Oil markets recovered on Friday, clawing back gains that were lost in the last oil price correction.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, February 16, 2018

Oil prices continued to post modest gains at the end of the week, rising on the back of a falling dollar and comments from Saudi Arabia that bolstered confidence in the longevity of the OPEC cuts. The broader upswing in equity markets also helped crude benchmarks.

Russia and Saudi Arabia sign LNG deal. Russia and Saudi Arabia signed several energy deals in Riyadh this week, committing more than $2 billion to join ventures, including an LNG project in Russia. Meanwhile, Russia says it will invest in Saudi Aramco’s upcoming IPO. The deals illustrate a deepening relationship between the two oil producers.

OPEC to form “super group.” The National reported earlier this week that OPEC and the non-OPEC coalition led by Russia are looking to cement their cooperative arrangement into something more permanent. The OPEC “super group,” as it has been dubbed, would be a cooperative framework that would last beyond the current production cut deal. They hope to have a draft agreement in place by the end of 2018. The super group would help answer some questions about how OPEC and its partners plan on exiting the current output agreement and what would happen next. Presumably, market management would continue indefinitely, depending on supply and demand conditions.

OPEC willing to overtighten the market just to be sure. Saudi oil minister Khalid al-Falih said this week that keeping the production limits in place and allowing the oil market to tighten too much is preferable to the alternative. “If we have to err on over-balancing the market a little bit, so be it,” al-Falih said in Riyadh. “Rather than quitting too early and finding out we were dealing with less reliable information ... Stay the course and make sure that inventories are where the industry needs them,” he added. Related: Is This The Future For OPEC?

Oil benchmark differentials deteriorate. Reuters reports that individual benchmark oil prices have fallen in key areas, including the North Sea Forties, Russia’s Urals, WTI in Midland, and Atlantic diesel. The various price declines paint a bearish picture because the dip appears related mostly to the physical market as opposed to swings in financial flows. “Physical markets do not lie. If regional areas of oversupply cannot find pockets of demand, prices will decline,” Michael Tran of RBC Capital Markets, told Reuters. “Atlantic Basin crudes are the barometer for the health of the global oil market since the region is the first to reflect looser fundamentals. Struggling North Sea physical crudes like Brent, Forties and Ekofisk suggest that barrels are having difficulty finding buyers,” he added.

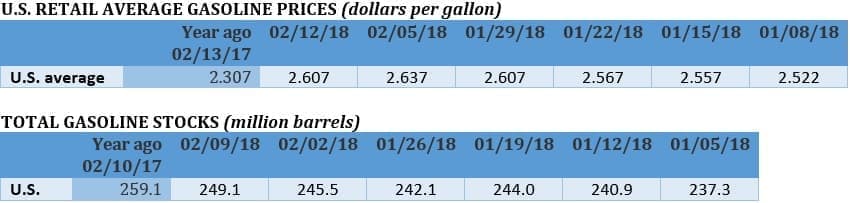

Trump ponders gasoline tax hike. President Trump reportedly voiced support for a 25-cent-per-gallon tax increase on gasoline in order to help pay for a major infrastructure bill. Still, most political analysts see the proposal as highly unlikely.

Shale vs. OPEC = $60-$75 oil. A study from the Oxford Institute for Energy Studies predicts that the battle between U.S. shale and OPEC could keep oil prices trapped between a price band of $60 and $75 per barrel. If prices rise to the upper end of that band, more shale output will drag prices back down. But the OPEC cuts will prevent prices from falling much below $60.

Largest oil export terminal in U.S. begins tests. The Louisiana Offshore Oil Port (LOOP), the largest privately owned crude terminal in the U.S., began test loading oil shipments this week. The terminal can handle very large crude carriers (VLCCs), the largest tankers that carry about 2 million barrels, unlike the rest of the U.S. export terminals on the Gulf Coast. The opening of the port could accelerate U.S. crude exports. Related: Oil Rig Count Rises As Prices Recover

U.S. LNG finds growing Asian market. Skyrocketing natural gas demand in China, Indonesia and other parts of Southeast Asia are erasing an LNG glut that had been predicted to last for years. China is in the midst of aggressively replacing coal-fired heating and electricity with natural gas. Booming demand likely means that the gas market in Asia could remain tight for the rest of the year. “The tight market is going to continue simply because demand is growing and expected projects have been delayed,” Jun Nishizawa, senior vice president at Japan’s Mitsubishi Corp‘s, told Reuters. LNG projects worldwide had been shelved in recent years because of the glut. But with the surplus clearing, more projects could begin to move forward.

Trump administration to rollback methane regulations. The Trump administration said this week that it would revise an Obama-era rule on methane emissions from oil and gas drilling, after the Republican-controlled Congress failed to overturn the rule through legislation last year.

Floating storage in Asia declining. Reuters reports that there are about 15 supertankers of oil floating off the coast of Singapore and Malaysia, which is down a bit from November but down by about half from mid-2017. The data is a sign that the oil market is tightening.

Oil majors focus on shale. Chevron (NYSE: CVX) now counts shale drilling as part of its “base business,” according to Argus Media, an indication that the oil majors are prioritizing shale drilling. Chevron plans on spending $3.3 billion on the Permian this year, half of its total U.S. upstream spending. Chevron’s CEO says shale offers “predictable, flexible and controllable growth,” while large-scale projects often have uncertain timelines.

...but oil majors also increasing spending on offshore. While shale continues to garner attention, the oil industry is also starting to breathe new life into the offshore sector. According to analysts at Bernstein, the industry is set to give the greenlight on 40 new offshore projects this year, compared to just 29 last year and 14 in 2016. Lower costs plus an increase in oil prices has made offshore drilling more attractive.

U.S. refineries buy UK oil. U.S. Gulf Coast refiners are slated to buy the most North Sea oil this month since 2010, according to Bloomberg. The uptick in purchases come as U.S. oil imports from Venezuela continue to decline.

Fieldwood Energy LLC declares bankruptcy. Fieldwood Energy LLC, one of the largest oil producers in the Gulf of Mexico, filed for bankruptcy this week. The bankruptcy plan would hand over control of the company to junior debt holders, led by investment firm Riverstone Holdings.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Is History Repeating Itself In Oil Markets?

- Russia Is Taking Over Syria’s Oil And Gas

- An Eastern Mediterranean Offshore Gas War Is Brewing

Another contributing factor for the rise in oil prices is that the OPEC/non-OPEC production cut agreement could go beyond 2018 albeit in a format that will reflect the changing market conditions such as rising oil prices and a re-balanced oil market.

Oil prices got further boost from the talk about Russia and OPEC intending to cement their cooperation arrangement into something more permanent like a super group where Russia could in theory become a member of OPEC in all but name.

There is no doubt that the strengthening relations between Russia and Saudi Arabia and the mutual investments in each other’s oil and gas projects bode well for the future of oil prices..

OPEC means business and it is ready to tighten the market further to ensure that oil prices trend upward to $70/barrel and beyond.

I am convinced that oil prices will range between $70 and $75/barrel in 2018 and that $60 has become the floor for oil prices.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London