Natural gas production hit another high in the United States at approximately 87 billion cubic feet per day (Bcf/d) over the last weekend. The rise in production contributed to a total gas supply over 91 Bcf/d before we even head into the winter months.

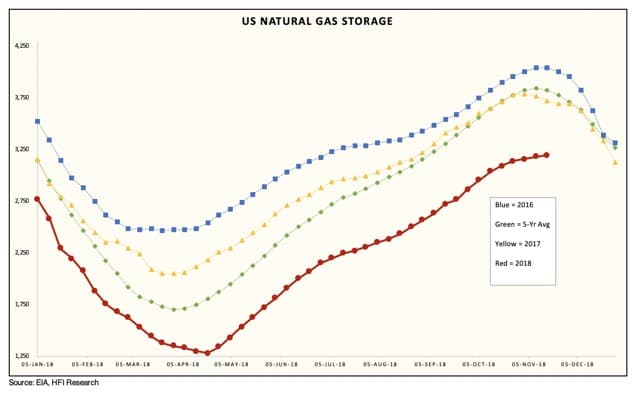

The surge in domestic natural gas production comes at the same moment as we are experiencing a shortage in storage going into the season with highest natural gas demand. Storage is vital during the winter months when demand for natural gas spikes and production is not able to keep up, causing the necessity to dip into reserves.

Currently storage is at a 10-year low, coming in below 3.2 trillion cubic feet of available storage capacity. What’s more, net imports of Canadian natural gas have been low thanks to Enbridge’s pipeline rupture near Prince George, British Columbia. When the import volumes return to their normal levels, total gas supplies in the U.S. would rise even higher, potentially exceeding 92 Bcf/d.

(Click to enlarge)

Source: HFI Research

Most estimates for this week’s Energy Information Administration (EIA) weekly storage report project that there will be an injection in the low 50s Bcf, not nearly enough to make a dent in the persistent storage deficit.

Related: EIA: Market Tightens As Outages From Iran, Venezuela Pile Up

A Reuters poll of 18 market participants showed a range of 39 Bcf to 65 Bcf, with a median build of 51 Bcf. At this time last year, the build was 63 Bcf, and the five-year average is 77 Bcf for the corresponding period, emphasizing the shortcomings of this week’s storage injection.

(Click to enlarge)

Natural gas demand can’t be expected to spike in early November either, with a very mild forecast for the coming weeks. We can therefore continue to expect a relatively low heating demand nationwide, despite several cold snaps in the Midwest and Northeast. In the face of this news, natural gas futures have been falling accordingly. Nymex futures settled at $3.166 for November, down 4.6 cents on the day. December plummeted 5.6 cents, ending up at $3.227, and the winter strip (November through March) went down 5.4 cents to $3.174. That being said, weather model volatility and market uncertainty means that big price swings more than likely in the near future.

Meanwhile, despite depressed gas prices and major storage shortages, across the country production is natural gas production is ramping up.

Related: Will Big Oil Ever Win Back Investors’ Trust?

Take the case of East Texas Haynesville, which has been experiencing a major renaissance thanks to a recent spike in investment from majors like ExxonMobile and BP, and is now at a record high, having skyrocketing at a breakneck speed, up approximately 55 percent since January. The up-and-coming field has shown ballooning initial production rates, high internal rates of return growing higher, and a major increase in overall production. They’ve reached approximately 9.9 Bcf/d currently, up from 6.1 Bcf/d just two years ago, according to data from S&P Global Platts Analytics.

In fact, East Texas counties including Shelby, San Augustine and Nacogdoches have seen global majors ExxonMobil and BP double their rig count in the area just within the last year, making the region more competitive with established fields in neighboring Louisiana. In October the East Texas rig count reached 21, as compared to just 12 rigs at this time last year.

Despite major drawbacks like unpredictable weather patterns, volatile gas prices, and storage capacity grinding by at a 10 year low, major investors are continuing to pour money into natural gas production. With so many factors of unpredictability going into the winter season, it looks like the only thing we can expect for natural gas futures is a wild ride.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- The Perfect Storm Bringing China And Russia Together

- Trump Sides With Farmers In Battle Against Refiners

- U.S. Drillers Add 11 Rigs Despite Oil Price Correction