Friday March 16, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Decline rates shrink

(Click to enlarge)

- In a very surprisingly development, the IEA reported that the decline rates at existing mature oil fields have actually shrunk quite a bit over the last few years.

- The average decline rate dipped to just 5.7% in 2017, after averaging 7% for the period of 2010-2014.

- The improvement was unanticipated because many analysts expected that the oil market downturn that began in 2014 would lead to spending cuts, resulting in less maintenance and investment, and a corresponding spike in decline rates.

- But instead, the opposite has occurred. The oil industry has focused its resources on maintaining existing output (at the expense of developing new projects), helping to slow the rate of decline.

- The IEA singled out the North Sea and Russia, two places that have posted significant improvement.

2. Refiners might not want all that shale

(Click to enlarge)

- U.S. shale production is growing rapidly, but the light sweet oil coming from Texas is not exactly what Gulf Coast refiners want. Many facilities are equipped to handle medium and heavy oil and won’t simply buy light oil because it’s…

Friday March 16, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Decline rates shrink

(Click to enlarge)

- In a very surprisingly development, the IEA reported that the decline rates at existing mature oil fields have actually shrunk quite a bit over the last few years.

- The average decline rate dipped to just 5.7% in 2017, after averaging 7% for the period of 2010-2014.

- The improvement was unanticipated because many analysts expected that the oil market downturn that began in 2014 would lead to spending cuts, resulting in less maintenance and investment, and a corresponding spike in decline rates.

- But instead, the opposite has occurred. The oil industry has focused its resources on maintaining existing output (at the expense of developing new projects), helping to slow the rate of decline.

- The IEA singled out the North Sea and Russia, two places that have posted significant improvement.

2. Refiners might not want all that shale

(Click to enlarge)

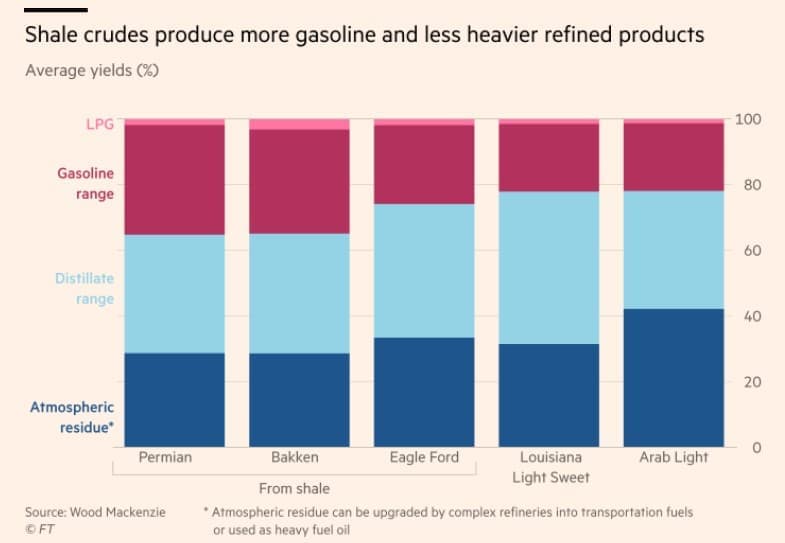

- U.S. shale production is growing rapidly, but the light sweet oil coming from Texas is not exactly what Gulf Coast refiners want. Many facilities are equipped to handle medium and heavy oil and won’t simply buy light oil because it’s available.

- Light oil is not suited for the production of diesel and jet fuel, so-called middle distillates.

- The surge in shale production might have trouble finding willing buyers, particularly as shale continues to scale up.

- WoodMac estimates that three-quarters of the expected 4 million barrels per day of additional shale production over the next five years will have to be exported.

- Shale producers might be forced to accept discounts for their product as the market for light oil suffers from a surplus.

3. Oil volatility briefly dropped below S&P volatility

(Click to enlarge)

- At the end of January and in early February, the financial markets suffered a bout of extreme volatility, and the volatility of equities – captured in the VIX index – briefly exceeded the volatility of crude oil (OVX).

- It was the first time that broader financial market volatility surpassed that of crude oil since the financial crisis in 2008. The VIX has only closed a trading day below OVX four times since the OVX was formed back in 2007.

- The EIA notes that a single commodity would be expected to have much greater volatility than such a broad index as the S&P.

- Recently, the two indices opened up a positive correlation with each other, after about a six-month hiatus when there was no correlation.

- The cause for this is not clear, but it could be a response to expectations of an interest rate hike.

4. Pipeline problems make oil sands upgraders profitable

(Click to enlarge)

- Canada’s oil sands industry has suffered from a lack of takeaway capacity for a long time, but the problem is growing more acute as new supply has recently come online.

- With the pipeline system maxed out, the price of Western Canada Select (WCS) has opened up a wide discount relative to WTI.

- Because there is no immediate solution to the pipeline problem, Canada is now looking at upgraders that could transform heavy oil sands into something more marketable. New technology would allow bitumen to flow through pipelines easier without the need of ultra-light condensate, Bloomberg reports. A University of Calgary report says that it could add $10 to $15 per barrel of value to Canadian bitumen.

- It would also free up space on Canada’s pipelines since condensate would not need to be added.

- The Alberta government is set to offer incentives to encourage companies to build upgraders.

5. Iran oil production in focus

(Click to enlarge)

- Iran was able to dramatically increase its oil production after international sanctions were lifted at the beginning of 2016, adding around 1 mb/d within a year.

- Iranian officials have expressed an eagerness to ramp up production more, sparking speculation that the resolve within OPEC might fray at some point later this year.

- On the other hand, President Trump’s nomination of CIA Director Mike Pompeo to lead the State Department has raised fears of sharper confrontation between the U.S. and Iran, threatening Iranian oil supply.

- A report from Columbia University says that Iran could lose 400,000 to 500,000 bpd if the U.S. puts sanctions back on Iran, or perhaps 600,000 if it convinces China to go along.

- Few expect Iran’s oil production to go back to pre-2016 levels, particularly since the U.S. will lack the international cooperation that it had previously, but supply could still suffer from U.S. sanctions.

6. Inventories close to 5-year average, but declines have stalled

(Click to enlarge)

- Crude oil inventories increased in January for the first time since last summer, according to the IEA’s March Oil Market Report.

- Crude stocks fell sharply in the second half of 2017, and refined products are actually in a bit of a deficit.

- Yet, the declines have halted amid soaring U.S. shale production. Inventories could build slightly in the first quarter.

- However, the IEA was not as bearish as it was in previous reports. The agency noted that inventories are already close to the five-year average, and strong demand along with the high OPEC compliance rate could lead to further destocking for the rest of this year.

- Meanwhile, an accelerated decline in output from Venezuela could “decidedly” tip the market into a deficit, the agency said.

7. Cushing inventories at lows

(Click to enlarge)

- Crude inventories at Cushing, OK fell to just 28.2 million barrels in the first week of March, then posted a modest 0.3-million-barrel increase this week.

- Cushing inventories are at their lowest levels in more than three years. Tank utilization fell to just 36% in early March, down from as high as 82% in October.

- The shrinking of Cushing stocks led to a dramatic narrowing of the WTI-Brent spread, while also pushing WTI futures into a state of backwardation – in which front-month futures trade at a premium to longer-dated contracts – a sign of a tight market.

- However, the tightness is the result of changes in the pipeline system, not a shortage of crude. TransCanada’s Keystone pipeline suffered an outage, slowing oil flows from Canada.

- Plus the startup of the Diamond pipeline, which runs from Cushing to Memphis, TN, helped offload stocks from Cushing.

- Meanwhile, rather than running to Cushing, Permian oil is being routed to the Texas coast, where it can fetch a higher price from refiners. All of this is helping drain stocks at Cushing.

- Still, the IEA says that Cushing will likely see inventories rise later this year as U.S. shale production continues to grow.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.