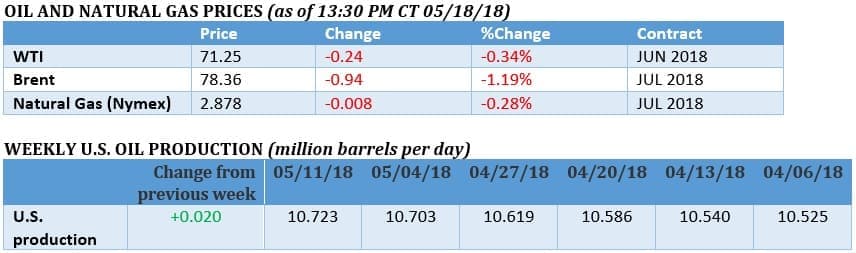

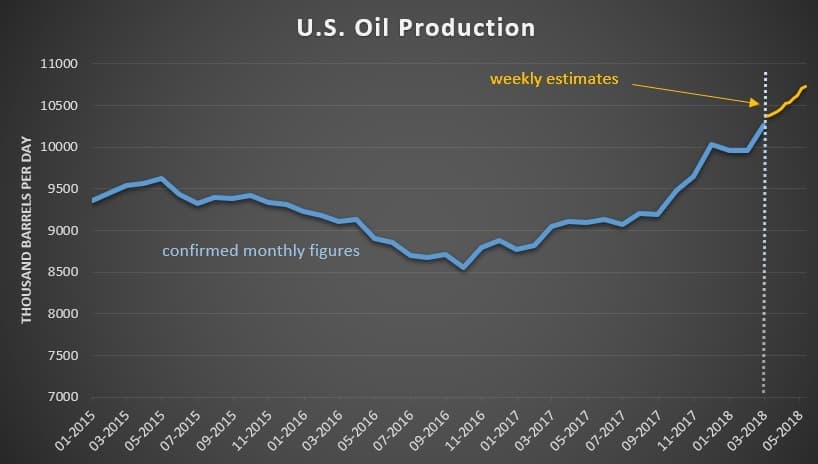

Oil prices pulled back slightly on Friday following a week of bullish news, and despite an increase in U.S. oil production, crude prices are set to continue climbing.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, May 18, 2018

Oil prices took a breather on Friday, with Brent sitting just shy of $80 per barrel. The Venezuelan election on Sunday could be the next near-term catalyst for the oil market.

$80 Brent for first time since 2014. Brent briefly breached $80 per barrel this week, although it is facing resistance at that level. Still, oil prices are at their highest in three and a half years. “There’s the Iran story which continues to develop and the general talk about a tighter market. It will be interesting to see if we make a clean break of $80 next week. It seems like that’s the direction we are going,” Jens Pedersen, a senior analyst at Danske Bank A/S, said in a Bloomberg interview.

$3 gasoline spreading across U.S. Average retail gasoline prices in the U.S. have climbed to $2.90 per gallon this week, but with Brent hitting $80 per barrel, more pain at the pump could be on the way. Peak summer demand unofficially begins during the Memorial Day holiday at the end of May, and this year motorists will see the highest gasoline prices in more than three years. The average motorist will pay an additional $100 for gasoline this summer compared to last year.

Shortage of oilfield services in Permian. Costs for oilfield services are on the rise as companies struggle to find enough workers. “Recruitment and staffing is a big challenge. We’re aggressively focused on recruiting people,” Kevin Neveu, chief executive at Precision Drilling Corp., said at a conference in Houston. He said they hired about 2,000 people in 2017. A study last year estimated that about 25 percent of the workers laid off during the downturn have moved on to other industries. Related: LNG Remains In Tight Supply In This Key Market

OPEC and Russia discuss oil prices. Saudi oil minister Khalid al-Falih said that OPEC and Russia were discussing price volatility and the health of the oil market. Al-Falih has said that OPEC would step in to mitigate and supply losses, although for now, the preference seems to be to leave the production limits unchanged. OPEC officials have said the price rally is being driven by fear and not based on the fundamentals.

EU moves to insulate companies from U.S. sanctions. Danish shipping giant Maersk said it would wind down operations in Iran by November to avoid U.S. sanctions. French oil company Total SA (NYSE: TOT) had the most high-profile investments on the line in Iran, including $1 billion tied up in the development of the South Pars gas field. Total said it would withdraw from Iran if it cannot obtain a waiver from the U.S. Treasury. China’s CNPC could buy out Total’s stake in the project. This comes even as the EU is trying to protect its companies from U.S. sanctions.

Trump tells Germany to scrap Nord Stream 2 to avoid trade war. The WSJ reports that President Trump is pressuring Germany to scrap the Nord Stream 2 natural gas pipeline from Russia if it wants to avoid a trade war with the United States. Trump reportedly told German Chancellor Angela Merkel that the U.S. would restart talks with the EU on a trade deal in exchange for Germany cancelling the Nord Stream 2 pipeline. “Trump’s strategy seems to be to force us to buy their more expensive gas, but as long as LNG is not competitive, Europe will not agree to some sort of racket and pay extortionate prices,” an EU official said.

Canada hoping to backstop Kinder Morgan pipeline. In an extraordinary move to benefit a single company, the Canadian government is trying to backstop Kinder Morgan’s (NYSE: KMI) Trans Mountain Pipeline, which would carry Alberta oil to the Pacific Coast. Kinder Morgan is on the verge of cancelling the project because of political opposition in British Columbia, which has created legal and financial risk. Canada’s finance minister suggested the federal government could offer “indemnity,” which could help defray unforeseen costs stemming from political delays. “We think there is a way to do it in a commercially appropriate way, so the project is economically viable -- then we can actually provide sort of like insurance,” he said during an interview with BNN Bloomberg. “We can effectively say, ‘Look there is a premium that’s going to get paid but we can insure this sort of delay so that the project gets done.”’ Talks with Kinder Morgan are ongoing although the company set a May 31 deadline.

Renewed interest in LNG as glut disappears. Up until recently, analysts expected the global LNG market to be oversupplied for years to come. But unexpectedly strong demand from China and others has rapidly erased the glut. China’s LNG imports were up 59 percent in the first quarter from a year earlier. LNG developers are now expressing interest in new projects again, but because of the long lead times, they may be too late to prevent a supply crunch in several years’ time. WoodMac estimates a supply deficit by 2025.

Statoil name change illustrates oil industry challenge. Statoil (STO) officially changed its name to Equinor on Wednesday, a move intended to better reflect the evolving makeup of the company, which is making heavy investments in renewable energy. By 2030, Equinor will allocate 15 to 20 percent of capex to “new energy solutions.”

Related: The Regulations That Could Push Oil Up To $90

Shale industry struggles to make money. The WSJ reports that 15 out of the 20 top shale drillers posted negative cash flow in the first quarter, a surprise result given the rally in oil prices. The top 20 companies by market cap collectively spent $2 billion more than they earned in the quarter. Some of that is the result of locking themselves into hedges back when oil prices were lower, meaning they were unable to benefit from higher prices. Oasis Petroleum (NYSE: OAS) spent $3.27 for every $1 in revenue in the quarter.

Venezuela election looms, U.S. might not slap on new sanctions. Venezuela’s meltdown continues, and ConocoPhillips’ (NYSE: COP) pursuit of PDVSA assets threatens deeper troubles. But the presidential election on Sunday could be pivotal in deciding what happens next in the country. The situation is so bad that the U.S. is seemingly thinking twice about stiffer sanctions following the vote. That, combined with the fact that the U.S. has already put Iranian supply in jeopardy, might mean that the Trump administration holds off on further sanctions following the sham election. A ban on Venezuelan crude imports is “off the table now,” said Francisco Monaldi, fellow at Rice University's Baker Institute for Public Policy, told S&P Global Platts. “Partly because the collapse of the Venezuelan oil sector makes it almost unnecessary, partly because with the price of oil going up and elections in the US they do not want the domestic backlash, partly because the Iran sanctions make it less timely.”

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Oil Exports Continue To Break Records

- Is Russia About To Abandon The OPEC Deal?

- IEA: High Oil Prices “Taking A Toll” On Demand

The first topic is how high oil prices could still go. Aside from periods of profit-taking, I project oil prices have still a long way to go. I would not be surprised if oil prices go beyond $80 a barrel in 2018, rising to $85-$90 in 2019 and hitting $100 if not higher in 2020. Prices are currently in the best situation in terms of economics and geopolitics.

Three major factors will continue to give oil prices added support. One is the continued OPEC/non-OPEC production agreement well into the future in one form or another. OPEC and Russia have at last found a successful and workable mechanism to virtually put an end to future glut or at least mitigate its impact on prices.

Another is that OPEC members and Russia are starting to believe in the sound economic principle of aiming to maximize the return on their finite assets to the highest level the global economy will allow them.

A third factor is the brewing confrontation between the petro-yuan and the petrodollar. The petro-yuan is already starting to serve as a refuge to countries threatened by US sanction like Iran. In effect, the petro-yuan is nullifying US sanctions.

The second topic is that the use of Sanctions by the United States as a geopolitical and economic tool is fast becoming useless. The global oil market has been seismically changed since the lifting of the sanctions on Iran in 2015. The fact that the EU is standing by the Iran nuclear deal and thus will not be complying with US sanctions and the introduction of the petro-yuan have virtually made any future US sanctions on Iran ineffective.

Not only the EU will be moving to insulate European companies from US sanctions, it will maintain and deepen economic relations and trade with Iran, will also consider switching to euros instead of US dollars in the oil trade with Iran thus nullifying sanctions on Iran.

Iran has already indicated that it will be using the petro-yuan for payment for its oil exports to China, the euro for its exports to the EU and barter trade with Russia, India and many other countries around the world thus bypassing the petrodollar altogether and nullifying the impact of the sanctions.

That brings us to the third topic: the Nord Stream 2. According to the WSJ, President Trump reportedly told German Chancellor Angela Merkel that the US would restart talks with the EU on a trade deal in exchange for Germany cancelling the Nord Stream 2 pipeline. Chancellor Merkel’s answer was to defy Trump and start building its portion of Nord Stream 2 —in its Baltic Sea port of Lubmin.

Germany receives 57% of its natural gas and 35% of its crude oil from Russia. Furthermore, Russian gas is and will remain cheaper for Germany than US LNG for the foreseeable future until US producers can match Russian gas prices.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London