The world is ticking down to a deadline that promises to have major ramifications in the global fuel markets. On January 1, 2020, the International Maritime Organization (IMO) will require the sulfur content in marine fuel to drop from a maximum of 3.5 percent down to 0.5 percent.

The rule is meant to curb pollution from ships. Combustion of high-sulfur fuels leads to the production of compounds like sulfur dioxide, which causes respiratory problems and produces acid rain.

This rule continues a trend of limiting the sulfur content in fuels (which originates from the sulfur contained in crude oil). Europe began tightening sulfur specifications in the 1990s, and the U.S. began to phase in ultra-low-sulfur diesel (ULSD) in 2006.

Prior to implementation of the ULSD standard in the U.S., gasoline often traded at a premium to diesel. But meeting the ULSD standards required refineries to invest billions of dollars into equipment to remove the sulfur. This drove up diesel prices in two ways.

First, the cost to produce diesel was simply higher due to additional capital and operating costs.

Second, this meant that refiners had to be more selective about purchasing high-sulfur (i.e., “sour”) crude oils. This drove down the demand for sour crudes and drove up the demand for lower sulfur (i.e., “sweet”) crudes, increasing the price differential between the two.

So refiners had to pay more for sweet crudes, or invest heavily into new equipment that could remove the sulfur from the sour crudes. The net result was that after 2006, the price differential between gasoline and diesel flipped.

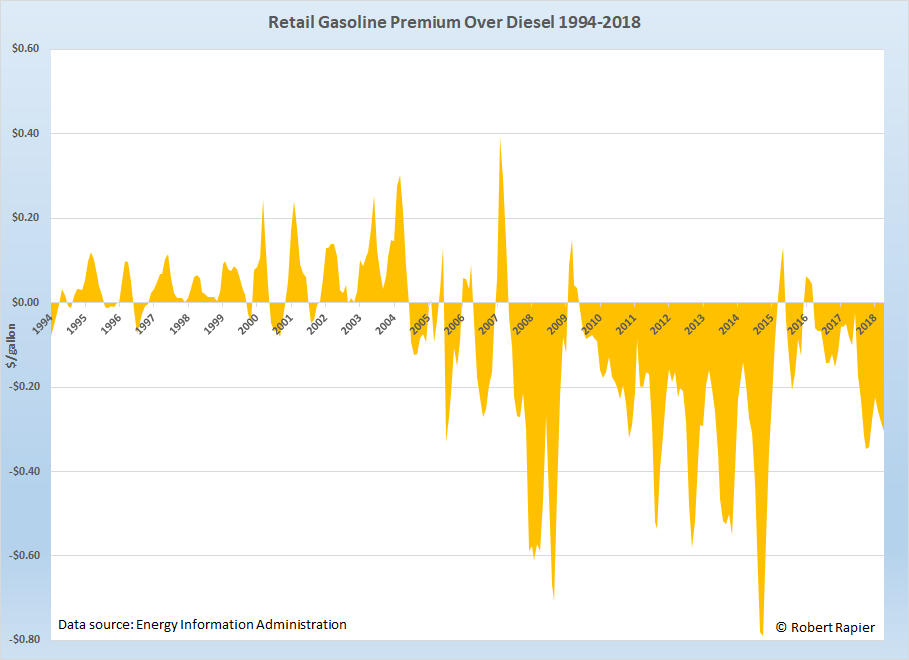

According to data from the Energy Information Administration (EIA), in the decade prior to the implementation of ULSD, retail gasoline traded on average at a $0.04/gallon premium to retail diesel. In 2005, the year before the phase-in of ULSD began, diesel traded at an average of $0.09/gallon over the price of gasoline. And in the decade following implementation, diesel averaged $0.23/gallon over the price of gasoline.

(Click to enlarge)

The gasoline premium over diesel disappeared following the rollout of ultra-low-sulfur diesel.

It has been estimated that the new IMO rules will apply to 3.5 million barrels per day of high-sulfur fuel oil, although post combustion gas scrubbers may allow some vessels to continue using the high-sulfur fuel. Most marine vessels will have to switch to cleaner distillate fuels like low-sulfur diesel, which will increase demand significantly. Related: Canadian Court Deals Blow To Trans Mountain Expansion

As with the previous USLD switch, the new regulations will increase the cost to produce marine fuel, and it will again put upward pressure on the price of sweet crudes and downward pressure on sour crudes.

Refineries are certainly gearing up for the increase in diesel demand. But given the time, complexity, and expense of increasing capacity to meet the new demand, it is possible that there will be insufficient supplies when the new specifications come into effect.

EnSys Energy and Navigistics Consulting conducted a Marine Fuel Availability Study in which they conclude that there are significant risks leading up to the transition. Specifically, they note that installation of exhaust gas scrubbers has been lower than expected. They also project that there will be a “Scramble” period where refineries that aren’t equipped to process sour crude will bid up the price of light sweet crude that can enable them to meet the lower sulfur specifications.

In any case, it seems certain that diesel prices are set to rise, and perhaps significantly. Low sulfur crudes like West Texas Intermediate (WTI) will likely see demand spike as well. Yet you can buy WTI today for February 2020 delivery for $64.19/bbl, which is more than $4/bbl cheaper than the current price.

History suggests that discount won’t last.

By Robert Rapier

More Top Reads From Oilprice.com:

- Is This The World’s Most Beautiful Electric Car?

- Why Oil And Natural Gas Prices Are Diverging

- Airlines Are Suspending Flights Because Fuel Is Too Expensive