Friday April 27, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Gasoline prices at highest in years

(Click to enlarge)

- Global demand is expected to rise by 1.6 mb/d this year, which could mark the fourth consecutive year of demand growth exceeding 1.5 mb/d, the longest stretch since the 1970s.

- But OPEC cuts combined with strong demand has pushed oil prices up to multi-year highs. The EIA says that gasoline prices in the U.S. will average $2.74 per gallon this summer, the highest in four years.

- If prices keep rising, demand will slowdown. There is debate about when this occurs and by how much, but above $3 per gallon, U.S. consumption starts to take a hit.

- OPEC seems somewhat in denial. "I haven't seen any impact on demand with current prices," Khalid Al-Falih told reporters at the meeting of OPEC and non-OPEC producers in Jeddah.

2. Offshore drilling picking up

- The head count at oilfield services companies exposed to the subsea industry has declined by 32 percent since 2013.

- The losses continued last year. In 2017, subsea-exposed companies cut 10 percent of its workforce relative to the year before.

- However, offshore drilling is starting to revive a bit as costs have declined.…

Friday April 27, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Gasoline prices at highest in years

(Click to enlarge)

- Global demand is expected to rise by 1.6 mb/d this year, which could mark the fourth consecutive year of demand growth exceeding 1.5 mb/d, the longest stretch since the 1970s.

- But OPEC cuts combined with strong demand has pushed oil prices up to multi-year highs. The EIA says that gasoline prices in the U.S. will average $2.74 per gallon this summer, the highest in four years.

- If prices keep rising, demand will slowdown. There is debate about when this occurs and by how much, but above $3 per gallon, U.S. consumption starts to take a hit.

- OPEC seems somewhat in denial. "I haven't seen any impact on demand with current prices," Khalid Al-Falih told reporters at the meeting of OPEC and non-OPEC producers in Jeddah.

2. Offshore drilling picking up

- The head count at oilfield services companies exposed to the subsea industry has declined by 32 percent since 2013.

- The losses continued last year. In 2017, subsea-exposed companies cut 10 percent of its workforce relative to the year before.

- However, offshore drilling is starting to revive a bit as costs have declined. The Johan Castberg project in the Barents Sea, for instance, has a breakeven price of just $31 per barrel, according to Rystad Energy.

- The number of subsea contracts is expected to rise as a result of the uptick in activity.

- Rystad says there is a potential for as much as a 36 percent increase in awarded subsea contracts between 2017 and 2020.

3. Solar installations set to rise on cheap finance

(Click to enlarge)

- Solar installations are set to rise next year after dipping in 2017 and 2018.

- One tailwind working in the industry’s favor is that banks are increasingly interested in the sector, so much so that they are cutting interest rates even as the broader rate environment is tightening.

- Bloomberg notes that loans of seven years or longer can be obtained by solar developers at 137.5 basis points above LIBOR, down from 200 basis points last year.

- So, not only are equipment costs falling, but financing costs are also seeing unexpected improvements.

- “Investor confidence has increased, causing debt costs to fall despite rising interest rates,” Ed Fenster, executive chairman of Sunrun Inc., the largest U.S. residential-solar company, told Bloomberg. “Our spreads are coming down faster than the base rate is increasing.”

4. Big oil losing influence

(Click to enlarge)

- In 2018, the oil majors are expected to report their largest profits in years. In fact, many of them are making more money with oil at $65 per barrel than they were when oil topped $100.

- However, investors are no longer in love with Big Oil. Even as the stock market skyrocketed over the course of 2017 (and hit some bumps in 2018), energy stocks did not enjoy the same treatment.

- The divergence has left the oil majors with a shrinking portion of the S&P 500.

- The weighting of energy stocks in the S&P 500 dropped by 5.5 percent in February, down to the lowest level in 14 years, according to Bloomberg.

- Goldman Sachs says that the weighting for the oil majors in global indices is at a 50-year low.

- Yet, that could offer investors a cheap entry point. Goldman says in the short run, the oil majors are a very attractive investment as both profits and shareholder payouts are on the rise.

5. Electric buses start to make a mark on oil demand

(Click to enlarge)

- Electric buses have burst onto the scene in the past two years, particularly in China.

- Because buses are incredibly fuel inefficient, the gains from electrifying them vastly outweigh that of electrifying passenger cars on a vehicle-to-vehicle basis.

- Roughly 99 percent of the 385,000 electric buses on the roads around the world in 2017 were located in China. Bloomberg says that every five weeks, China adds 9,500 electric buses.

- For every 1,000 electric buses, diesel demand drops by 500 barrels per day.

- In 2018, electrification of the transportation sector will eliminate 279,000 bpd in oil demand. For all the hype about electric cars, it is actually buses that make up 233,000 bpd of that eliminated oil demand.

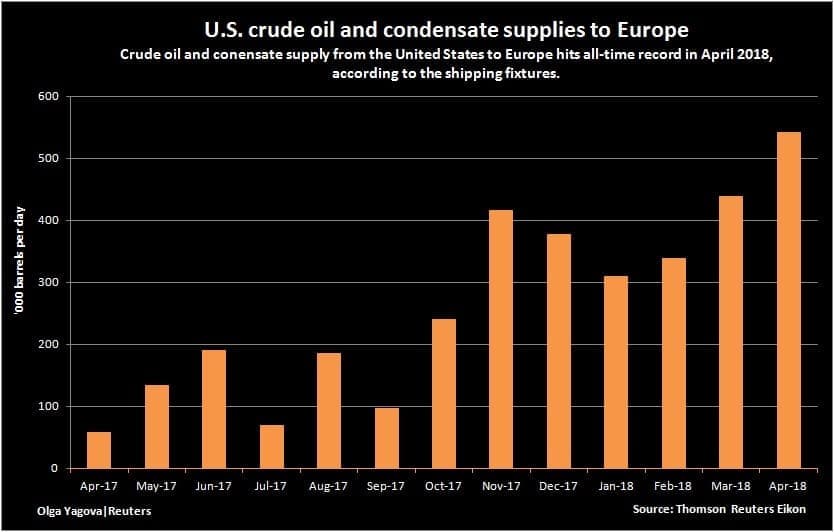

6. U.S. exports surging

- U.S. crude oil exports hit 2.3 mb/d in the week ending April 20, an all-time high since record keeping began decades ago.

- Including refined products such as gasoline and diesel, U.S. petroleum exports hit a record 8.3 mb/d last week.

- A lot of that product is finding its way to Europe, making it difficult for Nigeria and Russia to sell their grades in Europe.

- In April, U.S. exports to Europe are set to hit a record high at 550,000 bpd, according to Reuters estimates.

- “U.S. oil is on offer everywhere,” a trader with a Mediterranean refiner, who regularly buys Russian and Caspian Sea crude and has recently started purchasing U.S. oil, told Reuters. “It puts local grades under a lot of pressure.”

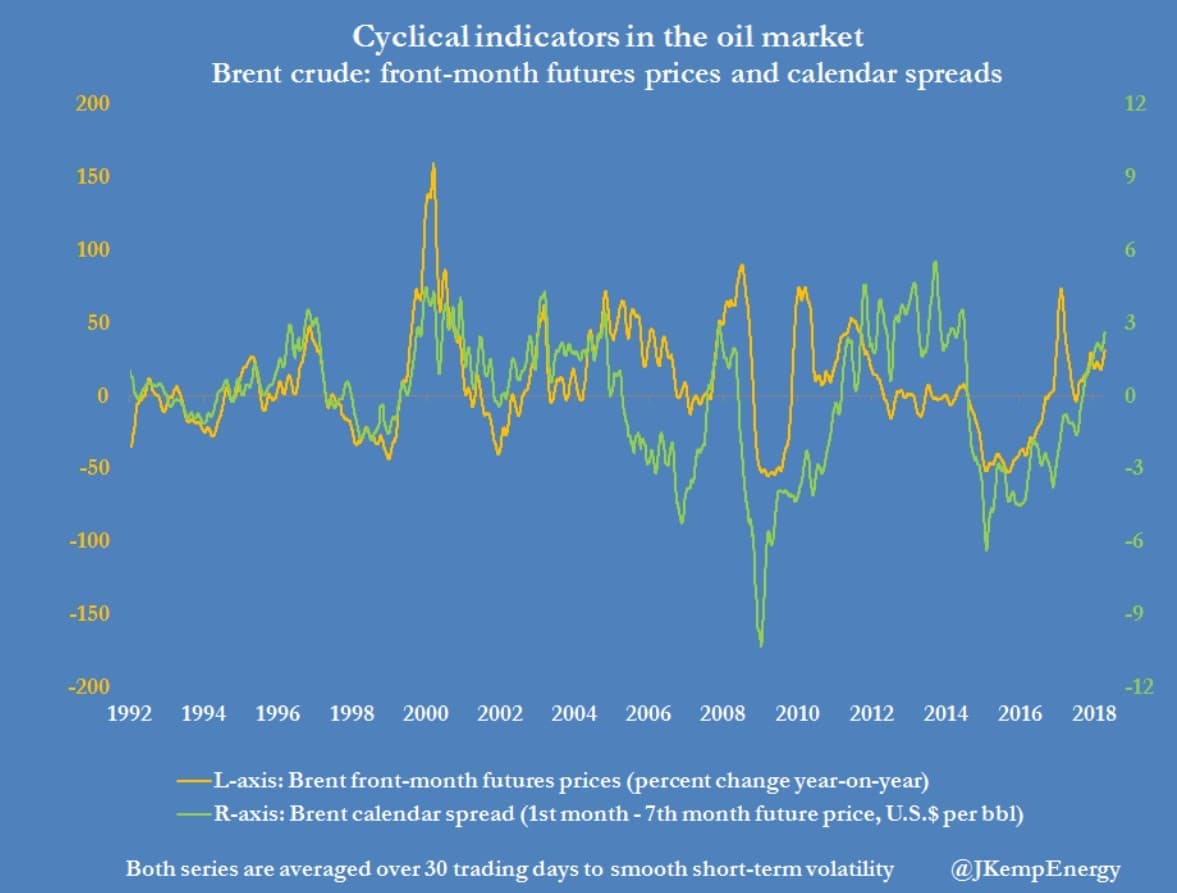

7. Calendar spreads suggest oil boom is here

(Click to enlarge)

- Brent prices have climbed more than 170 percent since hitting a low point in early 2016.

- While there is still a bit of unease about the state of the oil market, or the longevity and sustainability of the recent price gains, the calendar spreads for Brent futures points decisively to a tighter oil market, according to Reuters.

- Futures were in contango for much of the 2014-2016 oil bust. But since the middle of 2017, futures flipped into backwardation – when front month contracts trade at a premium to futures dated several months out – which is typically associated with a tight oil market.

- Even as U.S. shale output is surging, strong demand and declines in Venezuela and potentially Iran suggest that supply might not be able to keep up with demand.

- “So on every indicator, from spot prices and spreads to consumption, production and inventories, the oil market is now well into the boom phase of the cycle,” John Kemp of Reuters concludes.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.