The year has started well for Russia when it comes to energy. Two large energy projects have been finished, Turk Stream and Power of Siberia, and the third, Nord Stream 2, has passed the point of no return - with U.S. sanctions now unable to obstruct its completion. Moscow's ambitions, however, are loftier still. China and Russia have voiced plans for ever-closer political and economic cooperation. Energy is one of the most important areas of collaboration between these two superpowers due to the complementary nature of their economies. China requires ever-larger volumes of energy to power its expansion and Russia needs money to modernize and sustain a reasonable standard of living for its population.

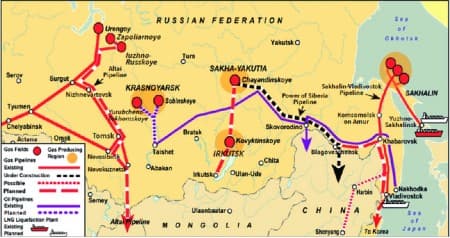

For nearly two decades Russia has been trying to convince China to buy natural gas from its natural gas fields in Western Siberia. Moscow has both political and financial reasons to convince Beijing of this. The Russians have been looking for alternatives to lessen their dependence on Europe as the vast majority of the natural gas is exported towards the west. Supplying China with energy from the same natural gas fields would strengthen the country’s bargaining position vis-à-vis Europe as it would increase the available options in case demand decreases from either one. From a financial point of view the Altai pipeline is relatively cheap as much of the infrastructure is already present.

Negotiations on the pipeline have been slow due to Chinese foot-dragging. Northwestern China is already an important production area for oil and gas. Therefore, the regional market is already saturated. This means that Chinese companies would have to invest heavily in additional infrastructure to carry the gas to the densely populated areas in the east. Also, the country is already well-connected to Turkmenistan’s gas fields through Central Asia with a 55 bcm capacity pipeline. Related: The Unexpected Consequences Of Germany’s Anti-Nuclear Push

Putin, however, recently made a bold move to kickstart the project and save face by reviving the second option through Mongolia. On December 5, Moscow and Ulaanbataar signed a memorandum of understanding for a feasibility study for a pipeline from Russia through Mongolia to China. The study is significant because it has the support of the leadership of the three involved countries. The results should be out within six months.

The relatively high costs of the project compared with the western alternative don't make it the preferred option from a Russian point of view. According to Interfax Putin said, "I know the route there [through Mongolia] isn't easy, but a preliminary consideration of this matter showed that it's realistic, and our Chinese partners tend to agree."

Moscow’s changing strategy seems to be motivated by recent developments and a new window of opportunity. The recent turmoil in Xinjiang could have convinced the leadership in Russia that another pipeline through the region won’t be approved due to security risks in the area. Another reason could be Moscow’s conviction that it is the right moment to push for Siberian gas to replace Central Asian energy as Beijing and Turkmenistan have been discussing a fourth line of the Central Asia-China pipeline. Although the infrastructure's deadline has been pushed back from 2016 to 2022, it remains likely that it will be completed eventually. Therefore, Moscow is pushing for its pipeline to be completed earlier to increase market share.

Besides a lower risk of supply disruptions, the Mongolian route has another advantage. The geography of the region makes it ideal for the construction of major pipelines. Moscow and Beijing have already shown that they are capable of finishing massive projects on time when the political will is there. Fueled by Western hostility, the political and economic cooperation of the Asian giants will strengthen even further in the future. Energy is a straightforward and necessary option for Beijing and Moscow to integrate their economies. If the project is to get a green light, it will most likely happen this year as the circumstances are ideal.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- What’s Next For Oil? No One Seems To Agree

- Massive Oil Product Build Sends Prices Lower

- Is Iran Preparing To Send Oil Back To $100?

Energy has become the catalyst for economic integration between China and Russia bringing together China, the world’s largest economy based on purchasing power parity (PPP) and Russia the superpower of energy.

Moreover, Russia’s strategic alliance with China is already changing the global political order and is emerging as the dominant force that will shape the globe in the next two decades.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London