U.S. natural gas prices reached the highest maximum level in 4 years this winter. That’s because of a new “just-in-time” gas supply paradigm that relies more on wellhead production than storage. It has pluses and minuses.

In November 2019, weekly Henry Hub spot prices were $4.68/mmBtu, a level only exceeded in January 2014 over the last several years (Figure 1).

(Click to enlarge)

Figure 1. Highest natural gas price maximum in four years.

Source: EIA and Labyrinth Consulting Services, Inc.

That was because winter gas storage was the lowest since then (red fill in Figure 1).

Record gas production and expansion of northeastern pipeline systems led to a new just-in-time natural gas supply paradigm. Dry gas production set a new record high of 88.7 bcf/d in February (Figure 2). Gas output increased an astonishing 17.7 bcf/d from January 2017 and the present

(Click to enlarge)

Figure 2. Record 88.77 billion cubic feet per day dry gas production in February 2019.

Source: EIA STEO and Labyrinth Consulting Services, Inc.

That and new pipeline take-away capacity from the Marcellus and Utica plays led markets to believe that supply was almost infinite."

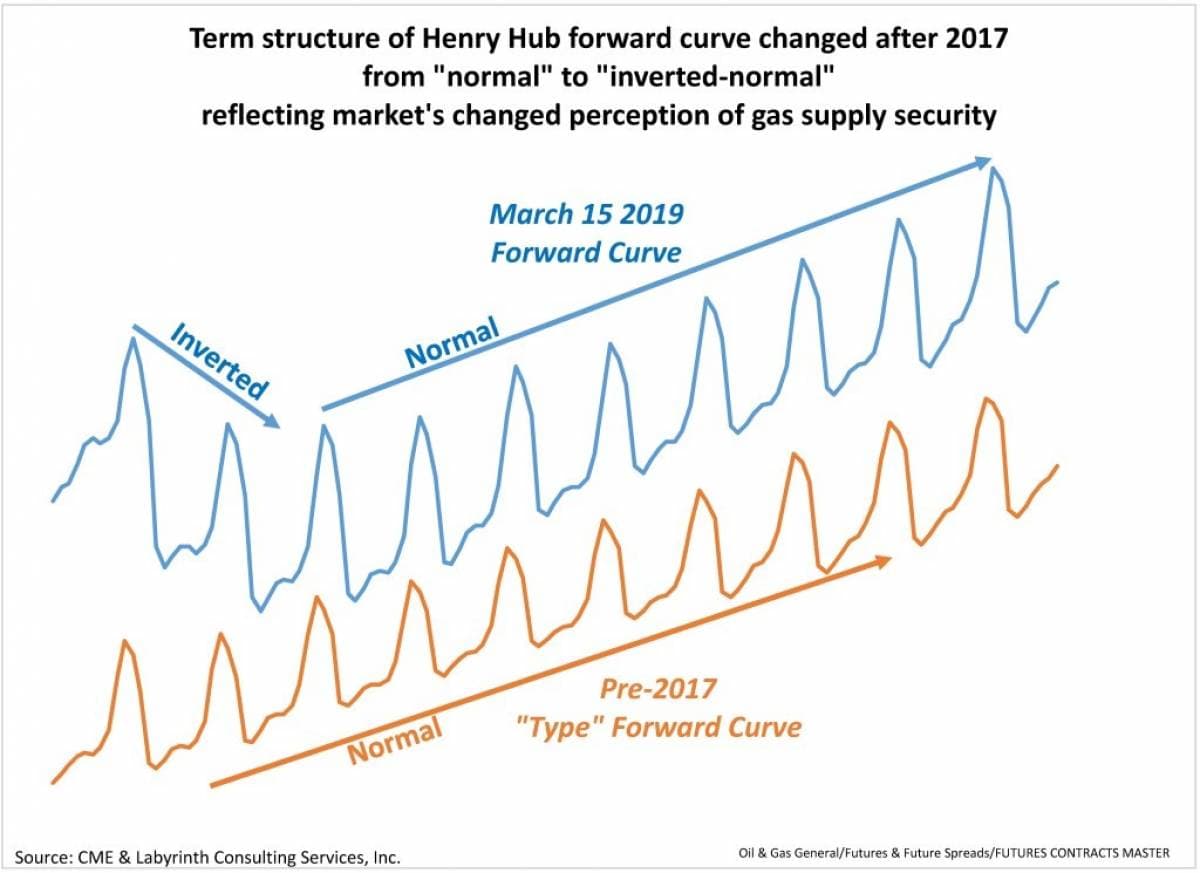

Gas futures forward curves reflected the new just-in-time paradigm. Before 2017, the “normal” term structure of gas forward curves reflected generally higher future than spot prices. This contango structure included higher frequency seasonal use variations in pricing (Figure 3).

(Click to enlarge)

Figure 3. Term structure of Henry Hub forward curves changed after 2017 from “normal” to “inverted-normal.”

Source: CME and Labyrinth Consulting Services, Inc.

Beginning in about 2017, the term structure for shorter-dated contracts inverted and then, reverted to the normal pattern. This discouraged storage in the short term and resulted in record low inventory volumes going into the winter heating seasons of 2017-18 and 2018-19. Related: Oil Is Set To Rise, But The Rally May Not Last

Although production is at record levels, so are U.S. gas exports. February net imports were -4.52 bcf/d and net imports are expected to reach almost -8 bcf/d by November 2019 (Figure 4).

(Click to enlarge)

Figure 4. February U.S. net natural gas imports were -4.52 billion cubic feet per day.

Source: EIA STEO and Labyrinth Consulting Services, Inc.

Markets may not have fully comprehended that production and supply are not the same thing. Exports reduce the amount of gas available for domestic consumption.

The new gas supply paradigm has led to lower levels of gas-in-storage than in previous years. This in turn exposed markets to higher short-term prices during cold periods this winter.

Many believe that higher prices resulted from a cold winter and that this will not be repeated during more normal winters. That is untrue. So far, this winter has been 3 percent warmer than the norm. Gas price spikes occur when storage is low. Cold weather is an accelerant for price spikes, not their cause.

Just-in-time gas supply is here to stay as long as shale gas and tight oil companies continue to over-produce natural gas. That will lead to lower prices on average. That’s a plus for consumers. We should, however, expect greater price volatility when weather and low storage combine to produce temporary tight supply. That’s a minus.

This winter’s pricing should be a reasonable model for next winter. Let’s see what surprises just-in-time supply provides this summer!

By Art Berman for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. ‘’Oil Weapon’’ Could Change Geopolitics Forever

- Why Russia Fails To Comply With The OPEC+ Cuts

- Refiners Prepare To Profit From Dramatic Oil Product Switch