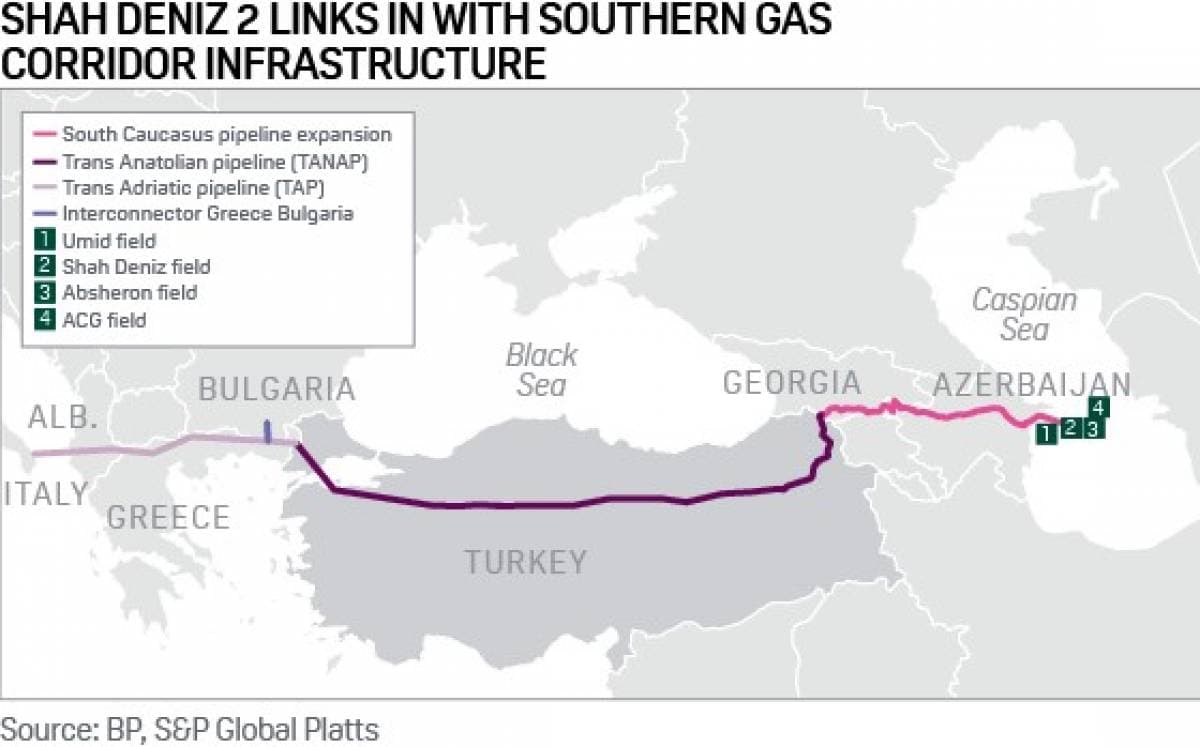

In a slight detour from our usual oil-focused weekly commentary on burning issues of the day, let’s look at Europe’s latest gas infrastructure project, the jewel in the crown of the European Union’s Southern Gas Corridor initiative, the Trans Anatolian Natural Gas Pipeline (TANAP). TANAP has been completed by the first days of July and is now fully ready to export gas from the Shah Deniz 2 project (whose 2nd phase is now gradually ramping up). Azerbaijan’s gas exports via Turkish territory to Europe were first perceived as the first step in the EU’s quest for new import routes, yet now seems to be the only viable one that does not entail Russia (and even this might be revisited soon).

Promoting the Southern Gas Corridor is Brussels’ lingo for ridding EU countries of dependence on Russia, Central and Eastern Europe’s traditional gas supplier, oftentimes the only one. Never would you find Russia explicitly stated, yet phrases like “breaking the monopoly of the current gas supplier to Bulgaria” has Gazprom written all over it. In view of this, perhaps it is not surprising that most of TANAP’s financing came from external financial entities, most notably the European Investment Bank, the European Bank for Reconstruction and Development and the World Bank Group. Apart from gas interconnectors between Central European nations, TANAP is the only physical conduit currently under construction that is destined to actually increase non-Russian gas imports to Europe.

TANAP’s…

In a slight detour from our usual oil-focused weekly commentary on burning issues of the day, let’s look at Europe’s latest gas infrastructure project, the jewel in the crown of the European Union’s Southern Gas Corridor initiative, the Trans Anatolian Natural Gas Pipeline (TANAP). TANAP has been completed by the first days of July and is now fully ready to export gas from the Shah Deniz 2 project (whose 2nd phase is now gradually ramping up). Azerbaijan’s gas exports via Turkish territory to Europe were first perceived as the first step in the EU’s quest for new import routes, yet now seems to be the only viable one that does not entail Russia (and even this might be revisited soon).

Promoting the Southern Gas Corridor is Brussels’ lingo for ridding EU countries of dependence on Russia, Central and Eastern Europe’s traditional gas supplier, oftentimes the only one. Never would you find Russia explicitly stated, yet phrases like “breaking the monopoly of the current gas supplier to Bulgaria” has Gazprom written all over it. In view of this, perhaps it is not surprising that most of TANAP’s financing came from external financial entities, most notably the European Investment Bank, the European Bank for Reconstruction and Development and the World Bank Group. Apart from gas interconnectors between Central European nations, TANAP is the only physical conduit currently under construction that is destined to actually increase non-Russian gas imports to Europe.

TANAP’s putting into operation is carried out in two steps: first, Azerbaijan’s commitments vis-à-vis Turkey had to be fulfilled. SOCAR is contractually obliged to deliver 6 BCm per year (equivalent to 210 BCf), effectively doubling Turkey’s gas imports from Azerbaijan) to the Turkish state company BOTAS, starting from 2 BCm in 2019, then supplying around 4 BCm in 2020, attaining the required level of exports by 2021-2022. Right after Phase 2 of Azerbaijan’s key production project Shah Deniz went onstream, Turkey received its first volumes of gas in June 2018 – building upon the close cultural and political ties between Ankara and Baku, the two sides have agreed on a price formula that would make TANAP-supplied gas the cheapest option available for Turkish buyers.

The second step will be the start of TANAP-supplied gas exports to Europe, with 10 BCm per year expected to be moved into Greece, Bulgaria, Albania and Italy. Commercial gas deliveries to Europe will start in June 2020, according to SOCAR’s CEO Rovnag Abdullayev, i.e. only after the Trans Adriatic Pipeline (TAP), TANAP’s continuation into Europe, is fully operational. Due to the gradual character of Shah Deniz 2’s production ramp-up, non-Turkish exports will only attain projected capacity by 2025-2026. Hence, Greece will be the first EU country to see Shah Deniz gas molecules transited, the initial export ramp-up volumes will most probably land in there, too (Greece’s DEPA has 1 BCm per year contracted). Italy, by far the largest market outlet for TANAP-TAP Azerbaijani gas, will be the last to join the club.

Compared to past EU pipe-dream projects like Nabucco, TANAP/TAP’s progress is astounding and deserves praise for costing at $7 billion almost $5 billion less than was initially expected. However, if one is to have followed the project all along, they would notice that talks about bringing TANAP’s transportation capacity to 31 BCm per year have all but evaporated. This has direct implications for TANAP’s overall utility as the second offtake point, planned to be located near Gallipoli so as to be able to feed Istanbul, seems to have been cancelled by the Turkish side until a new source of supply is found for the pipeline, someone who can guarantee ample and continuous supplies of natural gas. The self-evident solution would be to increase natural gas production in Azerbaijan, yet this seemingly feasible goal is fraught with difficulties.

Being right in the middle of transforming from an oil-oriented exporter towards a predominantly gas-based export matrix, Azerbaijan has been searching in its Caspian offshore for a new Shah Deniz to boost its export potential. Let’s look at what went wrong with past favorites:

1. Absheron

Absheron was universally assumed to be Azerbaijan’s best shot in replicating its Shah Deniz success. Located offshore some 60km off the Absheron peninsula, drilling into sandstone layers as deep as 6km elicited only moderately positive news. SOCAR’s initial reserves estimates were set at 1-3 TCm (35-100 TCf), however after ChevronTexaco spudded a dry well on the structure in early 2001, the reserves dropped to 0.3-0.4 TCm. As things stand currently, all volumes from Phase I of Absheron’s development will feed the domestic market, whilst Phase II that foresees total output to reach 5 BCm per year will allow only for minor volumes to be exported. Condensate from the Absheron field will be supplied via the BTC pipeline, making the Baku-Ceyhan stream lighter over time.

2. Umid/Babek

One of SOCAR’s most recent discoveries, which it develops jointly with Noble Oil (SOCAR holding 80 percent of shares), the Umid/Babek field is estimated to contain 0.6 TCm. Umid, the smaller of the two, is already producing small volumes destined for the domestic market and has been experiencing volatile field pressure rates, indicating that perhaps even less than 0.2 TCm might be recovered. Oil majors have expressed interest in taking a part in Babek, however if Babek shares geological similarities with Umid, the traction might be rather short-lived. Similarly to Absheron, Umid/Babek would gravitate naturally towards satisfying domestic gas needs and not boosting export volumes.

Hence, Azerbaijan has no ascertainable surefire ways to increase its production in the mid-term and avoid its output plateauing after 2025. This is somewhat complicated by the relative narrowing of the pool of Western majors operating in Azerbaijan – most projects that are currently in the appraisal drilling phase take place with the involvement of BP or Total, only Equinor stands out as a major increasing its position around the Caspian. TANAP’s shareholding structure replicates the distribution of roles on the Azeri market: the pipeline is owned by SOCAR, BOTAS (the two co-own the operating company) and BP. Interestingly, the commissioning of TANAP coincided with rumors circulating around the Caspian that BP seemed to be interested in taking a part in the TANAP operating company, yet this was quickly refuted by BP officials.

The recalcitrance of Western oil and gas companies to enter TANAP stands in contrast with the shareholding structure of TAP, the 10 BCm per year capacity Pipeline which would deliver gas from the Turkey-Greece frontier across the Adriatic Sea to Apulia, Italy, which accommodates the likes of BP, SOCAR, Snam (20 percent each), Fluxys (19 percent), Enagas (16 percent) and Axpo (5 percent).

In view of the above, whither Azerbaijan? If we are to accept that Azerbaijan will not be able to move beyond the 25-27 BCm per year export threshold by late 2020s, then SOCAR has only two options on how to buttress TANAP/TAP exports. The first is Turkmenistan, oftentimes mooted as being the crucial element for making Trans-Caspian deliveries work, however it has shied away so far from taking on the construction of a subsea pipeline across the Caspian. In fact, using the hypothetical Transcaspian pipeline, as well as TANAP and TAP might make Turkmen gas prices inacceptable for South European customers due to the excessively lengthy supply chain. SOCAR’s second option, as odd as it may sound, is Russia.

For SOCAR, allowing Gazprom into TANAP would have multiple benefits – TurkStream might be partially fed into TANAP, which would eliminate the necessity to build 5 new compressor stations along TANAP if it wants to raise throughput capacity to 31 BCm per year. Second, this would increase SOCAR’s maneuvering space to eke out a quid-pro-quo with Gazprom on gas supplies to Azerbaijan, which still take place despite Baku being high on the hydrocarbon exporters’ list. Third, it would not have to contend with Gazprom’s South European spurs from TurkStream. Gazprom’s own benefits are primarily political as it would conform with the EC’s “3rd energy package” requirements as it does not own the pipeline, helping the Russian firm out in finding new ways of circumventing Ukraine. However, the European Union would certainly object to such convergence.