela

The global economy can’t reconcile itself with low oil prices for a long while because the main ingredients that make up the global economy such as global investments, the oil industry and the economies of the oil-producing countries, will be undermined as has been the case since the oil crash in 2014 and the end of 2016.

While it is true that low oil prices could reduce the cost of manufacturing, thus helping the global economy to grow, it is a short-term benefit as this is vastly offset by a curtailment of global investment which forces companies around the world to cut spending, sell assets and make thousands, if not millions, of people redundant. The shale oil industry is a case in point.

As a result of declining oil prices, there has been a loss of 0.75%-1.00% annually in global economic growth since 2014.

Moreover, global investment in upstream exploration from 2014 to 2020 will be $1.8 trillion less than previously assumed, according to leading US consultants IHS.

As a result of declining oil prices, the global oil industry has already sold many of its production assets and cancelled more than $200 bn in oil & gas investments so far, which will translate in two years' time into a smaller share in the global oil production.

The seven major oil companies in the world – Royal Dutch Shell, BP, Exxon Mobil, Chevron, Total, ENI and Statoil – need a price of $125-$135/barrel to balance their books. They also need certainty about the future trend of oil prices before committing themselves to huge investment in exploration and production.

Oil production by Exxon Mobil, Shell, Chevron and ENI has declined from 11.5 million barrels a day (mbd) in 2003 to 9.0 mbd in 2016. This is already being reflected in the recent surge in oil prices.

At prices much below $75/barrel, some of the North Sea’s remaining economically-recoverable reserves, estimated at 15 and 16.5 billion barrels (bb) of oil and natural gas, will end up as so-called stranded assets – hydrocarbons that are simply too expensive to develop.

The combined oil revenues of the world’s oil-producing nations plunged from US$1.6 trillion in 2014 to less than US$800 billion in 2016, according to JPMorgan Chase & Co. Included in that figure is a loss of an estimated $289 bn by the Arab Gulf oil producers during the same period. These losses have deprived the global financial system of vital liquidity.

A continuation of low oil prices leaves no winners only losers. It also demonstrates the destructive power of low oil prices.

This begs the question as to how high should oil prices rise. One has to differentiate between an opportunistic oil price and a fair oil price. Oil producers around the world should be guided by a sound economic principle meaning they should always try to maximize the return on their finite assets aiming for the highest prices the global economy could tolerate. This price could be anywhere between $70 and £130 a barrel. If oil prices rise too high, the oil market fundamentals will tell us in no uncertain terms and will take corrective measures as happened after oil prices reached $147 in 2008.

And while one can’t place a price on the blood of the global economy, a fair price ranges from $100-$130. Such a price is good for the global economy in that it enhances global investments, it improves oil producers’ revenues thus enabling them to explore more for oil and expand oil production capacity to meet future global demand and it enables major oil companies to balance their books and resume investing in oil and energy projects. We have seen how the oil crash of 2014 very adversely impacted on the global economy.

President Trump is not an economist. Therefore, his attack on OPEC for allegedly being responsible for rising oil prices is not only unfair but demonstrates a lack of grasp of the working of the global economy. He will soon realize that rising oil prices are already helping the US economy reduce its deficit through shale oil crude, refined products and LNG exports.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

With the current ratio between long and short positions being around 15, any catalyst that would move the price south would cause such 'correction' to be quite violent.

The recent break out of the USD is likely to be such a trigger.

Higher oil prices=higher interest rates=higher wage growth=return of petro-dollar reinvestment= higher global growth.

Global peace will cause for a spike in oil prices, not war in the middle east due to far greater trade and economic activity. Global economics have been distorted and caused for a lower level of activity than if constructed with the intention of having a balanced trade market.

Oil prices are below the level where the global economy expands optimally.