One month ago, when looking at the sharp spike in oil and gasoline prices (which at the time averaged $2.73), we said that the surge in energy costs - largely the result of geopolitical risk emanating from Iran for which Trump was been responsible - will wipe out any remaining benefits for the middle class from Trump tax reform. Fast forward to today, when gas is nearly 20c higher than it was a month ago, and fast approaching the critical for middle-class consumption level of $3.00.

(Click to enlarge)

Since then the topic of how much of an adverse impact rising oil prices will have on the economy has emerged front and center, with pundits and economists debating at what price the negative consequences from reduced consumer spending will offset the favorable benefits from increased CapEx spending by US shale and energy companies.

Picking up on this topic overnight, Bank of America's energy analyst Francisco Blanch said that he expects Brent crude oil prices to trend gradually higher, hitting an average of $80/bbl by mid-2019 before then just as gradually trending lower to an average of $71/bbl by year-end 2019. This amounts to approximately a $20 appreciation in crude oil from the end of last year to the peak in the outlook.

But the real question is what does this $20 jump in the price of oil mean for the economy?

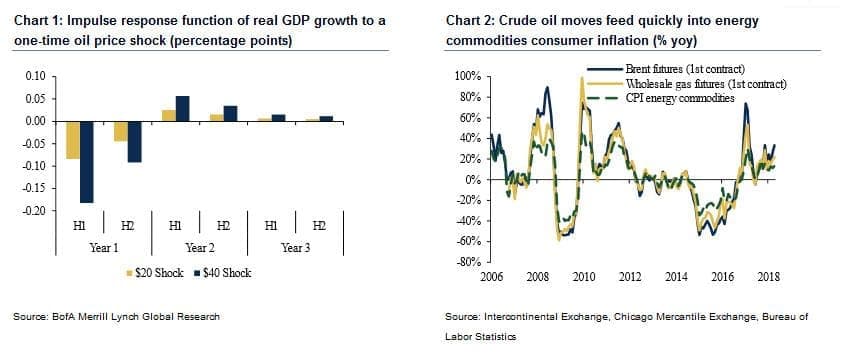

As BofA explains, to get a sense of how the rise in oil prices will affect growth, the bank ran a one-time $20 oil shock in FRB/US, the Federal Reserve Board's general equilibrium macroeconomic model.

It found only a modest impact: real GDP growth initially slows by less than 0.1pp relative to baseline before some modest positive payback in following years (Chart 1). It also ran an "oil shock" scenario that doubles the increase in the baseline forecast which aligns with the BofA Commodity Research team's upside risk scenario. Predictably, in that case growth slows more noticeably - to the tune of roughly 0.1-0.2 percent - before retracing some of the drag in the out years.

(Click to enlarge)

So, to the Trump administration this is good news, if only superficially: these simulations suggest a temporary rally in oil prices is unlikely to create a major headwind for the economy. As we said, that the "superficial" case. Related: Oil At Highest Level Since 2014

However, a sustained oil price shock where crude oil prices remain at peak levels would be significant. The BofA model simulations indicate a permanent oil price shock to $80/bbl would shave roughly 0.2pp from growth over the next eight quarters while a sustained shock to $100/bbl would cut roughly 0.5pp. Also note that the economic literature finds that large movements in oil prices could have negative nonlinear effects on growth as consumers may be slow to adjust to higher energy prices. However, given that the bank is only forecasting a gradual rise in prices over the outlook, it does not expect a material slowdown in growth and maintain our current growth forecast.

Here are some more details from the BofA analysts:

Drilling into energy inflation

Energy is broken up into energy commodities and energy services in consumer inflation. The former reflect products like retail gasoline that are refined from crude oil, while the latter capture electricity and piped gas where natural gas is the primary consideration. As of 2017, petroleum only accounted for 0.5% of electricity generation, so it really is not an important driver of energy services.

Energy commodities largely reflect gasoline and other motor fuels, which account for more than 90 percent. To model the elasticity of energy commodities to crude oil, first think about the retail gasoline pipeline. Crude oil is first refined into gasoline and sold wholesale before reaching consumers. Without getting too into the weeds, BofA estimates the elasticity of crude oil onto energy commodities to be roughly 0.7, meaning that a 1 percent increase in crude oil over a two month period results in a 0.7 percent increase to energy commodities Accounting for energy commodities making up 2.3 percent of headline inflation, a $20 increase in crude oil would add 0.3% to headline PCE and a $40 increase would boost headline inflation by 0.6 percent.

Hitting (headline) inflation

Based on the analysis above, a transitory increase in crude oil prices would be reflected quickly in headline inflation via the energy component (Chart 2). Indeed, the crude oil rally through the first quarter has contributed to headline PCE running, on average, 14bp higher than core PCE on a % yoy basis. However, the effects would filter out just as quickly if there was a reversal, and core inflation would be largely unaffected by the noise.

On core inflation, the literature generally finds limited pass-through of energy prices. Cavallo (2008) finds that oil price inflation have had a small and statistically insignificant effect on core inflation while Hooker (2002) finds little or no pass-through to core inflation since the 1980s. On the other hand, Conflitti and Luciani (2017) find some impact with their estimates showing an average elasticity of 0.01 in the first year of the shock and a small but lasting 0.003 over the next several years. Their estimates suggest that a $20 oil shock would boost core inflation by about 0.2pp in the first year, and less than a tenth thereafter. The more extreme $40 scenario would boost core inflation by roughly 0.4pp in the first year and 0.1pp after.

As BofA notes, the "Bottom line is that we think the new outlook for oil prices will temporarily lift headline inflation but have little to no effect on core inflation, leaving us comfortable with our call for core PCE inflation to hit 1.9 percent yoy and 2.1 percent yoy this year and next, respectively."

These aren't your parent's oil shocks

Another reason why BofA doesn't expect the rise in oil prices to materially impact its outlook is that the importance of oil shocks has diminished over time. In the past, changes in oil prices were a major source of economic fluctuation. For example, oil price shocks of the 1970s led to bouts of stagflation (i.e., low growth, high unemployment, and high inflation). However, since the late-1990s, growth and inflation have remained relatively stable in the face of major oil shocks. There are several factors for this phenomenon.

First, we now consume less energy goods than in the past. Consumption of gasoline, fuel oil and other energy goods as a share of total consumption has fallen from around 8 percent before the 1970s to around 2.5 percent today, limiting the effect of oil shocks (Chart 3). Second, the US produces more oil domestically, reducing our reliance on foreign production (Chart 4). Production of crude petroleum and natural gas extraction has been surging since the mid-2000s.

Therefore, a rise in oil prices today redirects more income between domestic consumers and producers than it did previously, cushioning some of the negative impact of an oil shock. Related: The Myth Of An Imminent Energy Transition

Third, monetary policy credibility has improved over time. Blanchard and Gali (2007) find that fluctuations in inflation and growth diminished over time owing to the FOMC stronger commitment to price stability in the Volcker era. All these factors suggest the increases in oil prices will only have a mild effect on growth and inflation.

(Click to enlarge)

Heightened risk

Despite the generally favorable conditions, BofA admits that higher oil prices are a key risk to its growth outlook but at this stage, the bank maintains its view that growth will remain on target to hit 2.9% this year and 2.4% next year. The bank underscores that only a sustained pickup in oil prices is likely to weigh on the economy which appears unlikely given its current forecast for oil prices. Moreover, BofA adds that the likelihood that an oil shock will lead to recession appears low, for now, especially since the fiscal stimulus from tax cuts and the budget deal should buffer against any downturn. Moreover, structural changes to the economy should limit the negative impact.

On inflation, the pass-through of oil shocks to core inflation appears fairly limited while headline inflation is likely to respond quickly.

To BofA, all this suggest that Fed should remain comfortable in its gradually hiking cycle and keep them on track to raise rates two to three more times this year. Of course, if BofA is wrong and the inflationary impact is more acute, it will simply mean that the Fed is even further behind the curve, forcing it to hike at an even faster pace if and when the wage inflation finally spills over into the economy.

By Zerohedge.com

More Top Reads From Oilprice.com:

- These Two Shale Plays Are Making A Comeback

- Is Russia About To Abandon The OPEC Deal?

- How To Mitigate The Risk Of Peak Oil Demand

The economy, though slowly improving, isn't as hot as some are claiming. We hear that it's hitting on all cylinders but take away a couple of big movers on the Dow 30 industrials, i.e., ExxonMobil, Apple and a few others, it is quite static.

Consider these numbers reported by the Bureau of Labor Statistics (BLS.gov):

1) For comparison take last 15 months under Donald ?Trump the average monthly jobs created has been an anemic 182,000. During the last 15 months of the Obama administration monthly created jobs averaged 206,000.

2) Unemployment. Over the same period of time under both Barack Obama and Donald Trump average monthly hourly earnings increased by .05%.

3) Percentage of working age people participating in the workforce. This is a number that was twisted durning the 2016 presidential campaign claiming that the 62.% eligible workers actually represented nearly 40% unemployment. Of course there are many reasons why this number has been decreasing over the past 10 years, mainly automation and computerization which displaced jobs performed manually.

That percentage was 62.9% when Obama left office in January 2017. However, in April 2018 that number declined to 62.8%. We no longer hear Donald Trump claiming that real unemployment is nearly 40%.

4) Inflation or CPI whichever you prefer. During Obama's final 15 months inflation averaged 1.18%. In the past 15 months under Donald Trump that number climbed to 2.14% and it is still rising as this article succinctly points out.

The Fed can't do much to play with the interest rates (which are presently going up) nor would Quantitative Easing do much to boost the economy when the so-called fiscal conservatives just passed a $1.5 trillion unfunded tax cut and a $1.3 trillion budget which is also unpaid for, unfunded, that will expire in September. How will the exploding deficit be paid for with this disastrous version of trickle-down economics where only 1% of the most affluent got the biggest tax cut and the greatest financial gains?

Added to the coming pain for ordinary Americans is the burgeoning health care costs and health insurance premiums, rising auto and home insurance, no plan to address the looming health coverage crisis caused by congress's eliminating the Affordable Care Act mandate forcing more people to drop out of the insurance pool and raising premiums for those who remain insured.

That big tax cut that Paul Ryan brayed about when he said that one woman told him she would be able to pay for a one-year membership at Costco just went right back into her gas tank -- and more.

I have been arguing for a while that high oil prices are good for the global economy as they invigorate the three biggest chunks of the global economy, namely, global investments, the economies of oil-producing nations including the US and the global oil industry.

This begs the question as to what constitutes a high oil price that the global economy could tolerate. My research has shown that a fair oil price ranges from $100-$130 a barrel. Higher than that and the global economy will let us know in no uncertain terms as it did in 2008 when oil prices hit $147.

Experience gained from the 2014 oil price crash has taught us that the global economy has not been able to reconcile itself with the collapse of oil prices because the main ingredients that make up the global economy, namely, global investments, the oil industry and the economies of the oil-producing countries, have all been undermined.

While it is true that low oil prices could reduce the cost of manufacturing, thus helping the global economy to grow, it is a short-term benefit as this is vastly offset by a curtailment of global investment which forces companies around the world to cut spending, sell assets and make thousands, if not millions, of people redundant. There has been a loss of 0.75%-1.00% annually in global economic growth since 2014.

As a result of declining oil prices, the global oil industry has already sold many of its production assets and cancelled more than $200 bn in oil & gas investments so far, which will translate in two years' time into a smaller share in the global oil production.

Moreover, global investment in upstream exploration from 2014 to 2020 will be $1.8 trillion less than previously assumed, according to leading US consultants IHS.

So if we accept the premise that high oil prices are good for the global economy, then by definition they are good for the US economy.

Prices as high as $130/barrel could hardly register on the inflation or GDP growth scales in the United States. As a result of rising crude oil prices, US oil production has risen significantly leading to a big reduction in US oil imports and also enabling the US to export some 1.53 million barrels of oil a day (mbd) and 3.18 mbd of refined products as well as some LNG shipments. Moreover, the US shale industry now employs 2% of the working force in the United States.

The Americans could certainly afford to pay extra for their gasoline without affecting their economy or their pockets. They are generous by nature so their extra spending could be looked upon as an indirect contribution to their country’s foreign aid to the less privileged citizens of the world.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

If we go into the elections with high gas prices, Congressmen (and women) will be turned out. My guess, we are almost at the high, downward forces will win, after the driving season. I could be wrong.